$IREN vs $NBIS: Location, Location, Location

Playing two different games

If you’d rather watch a video where I break down this article, here’s the link. That said, this written piece dives even deeper into the details, so I recommend reading it for the full scoop. Also, let me know if you appreciate video companions for my articles—drop a comment on my Substack or shoot me an email at info@lorenzo2cents.com.

Nebius and Iren are establishing positions in the AI infrastructure sector. Both companies develop and operate data centers equipped with high-density GPUs for AI model training and inference. They function as specialized providers of computational resources, addressing capacity constraints faced by major cloud platforms such as AWS and Azure.

Both maintain strong partnerships with NVIDIA, including preferred partner status for IREN and certified NVIDIA Cloud Partner with Reference Platform status for Nebius, recently achieving NVIDIA Exemplar Status specifically for NVIDIA H200 GPUs in training workloads.

Demand for these resources continues to expand rapidly, prompting both firms to invest in large-scale, energy-intensive facilities. Fundamentally, each pursues vertical integration—controlling key elements from hardware to service delivery—to mitigate commoditization risks and achieve cost efficiencies.

However, their methods differ: Nebius emphasizes software orchestration for enhanced customer retention and software like margins, while IREN focuses on securing land and power for scalable, unbundled capacity.

In other words, Nebius integrates proprietary software to create differentiated, cohesive offerings that encourage long-term customer commitment. In contrast, IREN prioritizes bare-metal provisioning—delivering servers and power without overlaid software—allowing clients to deploy their preferred orchestration layers.

As stated by IREN’s CEO, Daniel Roberts, in the Q4 FY25 earnings call:

Large, sophisticated end users of GPUs want a third-party provider to staple their own software… They just want compute. They want to run their own stuff.

And the Chief Commercial Officer Kent Draper on the same matter:

The vast majority of the customers… are highly experienced AI players, hyperscalers, developers. They are, for the most part, demanding bare metal because it actually suits them better.

Nebius, by comparison, adopts a comprehensive stack, as articulated by co-founder Roman Chernin:

It’s software built to use less power… Layers designed to work together from the start.

Thus, Nebius constructs a software-based competitive advantage, whereas IREN emphasizes control over physical assets and energy supply.

If you haven’t read my original deep dive on Nebius, I recommend doing so before reviewing this update. It’s essential reading for a thorough understanding of the company.

Speed of Execution

Execution speed is critical right now in AI infrastructure, where demand exceeding power availability represents the primary constraint, surpassing even GPU shortages. As Amazon CEO Andy Jassy noted in his most recent earnings call:

Overall in the industry, maybe the bottleneck is power.

The same view was recently pointed out by Satya Nadella, CEO of Microsoft:

The biggest issue we are now having is fast enough close to power. So if you can’t do that, you may actually have a bunch of chips sitting in the inventory that I can’t plug in. And in fact, that is my problem today. Right? It’s not a supply issue of chips; it’s actually, uh, the fact that I don’t have warm shells to short on compute

Both Iren and Nebius secure contracts prior to construction commencement, but the ability to deploy capacity more rapidly enables greater market capture.

IREN demonstrates strength in this area through strategic site selection and operational adaptability. The company has secured 2.91 GW of contracted power (+ 750 MW versus previous year) across North America, supported by renewable sources and renewable-energy credits. In regulated markets such as British Columbia, IREN targets regions with renewable-energy oversupply, where declining industrial activity may lead to elevated pricing, thereby converting surplus hydroelectric power into AI compute. In deregulated markets like Texas, it capitalizes on price volatility: absorbing low-cost renewable generation during periods of excess supply and curtailing usage during shortages, which supports grid stability.

Recent developments include 810 MW of operational capacity, that is a 550MW of additional capacity or +212% year-over-year in FY25, versus a total Nebius connected power of 220MW expected at the end of CY2025; the Horizon 1 facility, a 50 MW liquid-cooled site accommodating over 19,000 NVIDIA GB300 GPUs, slated for energization by Q4 2025; and a 2 GW hub at Sweetwater by 2027.

Nebius also advances fast, projecting 1GW+ of connected power by CY2026, so expect to grow 4,5 times from 2025.

While both maintain competitive deployment schedules and similar revenue payback, between 2 and 3 years, IREN’s emphasis on land and power acquisition likely provides an advantage in pre-empting competitors during periods of peak demand.

