Lemonade: Why Short Sellers Are Wrong Twice – And About to Get Squeezed

$LMND Q2 2025 ER Update

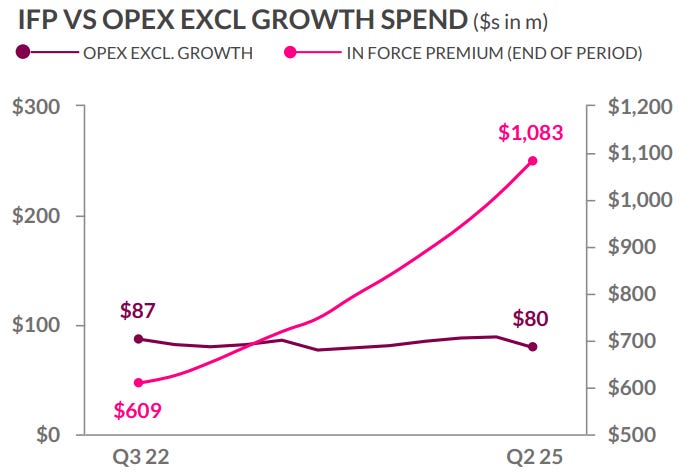

Momentum kept building this quarter in two of Lemonade's biggest growth drivers—Car and Europe—which we'll cover in more detail shortly. Looking forward, the company has bumped up its full-year 2025 guidance for IFP, GEP, and revenue, while holding steady on adjusted EBITDA. On the top line, IFP hit $1.08 billion, up 29% year-over-year, marking the seventh straight quarter of accelerating growth, with revenue climbing 35%.

But before diving into the quarter's details, let's address the elephant in the room: the go-to bear case against Lemonade. I figure it's got a short shelf life from here on out.

The typical short thesis boils down to Lemonade's ongoing lack of profitability and skepticism about ever getting there without burning through cash or getting crushed by bigger players. Critics point to the company's AI-fueled growth in IFP and customers—now serving about 2.7 million folks as of Q2 2025—but argue it's all smoke and mirrors in a capital-hungry industry where size matters. With giants like Allstate or Progressive pouring money into tech, Lemonade looks like an easy target.

Bears love to trot out charts showing declining net income, earnings per share, book value, or book value per share since the IPO. And yeah, the book value drop stems straight from those red-ink income statements.

In my view, the permabears are missing the mark on two fronts: qualitatively and quantitatively.

First, qualitatively, they insist incumbents are ramping up AI investments and, with deeper pockets, will lap Lemonade eventually.

That misses how AI really works. Legacy insurers have been around forever, saddled with patchwork IT systems from dozens of vendors that don't talk to each other. Data's scattered, uncontextualized, and often junk for real AI applications. Plus, they rely on agents for sales and service, so they're not gathering rich, direct customer data—it's thin and spotty.

Lemonade, on the other hand, was born AI-native and sells direct to consumers, which changes everything for leveraging data to sharpen operations.

Nicholas Stead, SVP Finance at Lemonade, nailed it in the earnings call:

We believe the gap between us and incumbent insurers who are built on legacy systems is very likely to expand as AI development accelerates. We have been AI native since day 1. Relative to new upstarts, that 10 years in market gives us a real data edge, thousands of A/B tests, 10 million driving trips, millions of customer interactions and claims.

When it comes to data, there's really no shortcut to that type of depth and scale. By the time generative AI really accelerated in 2023 and onwards, we already had AI embedded across the tech stack with terabytes of proprietary data flowing through the system. We stand apart from incumbents with a single AI system that connects every aspect of the business and from upstarts with the depth and breadth of proprietary data that feeds it.

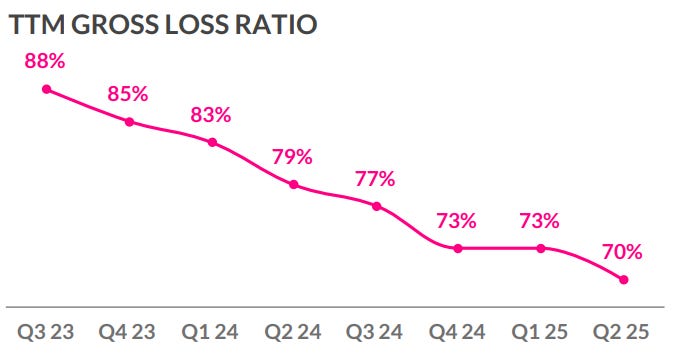

So we believe we're really the only full stack multiline insurance company with the tech stack and data to fully capture AI's potential. And this is playing out in our business outcomes. Our proprietary telematics pricing model now outperforms the off-the-shelf product that many competitors rely on. And over the last 2 years, our overall gross loss ratio improved by 27 points, while IFP grew by nearly 60% during the same period, clear evidence that our AI flywheel advantage is compounding.

