HIMS: The Gatekeeper

$HIMS Q1 2025 ER update

HIMS 0.00%↑ kicked off 2025 with a bang, delivering a Q1 performance that underscores its trajectory as a generational healthcare disruptor. Revenue soared 111% year-over-year, net income surged more than fourfold, and Adjusted EBITDA nearly tripled, driven by robust growth across new and established specialties.

CEO Andrew Dudum’s bold 2030 guidance of at least $6.5 billion in revenue and $1.3 billion in Adjusted EBITDA reflects a management team with unwavering confidence and a clear roadmap to scale to tens of millions of users. This implies a ~28% CAGR of Revenue from 2024, yet their conservative tone suggests potential for even greater upside.

Their strategy hinges on five growth levers: expanding personalized solutions, entering emotionally resonant specialties, enhancing care precision, forging partnerships, and pursuing global expansion. More on these will follow.

What sets Hims apart—and why it commands ~30% of my portfolio—is management’s long-term mindset. Take their Sexual Health specialty: they’re deliberately shifting from on-demand to daily, personalized solutions, accepting near-term headwinds to unlock higher customer lifetime value. As CFO Yemi Okupe noted,

Our focus remains on driving long-term growth, even if at times that results in near-term temporary headwinds,

This willingness to sacrifice short-term gains for exponential long-term rewards is the hallmark of a multi-bagger.

Miss this update, and you’ll miss why Hims remains my highest-conviction pick—read on to see how their vision is reshaping healthcare.

Hims the Gatekeeper

Hims is positioning itself as the Apple Store of healthcare, a gatekeeper that Big Pharma may soon find indispensable. Their April 2025 collaboration with Novo Nordisk to offer the weight-loss medication, injectable, GLP-1 agonist Wegovy®—bundled with 24/7 care, clinical support, and nutrition guidance at a unified price—marks a pivotal step toward this vision. As CEO Andrew Dudum emphasized,

Teaming up with Novo Nordisk is a pivotal milestone… it sets the blueprint for future partnerships that can expand both our reach and our relevance,

This partnership pairs Hims’ sticky, customer-centric platform with Novo’s innovative pipeline, creating a model that could redefine how pharmaceuticals reach patients. If this collaboration drives significant sales growth for Novo Nordisk, competitors like Eli Lilly may have no choice but to follow suit, lest they lose market share.

The shareholder letter underscores this ambition:

We expect our ecosystem will be further augmented by strategic partnerships across the healthcare industry… to bring subscribers access to a curated set of products and services,

Hims’ growing brand recognition and user base make it an attractive distribution channel, much like Apple’s App Store commands a commission for every transaction. A second major partnership—say, with another pharma giant—would signal that Hims is indeed becoming the go-to curator of healthcare services. As Dudum envisions,

This will strengthen our ecosystem and position us to curate a best-in-class offering that can reach tens of millions of people,

If Hims continues to scale and secure such deals, it could emerge as one of the most influential players in healthcare, controlling access to patients and reaping outsized rewards.

