Crowdstrike: on the cusp of the fifth industrial revolution

$CRWD Q1 2025 ER update

CRWD 0.00%↑ kicked off fiscal year 2026 well, delivering $1.1 billion in Q1 revenue, a robust 20% year-over-year surge, and Annual Recurring Revenue (ARR) soaring 22% to $4.44 billion, with all metrics meeting or exceeding expectation. Despite still decelerating from the July 19 incident, the Falcon platform’s sticky customer base and AI-driven innovation kept the growth engine humming.

With $384.1 million in record operating cash flow and a $1 billion share buyback signaling confidence, CrowdStrike is riding a powerful AI tailwind, positioning itself as the go-to protector of autonomous AI agents and enterprise workloads in an era of escalating digital threats.

As I’ve argued before, CrowdStrike’s Business Ontology—its ability to consolidate fragmented cybersecurity needs into a unified, cloud-native platform—continues to resonate, especially as AI adoption amplifies the attack surface. But with guidance slightly below Wall Street’s lofty expectations, is this a speed bump or a sign of deeper challenges? Let’s dive in.

If you haven't read my original deep dive on Crowdstrike, I recommend doing so before reviewing this update. It's essential reading for a thorough understanding of the company.

Crowdstrike Business Ontology

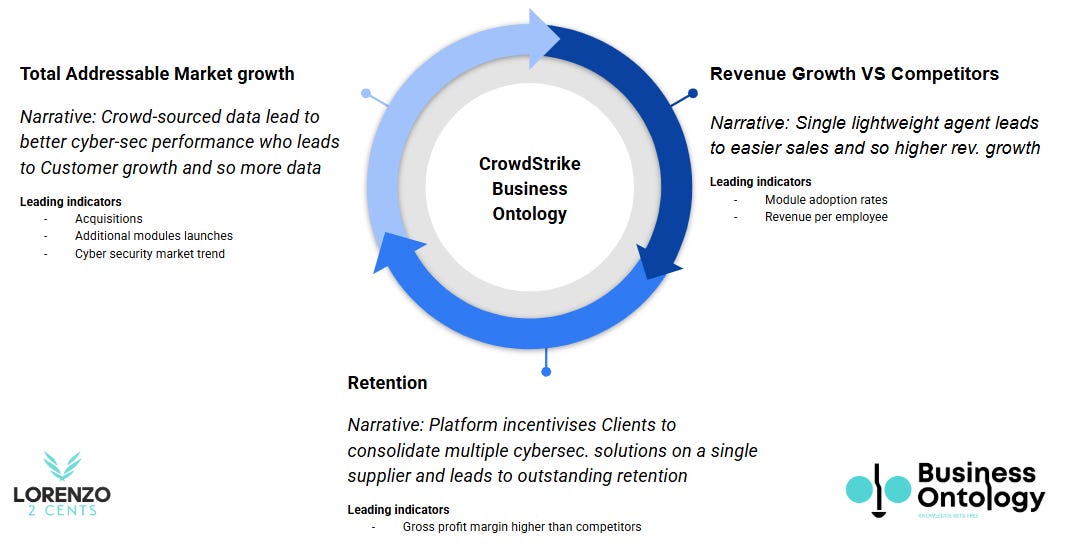

For loyal readers, my Business Ontology framework is old story: it’s about decoding a company’s core value engine—how it creates, captures, and compounds advantage in its ecosystem.

Newcomers, here’s the gist: think of it as a blueprint for why a business wins, beyond buzzwords or balance sheets. For CrowdStrike, the ontology is crystal clear: it’s the Archimedean lever of cybersecurity, a cloud-native, AI-powered platform that consolidates fragmented enterprise needs into a single pane of glass. The Q1 FY26 earnings underscore this, with 67% of deals involving eight or more Falcon modules and 28% of customers using generative AI capabilities like Charlotte AI. This isn’t just selling software—it’s rewiring how enterprises defend against threats, from endpoints to cloud workloads, while AI amplifies stickiness and scalability.

CrowdStrike thrives by being the indispensable nervous system for digital resilience, and the numbers prove it’s still firing on all cylinders.

Here a schematic representation of the Business Ontology for Crowdstrike.

Next, I dedicate a paragraph to providing an update on each component of the Ontology.