On the quantitative side, Lemonade's clearly marching toward profitability, with management targeting 2026. The numbers back it up.

As the CEO Daniel Schreiber said:

70% trailing 12-month loss ratio is simply fantastic and perfectly aligned with our long-term goals. And what that has meant is that our insurance entities have moved from being loss-making to profit-making. Rather than consuming capital, they are generating capital. And that is something that changed over the course of the last few quarters as we indeed became cash flow positive; we reported a $25 million adjusted cash flow this past quarter, a tenfold increase year-on-year. It is that more than anything else that's allowing us to take on board less or to utilize less quota share reinsurance.

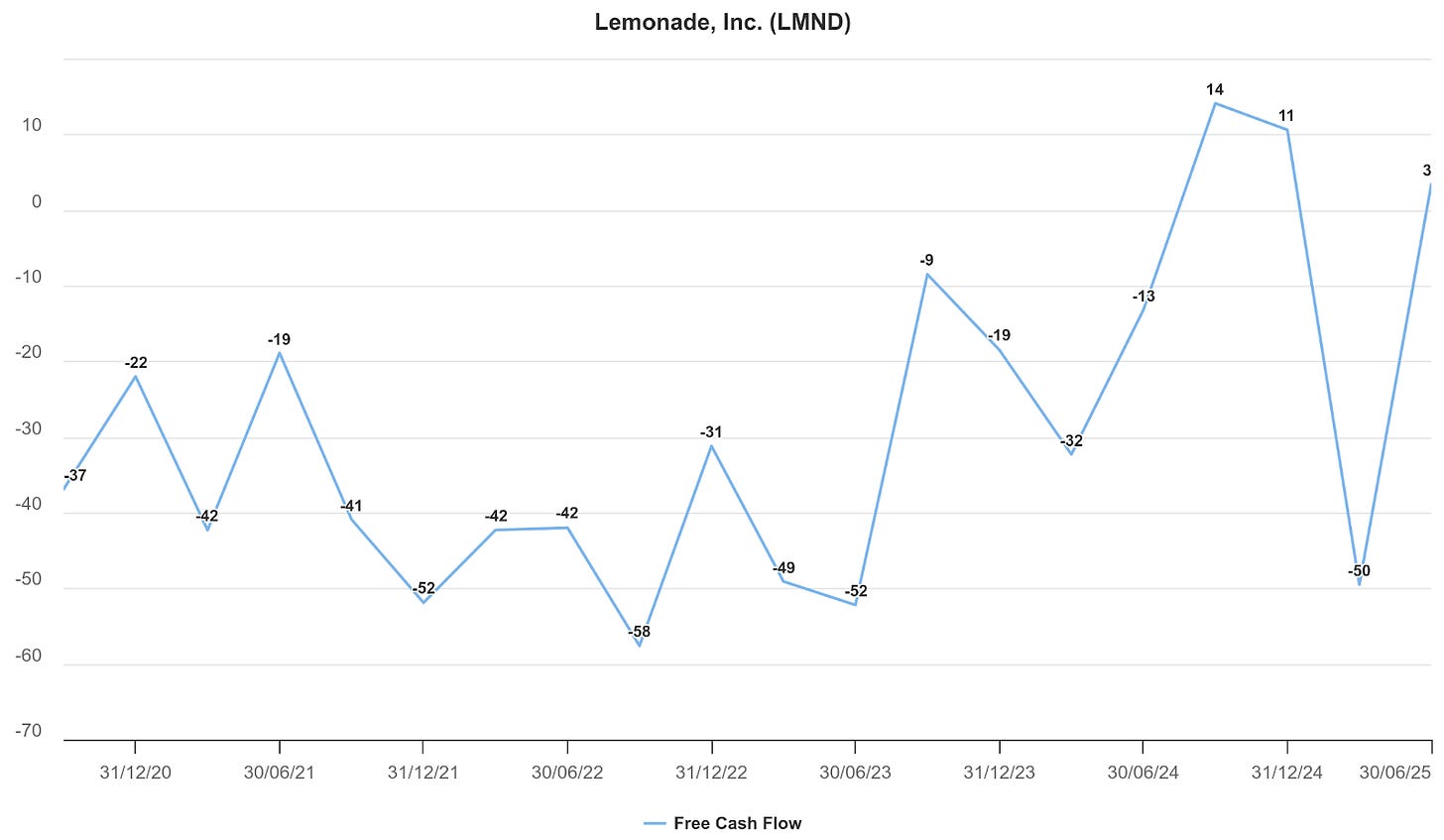

Free cash flow often leads net income for high-growth tech firms and insurers alike—and Lemonade fits both bills.

The company posted $25 million in adjusted free cash flow this quarter, up $23 million from last year, staying positive and trending higher since around September 2022. You can see it in this GAAP FCF chart (the key difference: GAAP skips the boost from net borrowings, mostly tied to the synthetic agents program).

FCF vs Net Income

To see how FCF might foreshadow net income shifts, consider this.

In the LTM chart below, the gap between FCF and net income comes mostly from three things dragging on income:

· Unearned premiums (basically deferred revenue): These are premiums collected upfront but earned over time as coverage unfolds—standard GAAP for insurance. Since Q3 2023, they've been rising, which is great news. It signals IFP growing quarter-over-quarter, with