Hims Business Ontology

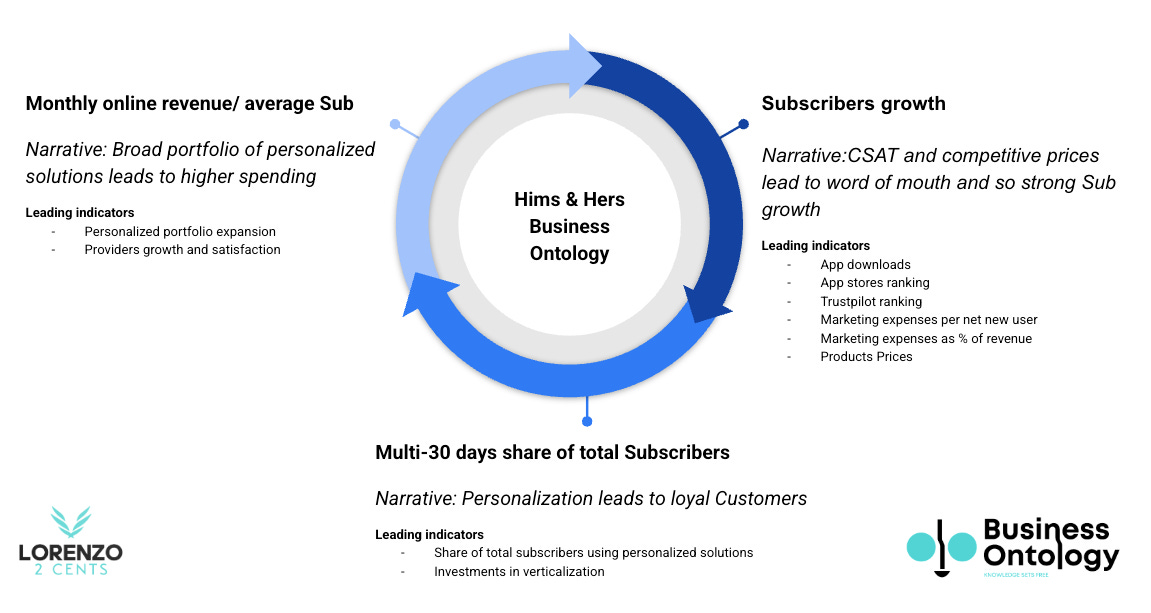

Hims operates a virtuous cycle that drives sustainable growth, as illustrated in my business ontology framework. At the core, their platform leverages personalized healthcare solutions to fuel three interconnected drivers: subscriber growth, multi-30-day share of total subscribers, and monthly online revenue per average subscriber.

Subscriber growth is propelled by competitive pricing and word-of-mouth from satisfied users, with marketing efficiency playing a key role.

The multi-30-day share reflects their focus on personalization, increasing the proportion of loyal subscribers using daily solutions, supported by investments in vertical integration for better care precision.

Finally, monthly revenue per subscriber grows through a broader portfolio of personalized offerings, enhancing user spending while maintaining provider satisfaction. This self-reinforcing loop—where personalization drives loyalty, growth, and revenue—positions Hims to scale efficiently and capture long-term value in the healthcare space.

If you’re unfamiliar with my Business Ontology approach, I encourage you to check out my original deep dive on Hims—particularly paragraph 4, where I first introduce the framework.

If you haven't read my original deep dive at all, I recommend doing so before reviewing this update. It's essential reading for a thorough understanding of the company.

This ontology isn’t static; it evolves with Hims’ journey. By focusing on these pillars, I aim to cut through the noise and provide a clear, repeatable blueprint for evaluating Hims’ performance each quarter, ensuring we’re tracking what truly matters as the company scales.

The next sections break down each pillar, updating how Hims’ execution keeps it a compelling investment.

Subscribers growth

Hims continues to drive impressive subscriber growth, fueled by strategic initiatives and operational efficiency. In Q1 2025, total subscribers reached 2.4 million, reflecting a 38% year-over-year increase.

This growth rate has stabilized around 40% year-over-year since Q1 2024, a remarkably high level to maintain over time. Excluding GLP-1s, subscriber growth was nearly 30%, with dermatology specialties leading at 50%, driven by high adoption of personalized solutions.

A key catalyst for future growth is international expansion, with CEO Andrew Dudum noting early traction in the U.K.:

Demand for convenient, customized, transparent, high-quality healthcare is universal… [this] gives us confidence that we can scale our platform globally,

Marketing efficiency also hit record levels, with spend dropping to 39% of revenue—a year-over-year improvement of 8 points—thanks to retention gains from personalized solutions and a rise in organic subscriber acquisition through lower-cost channels.

These tailwinds, combined with high advocacy in visible specialties like weight loss, position Hims for sustained subscriber growth as they expand globally and optimize their marketing engine.