Financial Strength

Competitive expansion in AI-cloud infrastructure requires substantial capital expenditures, in the order of billions annually. Sustaining funding amid accelerating growth is essential, and self-sufficiency becomes particularly valuable as credit conditions eventually tighten.

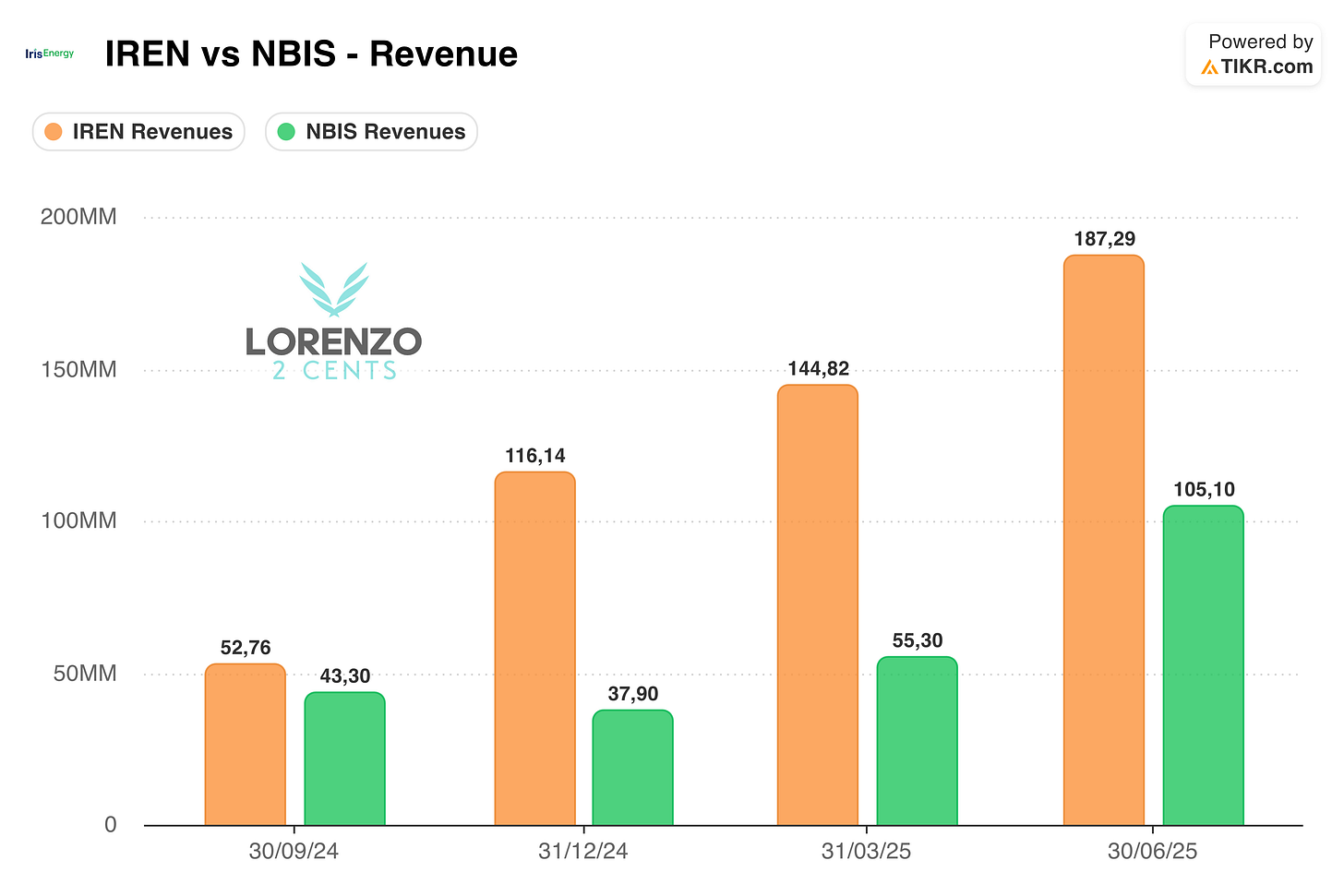

IREN’s FY25 performance underscores its financial resilience, featuring a $1.25 billion annualized revenue run-rate entering FY26 and $245.9 million in cash from operations. This robustness has earned clear market recognition, as demonstrated by the company’s successful execution of approximately $1 billion in convertible notes offerings throughout 2025, supplemented by additional GPU vendor financing, to fuel its AI cloud expansion.