claims taking a smaller bite. That's thanks to expanding IFP and shrinking loss ratios. Bottom line: the more this explains the gap (73% in Q2, expanding from previous quarters), the better, and net income should catch up to FCF's upward path.

· Reserve liabilities: Money set aside for future claims and costs. Changes reflect updates from new data or estimates. You'd think this swells with IFP growth, but it's stayed flat. I chalk it up to falling loss ratios and management's confidence they'll hold steady or improve.

· Stock-based compensation (SBC): Non-cash hit from employee equity grants. It's big for a growth company like Lemonade competing for talent. But it's controllable, and with a 2026 profitability goal, I trust they'll dial it in. Recent dips from peaks suggest that's underway.

All told, odds are high that net income tracks FCF higher in coming quarters, building on its positive base and mirroring IFP momentum.

Now, onto the Q2 specifics.

If you haven't read my original deep dive on Lemonade (since then, Lemonade is a multi-bagger), I recommend doing so before reviewing this update. It's essential reading for a thorough understanding of the company.

Lemonade Car

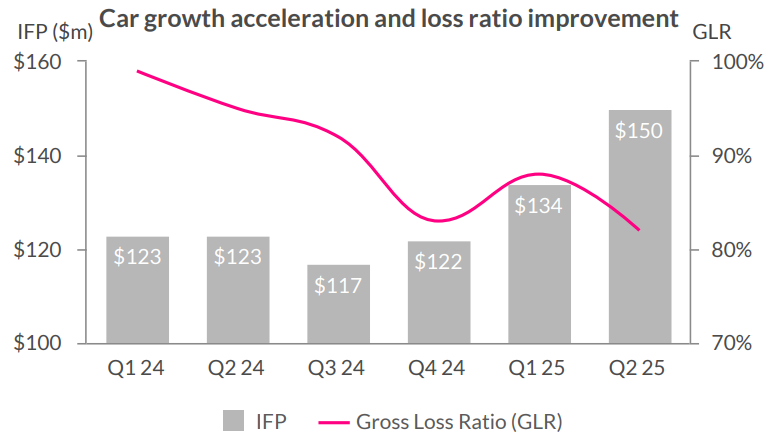

Lemonade Car kept accelerating, capping a solid first half of 2025. Q2 IFP grew 12% sequentially, beating the company's overall pace for the second quarter running. Expect that to continue.

Building on Q1 tests that wove telematics data into the customer journey early, conversion rates jumped ~60% from Q4 baselines. Q2 saw investments ramp up behind those wins, with Car marketing spend up 25% from Q1, all while keeping efficiency steady.