Multi-30 days share of total subscribers

Hims & Hers’ focus on personalization continues to propel the multi-30-day share of total subscribers, which soared to 92% in Q1 2025, up from 73% in Q4 2022, reflecting a growing base of loyal users on daily solutions. This metric underscores the company’s success in deepening subscriber engagement.

In Sexual Health, the number of subscribers on daily offerings more than doubled year-over-year, now making up nearly 40% of the category, with CFO Yemi Okupe noting,

We are already seeing benefits through signs of stronger retention with subscribers of sexual health daily offerings demonstrating a nearly 10-point improvement in retention in their first year relative to on-demand users, with evidence of even stronger retention benefits over time,

In Men’s and Women’s Dermatology, over 80% of subscribers now use personalized solutions, boosting first-year retention by nearly 20 points over the past two years and driving subscriber growth of 45% and 170% for Men’s and Women’s Hair Loss, respectively. Okupe added,

We expect long-term revenue retention to remain above 85% as more subscribers engage with personalized solutions across multiple specialties,

highlighting the durability of this shift.

A key enabler of this trend is Hims’ investment in verticalization, particularly through the early 2025 acquisition of an at-home lab testing provider, which enhances the flywheel of personalization, retention, and growth. The shareholder letter details,

We acquired the ability to collect blood through a device we believe can carry a lower ‘fear-factor’ compared to traditional needles… We believe this will help democratize access to a range of tests that provide insights into critical biomarkers across heart, hormone, liver, thyroid, and prostate function,

This capability, as illustrated in the accompanying graphic, plays a pivotal role in Hims’ ecosystem: lab testing makes personalized care more accessible by removing barriers like needle anxiety, delivers deeper health insights through a broad selection of tests (e.g., Core Essentials, Hormonal, Longevity Optimization), and empowers customers to take action with tailored medications and supplements.

This closed loop—testing, insights, action—drives higher engagement and retention by ensuring subscribers receive precise, actionable care. CEO Andrew Dudum elaborated,

These tools will support our current specialties and unlock entirely new ones… enabling more proactive, informed decisions for both patients and providers,

The shareholder letter further notes,

A lower-friction at-home testing experience will enable us to move into hormone driven categories… offering a more comfortable and accessible way to begin care,

targeting conditions like low testosterone and menopause, which affect over 50 million Americans.

Lab testing also supercharges Hims’ data flywheel, a cornerstone of their long-term strategy. The shareholder letter explains,

Proprietary structured data will enable us to better serve [unique health] needs over time… Technologies like MedMatch will become more effective, and new AI tools like coaches, therapeutic tools, and nutrition advice will drive stronger subscriber engagement,

Okupe reinforced this, stating,

Data enriched by each additional user on the platform will enable us to further refine our personalized offerings, elevating the experience for our subscribers and taking us one step further [toward] Hims & Hers becoming synonymous with high-quality personalized care,

By integrating lab diagnostics, Hims can offer more precise solutions—potentially thousands of SKUs. Dudum added,

Our vision involves expanding from hundreds of personalized treatments today to potentially thousands, powered by richer insights from lab diagnostics, growing subscriber data sets, and eventually daily tracking from wearable devices… resulting in greater optimized care,

Looking to the future, Hims is poised to expand into preventative care, capturing not just those needing treatment but also healthy individuals aiming to stay well. Dudum shared,

In the next 2 to 5 years, this grows to be very mass market, where for relatively affordable prices, you can get whole body testing… You can get cancer-preventative diagnostics… And on an annual basis, make sure that your body is operating as it should be,

He continued,

Hims & Hers is exceptionally well positioned with the trust we have, the distribution, the brand, the clinical capabilities to… help people identify these areas of risk, get ahead of them, and monitor them,

This vision mirrors Apple’s ecosystem, creating a platform so comprehensive that users remain within it for all their healthcare needs—from youth through aging—further boosting the multi-30-day share and solidifying Hims as a lifelong partner in health.

Monthly online revenue/average subscriber

Hims has seen a remarkable uptick in monthly online revenue per average subscriber, reaching $84 in Q1 2025, a 50% increase year-over-year, up from roughly $55 in Q1 2024.