Ownership of facilities ensures predictable cash flows, insulated from rental escalations. Vertical integration across power procurement and operations reduces expenses, complemented by Bitcoin mining as a supplementary revenue stream.

Nebius has committed ~$2 billion in capex for 2025, targeting ~$1 billion in revenue by year-end. A key differentiator is Nebius’s portfolio of non-core assets, including equity positions in entities such as ClickHouse, which are positioned for monetisation or divestiture as future funding sources, as explained by the CEO Arcady Volozh during the last earnings call:

We have a strong balance sheet, as you can see, and we have access to potentially billions of dollars more thanks to our noncore businesses and other equity stakes such as Avride, ClickHouse, Toloka.

Like the graphs and my analysis? Check out my “Tools I Trust & Use” page to see what I use—and grab ‘em via my links to support my work!

Efficiency

Efficiency underpins profitability in data centres, encompassing reduced power-usage effectiveness (PUE), lower energy costs, and expanded margins. As AI technologies advance, success depends on integration of hardware, software, and operational processes. This domain highlights most the divergence between IREN’s energy-focused approach and Nebius’s integrated stack.

IREN leverages cost-effective renewables, direct grid connectivity, and facility ownership to maintain consistent cash generation. The introduction of direct-to-chip liquid cooling at Horizon 1 has generated interest, though in my view its impact is largely demand-driven rather than transformative.

As Kent Draper, CCO of IREN, explained in the Q4 call:

Less driven by PUE overall… more driven by the customer side of the equation.

Specifically, Air-cooled operations in British Columbia achieve a PUE of ~1.1; liquid-cooling elevates the annual average to approximately ~1.2, prioritising GPU density over marginal efficiency gains.