State expansions helped too. Colorado, rolled out in Q1, showed strong early results—better new business and cross-sell conversions than any prior launch. Indiana went live July 7, looking poised for similar success.

Car's gross loss ratio hit 82% in Q2, down 13 points year-over-year and the best since launch. Improvements span new and renewal policies. This combo of faster growth and better underwriting spotlights a core strategy: widespread telematics use sharpens risk pricing, letting Lemonade cut rates for safe drivers while trimming losses.

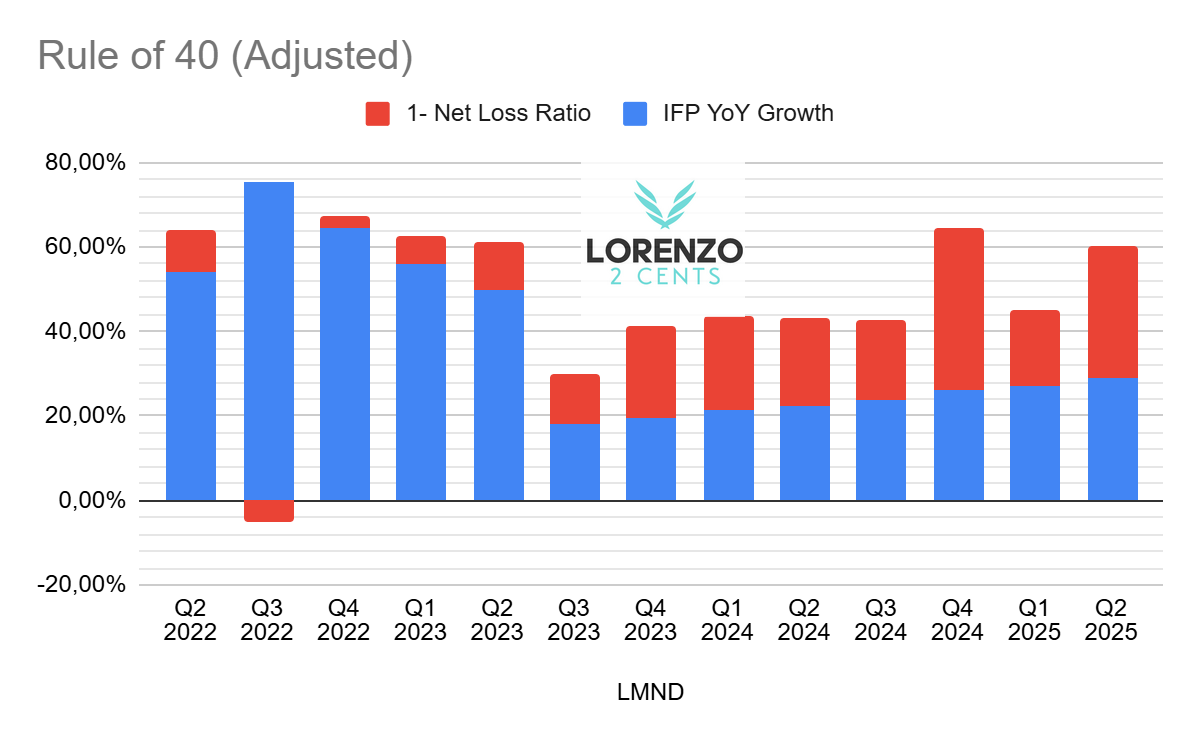

In Q2 2025, my adjusted Rule of 40 for Car—IFP growth plus (1 - gross loss ratio)—hit 40, up from 20 in Q1, showing real traction in the segment.