The content of this analysis is for entertainment and informational purposes only and should not be considered financial or investment advice. Please conduct your own thorough research and due diligence before making any investment decisions and consult with a professional if needed.

Revenue Growth VS Competitors

CEO, George Kurtz, signaled a breakout in the growth deceration, stating,

Q2 will be a quarter of improving sequential net new ARR growth followed by back-half acceleration,

with CFO, Burt Podbere, projecting Q2 net new ARR growth to “at least double” last year’s Q1-to-Q2 sequential rate. This positions Q1 as the potential bottom, with momentum building fast.

Powering this ascent is Falcon Flex, a subscription model amassing $3.2 billion in deal value across 820 accounts in under two years, boasting $1 million average ARR deals, 31-month terms, and 75% deployment rates so far. Strikingly, 39 customers have “re-Flexed” within five months of their 35-month contracts, hungry for more platform capabilities.

Alongside Falcon Flex, AI stands as a major driver of optimism, as Kurtz emphasized,

CrowdStrike is best positioned to protect the workloads, identities, data, and infrastructure for the AI age and the superhuman AI agents themselves.

This is my Business Ontology in high gear: an AI-native, cloud-powered platform consolidating enterprise cybersecurity at lightning speed, with 48% of subscription customers on six modules, 32% on seven, and 22% on eight or more. Adoption which keeps soaring quarter after quarter.

As AI reshapes the threat landscape, CrowdStrike’s ontology is a fortress, primed to scale toward Kurtz’s $10 billion ARR vision.

Retention

CrowdStrike’s customer loyalty remains ironclad, with Q1 FY26 gross retention steady at 97% and subscription gross margins at a best-in-class 80%. This isn’t just stickiness—it’s proof customers are eager to stay and pay premium for the Falcon platform, even after last July’s incident. My Business Ontology shines here: by consolidating cybersecurity into an AI-powered, cloud-native fortress, CrowdStrike keeps clients hooked. The numbers scream resilience—no reputational scars, just a platform customers can’t quit.

TAM Growth

CrowdStrike’s total addressable market is growing fast, driven by relentless innovation and the AI security imperative. In Q1 FY26, the company rolled out Falcon Data Protection for Cloud, AI Model Scanning, AI Security Dashboard, Falcon Privileged Access (within Identity Protection), and AI-powered Network Vulnerability Assessment for Falcon Exposure Management, all hitting general availability.

These modules, unified on the Falcon sensor, anchor CrowdStrike’s leadership in cloud, AI, and hybrid security. CEO, George Kurtz, nailed the opportunity:

The necessity agentic AI is creating for CrowdStrike’s AI-native security [is] growing our total addressable market each and every day.

With 96% of enterprises planning to expand AI agent use—some targeting over 1 billion agents—each “superhuman identity” requires protection, amplifying the attack surface’s size, severity, and speed. CrowdStrike is primed to secure these agents, their workloads, data, and infrastructure, underscored by its recently announced integration into NVIDIA’s Enterprise AI Factory as the cybersecurity standard.

Conclusion

CrowdStrike’s Q1 FY26 plants a flag in the AI-driven security landscape, leveraging its NVIDIA partnership to stake a claim as the guardian of “superhuman” AI agents. My Business Ontology frames it as cybersecurity’s Archimedean lever—a platform consolidating a fragmented market into a unified fortress.

Last July’s misstep hasn’t likely dented its armor, with customer loyalty holding firm and Falcon Flex gaining traction. Yet, the real test lies ahead: the next two quarters must deliver on management’s promise of reaccelerating growth to silence doubters. The premises—AI tailwinds, new modules, deep platform adoption—are compelling, but execution is everything. For investors, this is a high-stakes wager on a potential titan, not a guaranteed victory. Watch closely; the lever’s poised, but it’s not tilted yet.

As always, here is the “Deep Dive To Date” (DDTD), that is how the stock is performing since my initial deep dive. For Crowdstrike stock ($CRWD), the price on October 16th, when I published my analysis, was $304.97. As of this update, the price stands at $468.41, reflecting a

+53% DDTDStay tuned for the next update!

Hi Lorenzo! Do you think, as Antonio Linares does, that Palantir, as a horizontal ontology, will disrupt Crowdstrike, as a vertical one?