This metric, which had hovered around $50–$60 for much of 2022 and 2023, began a sharper ascent in 2024, reflecting the impact of personalized solutions and specialty expansion. CFO Yemi Okupe cautioned, however, that

we expect this to moderate as we move through the year, driven by subscriber transitions off of commercially available semaglutide and typical seasonality in our weight offering,

Despite this, the long-term trajectory remains promising, fueled by Hims’ strategic focus on broadening its portfolio of personalized treatments. The shareholder letter highlights,

More subscribers are discovering the benefits of personalized solutions each day… Investments in our facilities lay the foundation to scale from hundreds to potentially thousands of treatment options in the coming years, offering a portfolio of solutions that can meet customer needs across a variety of backgrounds and circumstances,

This growth is also supported by Hims’ disciplined expansion into new specialties, which drives higher subscriber spending. The shareholder letter notes,

Lab diagnostics and sterile capabilities have unlocked our ability to expand into low testosterone and menopausal support, which we expect to offer by year-end… Setting the stage for entries into longevity, sleep, and preventative medicine over the next five years,

CEO Andrew Dudum reinforced this, stating,

We expect to launch both a low testosterone and menopause support offering before the end of this year… We’ll continue expanding into new specialties that deeply impact people’s lives… with longer-term opportunities emerging in longevity, sleep, and preventative care as we expand lab testing and peptide capabilities,

By addressing emotionally resonant conditions and leveraging data to identify needs like vitamin deficiencies, Hims is poised to sustain upward pressure on monthly revenue per subscriber, even as short-term headwinds like semaglutide transitions play out, ensuring a robust foundation for future growth.

Conclusion

Hims & Hers delivered a stellar Q1 2025, reinforcing my unwavering conviction in the company and its management. The thesis I laid out in my original deep dive is playing out spectacularly: revenue doubled, net income quadrupled, and Adjusted EBITDA nearly tripled year-over-year, with subscriber growth holding steady at 38%.

Importantly, growth outside GLP-1 offerings remained robust at nearly 30% year-over-year, a testament to the platform’s strength across specialties, as CFO Yemi Okupe noted:

It demonstrates the underlying ability to drive robust growth across our broader business even in the presence of fewer dollars to drive top-of-funnel demand,

Management’s long-term vision—targeting $6.5 billion in revenue by 2030—and their willingness to prioritize sustainable growth over short-term gains continue to set Hims apart as a potential double-digit multi-bagger. The steady rise in free cash flow per share, which has grown consistently since mid-2023 to reach $1 by now, further supports this trajectory, signaling financial health and operational efficiency.

Looking ahead, Hims anticipates full-year 2025 revenue of $2.3–$2.4 billion (up 56–63% year-over-year), though Q2 may see a temporary quarter-over-quarter revenue drop due to the semaglutide transition, as Okupe cautioned:

This transition is expected to result in a onetime quarter-over-quarter revenue drop in the second quarter from which we are confident we can continue to build upon through the remainder of the year,

Despite this, growth in tenured offerings like mental health and dermatology, alongside new launches in low testosterone and menopause support, positions Hims for sustained momentum.

Even after the recent share price rise—making HIMS 0.00%↑ roughly a third of my portfolio—I have no plans to trim or sell. The management’s execution, strategic partnerships like Novo Nordisk, and expansion into preventative care solidify my belief that Hims is building a healthcare ecosystem poised to dominate for decades.

As always, here is the “Deep Dive To Date” (DDTD), that is how the stock is performing since my initial deep dive on the February 8th 2025, when the stock price was $42.54.

+38% DDTDSee you in the next update!

Check all the Ontologies I have built: ODD 0.00%↑ , RKLB 0.00%↑ , DUOL 0.00%↑ , LMND 0.00%↑ , CRWD 0.00%↑.

The content of this analysis is for entertainment and informational purposes only and should not be considered financial or investment advice. Please conduct your own thorough research and due diligence before making any investment decisions and consult with a professional if needed.