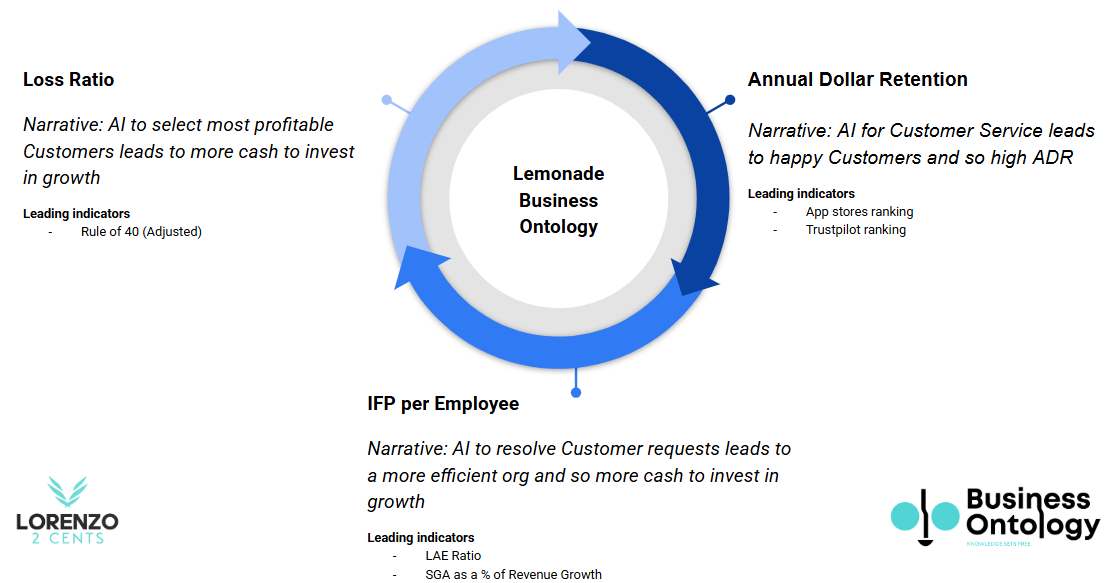

Business Ontology

Quick refresher: My Business Ontology framework views companies through linked metrics that expose model strength and scalability. For Lemonade, it's about IFP growth, loss ratios, efficiency, and retention—highlighting how AI creates compounding edges.

If you’re new to my Business Ontology framework, check out this article for a detailed introduction.

Annual Dollar Retention

ADR held flat at 84% from last quarter, a low point, but no red flag. As the CFO Timothy Bixby explained:

Annual dollar retention or ADR was 84%, flat as compared to the prior quarter, and continuing to show modest downward pressure as a result of our continuing effort to improve the profitability of our home book through targeted non-renewals. We expect ADR to normalize and resume improvement over the coming quarters.

He added:

We continue to move forward with the project we've called sort of clean the book in our home book, which provides a headwind, but a good headwind. It aids our move towards profitability. We take advantage of an ability to non-renew certain business that no longer fits our underwriting guidelines. And one place you'll see that in our metrics is in our annual dollar retention metrics, which have been flat for a couple of quarters now. We estimate that there's roughly a 4% drag on that metric because of our home efforts to move more aggressively to profitability.

Without the cleanup, ADR would sit at 88%—Lemonade's all-time high.

