Invest in AI, Avoid the Bubble - Ep.1 /4

Lorenzo2cents’ 2026 portfolio strategy

The content of this analysis is for entertainment and informational purposes only and should not be considered financial or investment advice. Please conduct your own thorough research and due diligence before making any investment decisions and consult with a professional if needed.

Investing in AI isn’t optional—it’s essential if you aim for meaningful returns over the next decade. Yet it carries an inherent risk: demand will eventually plateau, CapEx will contract in tandem, and stock prices will crater as a result. Call it a bubble or not, the reckoning feels inevitable—though whether it strikes in 10 months or 10 years remains anyone’s guess. So how do we capture the upside of this industrial revolution without betting the farm?

Here’s my strategy.

AI market Classification

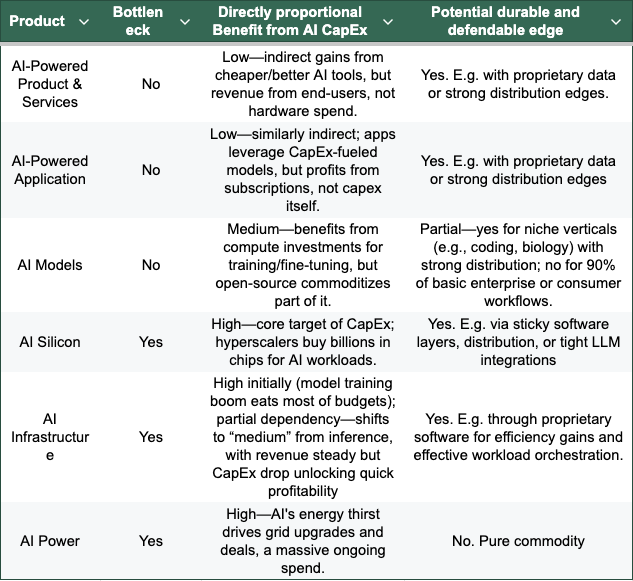

Looking into the AI market and the investable companies, I divided it in a few categories and tried to associate to each of them three labels, if they are or can be a bottleneck for the supply chain, if they have a directly proportional benefit from AI Capital Expenditure, and if they have an inherent potential durable and defendable edge.

In the first scenario, bottleneck, stocks in that category can surge short-term because demand is exploding and supply is short. This acts as a quick boost—it might even last years until supply catches up. But it’s just a “nice-to-have.” Without a lasting moat and/or in case the business benefits proportionally from AI CapEx, you’re in trouble: the stock rockets on hot demand, then crashes when things cool off.

If the business has a strong moat and its revenue does not depend heavily on AI CapEx—ideally paired with a bottleneck—you’ve hit the jackpot. You get the short-term boom for fast growth, but when demand eases, your investment doesn’t vanish. The business keeps humming. Sure, you’ll face some market dips, but likely nothing brutal like losing two thirds of your stake. There, is where I want to be.

Overall Takeaways

To sum up, after cutting through all the AI buzz, here’s what matters most. Don’t run after every hot new company. Focus on the ones that can surf the big wave—and land softly if it breaks.

Bottlenecks give quick boosts: Things like chips, servers, and power are hard to get right now. That pushes stock prices up fast. But watch out—without a strong edge, it’s a dead end. Demand will slow someday, and you’ll lose big.

Strong edges keep you safe: The real win? Mix a bottleneck with something that sticks, like special data, smart add-on software, or a big group of loyal users. Picture AI insurance that really gets your life, or chips locked into tools only you offer. That’s your backup plan for years ahead.

Build on the full pile, not one piece: AI is like a building—apps and services on top, models in the middle, hardware at the bottom. Pick companies that own the whole thing (think about Tesla). They grow wild during peaks and keep going steady later. Quick note on data centers: When the big training spend drops, everyday AI use (inference) keeps cash coming in. Growth eases, but costs crash too—turning spots like Nebius into money-makers fast. It’s not over; it’s a smart shift: from high growth to an utility.

My top investing rule: Look for that perfect mix—big jumps now, solid steps later. Markets will shake you a bit, but you won’t sink. Whether it’s a bubble or not, this keeps your investments safe and growing for 10 years and more.

Like the graphs and my analysis? Check out my “Tools I Trust & Use” page to see what I use—and grab ‘em via my links to support my work!

TIKR is my go-to tool for all my stock research—it’s a game-changer for spotting winners before the crowd. For you, my Lorenzo2Cents readers: Use the Coupon Code lorenzo20 for 20% off, live now through February 6. Don’t miss out—grab it.

Next Episode

In the next Episode of the series “Invest in AI, Avoid the Bubble”, I’ll be digging into the “AI-Powered Product & Services” category, in my view, the most interesting one. Stay Tuned (It will be out in about a week).

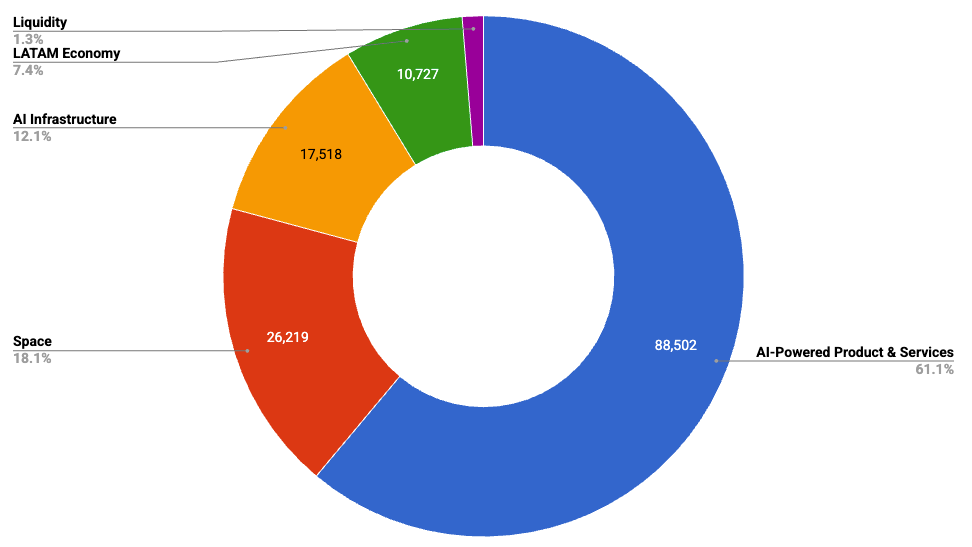

Lorenzo2cents Portfolio strategy for 2026

This is how I positioned my portfolio for 2026.

Here are the detailed positions for each category with their weights.