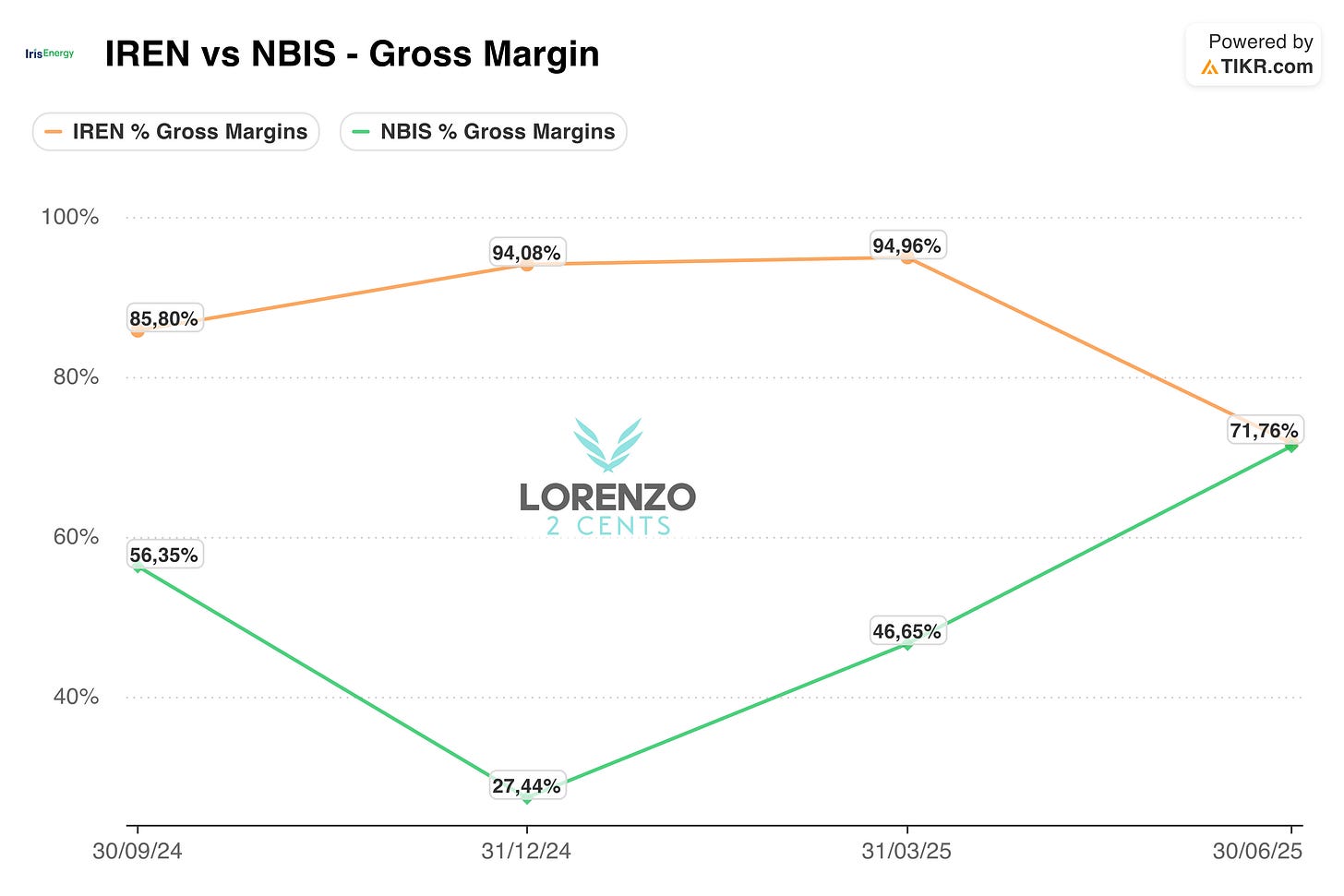

Complementary factors include reduced energy-procurement costs, accumulated expertise from vertical operations, and the ability to redeploy obsolete GPUs for mining. Nevertheless, the bare-metal model constrains margins to more commoditised levels.

Nebius addresses efficiency through software innovations. Its Finland facility attains a PUE near ~1.1, same as IREN in British Columbia, incorporating heat recovery, while proprietary integrations further minimise power consumption and operational expenses. As articulated by Nebius co-founder Roman Chernin:

It’s software built to use less power… Layers designed to work together from the start.

These elements foster defensible positions via switching costs, which bare-metal offerings lack. Should Nebius execute effectively, its margins are positioned to surpass IREN’s as operations scale.

Conclusion

IREN and NBIS are generating substantial value amid the current AI infrastructure expansion, yet their foundational strategies diverge meaningfully.

IREN’s approach resembles a real-estate developer in a housing boom: constructing as many facilities as possible to meet urgent demand, which thrives while hyperscalers and developers scramble for available capacity, prioritising volume over premium margins. It excels in rapid deployment and power-constrained environments, with versatility across colocation, cloud services, and Bitcoin operations.

However, as demand growth moderates—which is eventually inevitable—hyperscalers may shift toward internal development or intensified negotiations, reverting from outsourcing to self-construction. For instance, entities like Amazon or Google could develop on-site power generation adjacent to their data centres, eliminating grid intermediaries and achieving lower-cost renewable energy that diminishes IREN’s efficiency advantages. This competitive pressure alone could challenge IREN’s revenue sustainability, much like a real-estate model that falters once an acute shelter-supply mismatch eases.

Nebius, in contrast, is akin to a developer of proprietary smart homes: crafting a suite of integrated AI services designed to acclimate customers to its ecosystem, fostering familiarity and high switching costs over time. This strategy promotes retention, optimises efficiency, and cultivates loyalty in a manner similar to established cloud leaders. Such capabilities cannot be retrofitted and must be established early; effective implementation would yield network effects that outweigh bare-metal’s adaptability in the long run.

In the near term, IREN presents stronger opportunities tied to execution velocity. For longer horizons, Nebius potentially offers more resilient competitive moats—positioned to become the most valuable model once the foundational infrastructure needs are met and the focus shifts to seamless, entrenched experiences.

Over the next few quarters, we should have sufficient data to validate or challenge this thesis. While I anticipate both companies will deliver robust performance in this fast-evolving market, I remain invested only in Nebius, as it better aligns with my long-term strategy

As always, here is the “Deep Dive To Date” (DDTD), that is how the stock is performing since my initial deep dive AND when I started a position, on the July 28 2025, when the stock price was $51.63.

2,5x DDTDSee you in the next update!

The content of this analysis is for entertainment and informational purposes only and should not be considered financial or investment advice. Please conduct your own thorough research and due diligence before making any investment decisions and consult with a professional if needed.

Location really is everything for these AI compute plays. IREN's proximity to existing grid infrastrucure and lower land costs gives them a real edge on deployment speed compared to NBIS. The Microsoft deal proves that hyperscalers are willing to pay premiums for immediat capacity rather than wait for new builds.