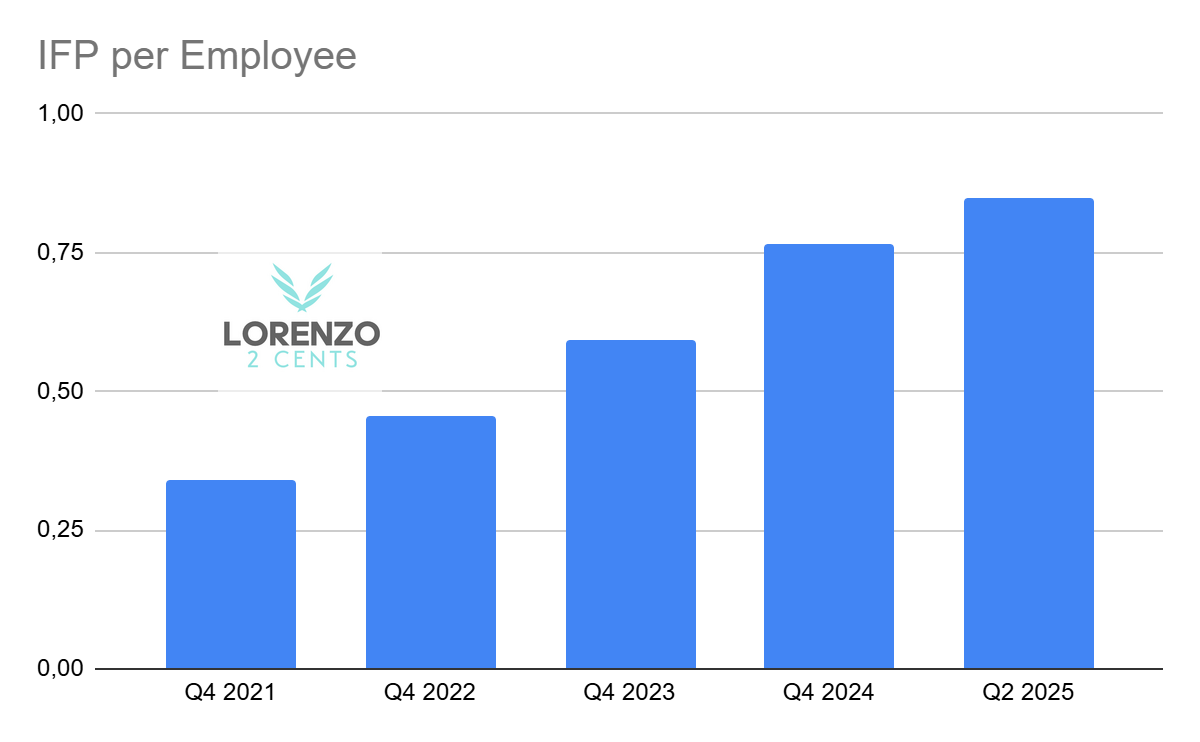

IFP per Employee

IFP per employee reached a fresh high of $850k in Q2.

Europe played a big role in IFP gains. Lemonade's European ops are making real waves. Active in Germany, France, the UK, and the Netherlands, they cover over 250,000 renters and homeowners. Europe spreads risk beyond the U.S., with less CAT exposure and regs that allow quick tweaks to pricing and underwriting—no filings needed. That speeds up learning, hones AI models, and boosts accuracy. The platform scales seamlessly across borders, no bulky local setups required, keeping costs low and prices sharp.

Outcome: Q2 Europe IFP surged over 200% year-over-year to $43 million, adding more than 20% of Lemonade's net new customers. Loss ratios improved too—low 80s, down 15 points from last year.

Versus U.S. at similar scale ($50 million IFP), Europe's loss ratio is 20+ points better, and it pulls in twice the new business per growth dollar. Future looks bright with deeper market digs, new products, and cross-selling.

Efficiency shines: Opex stayed flat amid 29% premium growth, thanks to AI automation, pushing positive FCF.

Loss Ratio

Slashing the quota share reinsurance from 55% to 20% screams confidence in loss ratio control. From the shareholder letter: Lemonade stuck with trusted partners on similar terms but dialed back cessions to fit a maturing book. This was intentional—they could've kept the old setup. Keeping more premium in-house means more revenue and profit retained.

It's possible because of years of steady loss ratio drops and predictable results.

Car and Europe loss ratios are falling, underscoring AI's structural edge.

On car renewals, Timothy Bixby said:

So there is actually a fairly notable difference that we've been pleased to see unfolding where it is typical in the insurance realm for renewal business to be at a more favorable unit economics than the initial policy. And in car, especially for us at Lemonade, we're seeing a much more notable difference, something on the order of 20 percentage points of loss ratio improvement from the first policy to the renewal policy. It is early, and so those -- that continues to develop, but that's a really encouraging sign that we're both choosing risks effectively. And as you see, the overall loss ratio coming down, but also that renewal is a great early indicator that we're doing this well.

Conclusion

This quarter lines up perfectly with my original thesis with a clear path to 30% growth YoY, Positive adjusted FCF for 2025 and EBITDA by end-2026.

I'm more bullish than ever on this holding. Even after the recent run-up, the valuation screams asymmetry. I added shares pre-earnings; it's now 15% of my portfolio (made of ten stocks). If it dips back to the 40s, I'd likely buy more.

My Rule of 40 proxy—which sums IFP growth and (1 - Net Loss Ratio)—keeps climbing, signaling balanced expansion.

As always, here is the “Deep Dive To Date” (DDTD), that is how the stock is performing since my initial deep dive on the September 24th 2024, when the stock price was $17.23.

3x DDTDSee you in the next update!

The content of this analysis is for entertainment and informational purposes only and should not be considered financial or investment advice. Please conduct your own thorough research and due diligence before making any investment decisions and consult with a professional if needed.