The Real Reason Why $LMND Is Better Than $ROOT, long term

It’s (Not) All About Data

If you’d rather watch a video where I break down this article, here’s the link. That said, this written piece dives even deeper into the details, so I recommend reading it for the full scoop. Also, let me know if you appreciate video companions for my articles—drop a comment on my Substack or shoot me an email at info@lorenzo2cents.com.

Winning the race as the top telematics-driven car insurer comes down to collecting great data and using it well.

The goal?

Keep loss ratio low while growing customers fast.

Root shows this in their shareholder letters with a simple infographic: a flywheel with “Data” at the center.

Here’s the loop:

Growth brings more data.

More data means better pricing and value for customers.

That creates smarter customer groups.

Better groups improve risk scoring.

Strong scores gather even more data.

This leads to better customer experiences.

Happy customers drive more growth.

It’s a basic cycle where each step helps the next one.

Minimizing Loss Ratio

In principle, the loss ratio is simple: it’s claims paid out divided by premiums earned. A low one means you’re doing well.

For telematics data in car insurance, Lemonade and Root collect similar types and quality. Both use their own smartphone apps as sensors. The amount of data depends on total miles driven by users.

So, a basic way to describe what could determine the winner in such a data-driven race, is:

Lemonade tracks driving continuously. If you stop, you lose the discount. Root tests the app for a few weeks to get a quote. After that, you might turn it off, though it can run continuosly in the background with permission.

Lemonade’s setup pushes for constant monitoring, which helps with ongoing risk checks. This suggests Lemonade may dig deeper into the data, which could support the Management’s thesis that their telematics is “dramatically different” from others: it’s built into an integrated system with in-house data science.

But ultimately on the tech side, I don’t have enough info to pick a winner. Both approaches are close, and the follower can eventually copy the leader.

For data volume, Lemonade uses Metromile’s data from 2013. Root started in 2015, so they’re similar in age. But Root has the first-mover edge and more scale. They have 32 billion miles of driving data as of July 2025, while Lemonade hasn’t shared a recent comparable metric.

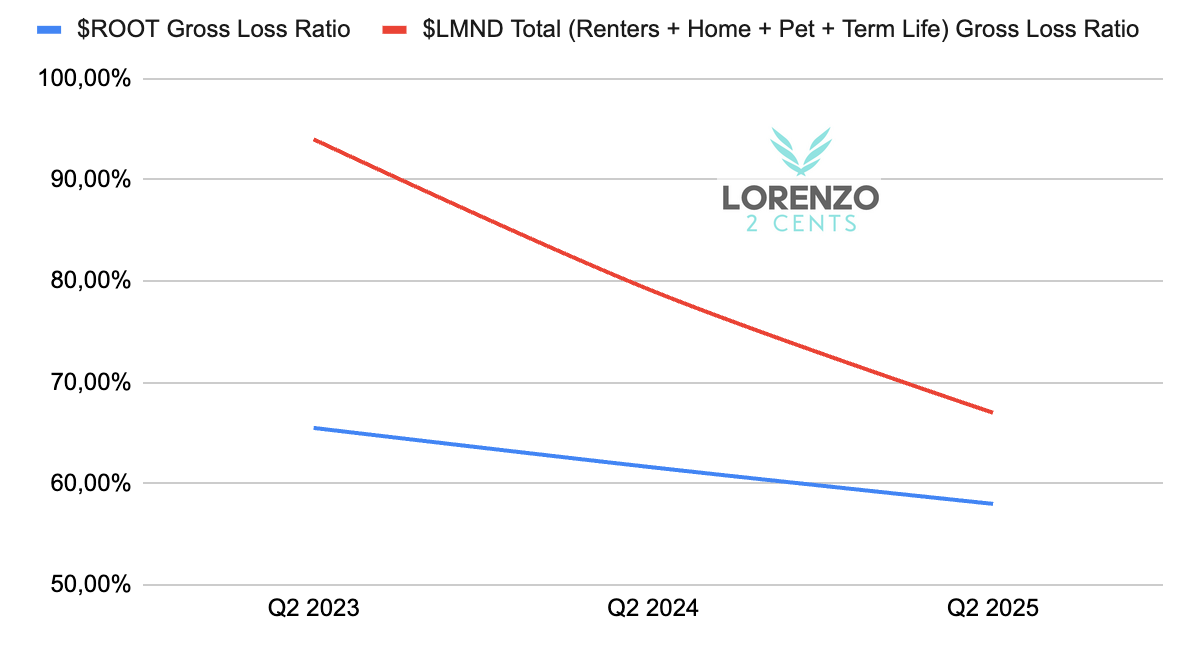

This advantage shows clearly in recent gross loss ratios: in Q2 2025, Root hit 61%, improved from 67.1% in Q1. Lemonade was at 82% and 88%. That’s a big gap.

Lemonade needs to close it to show their algorithms and data match Root’s.

But Lemonade can catch up: they’ve already improved loss ratios in homeowners, renters, pet and term life insurance. The trend is moving that way for car too.

Maximizing IFP Growth

In-force premium (IFP) growth is the flip side of the coin. Insurance premiums are—counterintuitively—inelastic, but the rise of online platforms and younger generations is making demand more price-sensitive. As a result, even a modest cut can attract new customers and capture significant market share.

A price reduction, which often means a higher loss ratio, goes hand-in-hand with faster IFP growth, and viceversa.

For data-driven companies like Lemonade and Root, balancing loss ratio and IFP growth through pricing is key. It’s a big strategic choice.

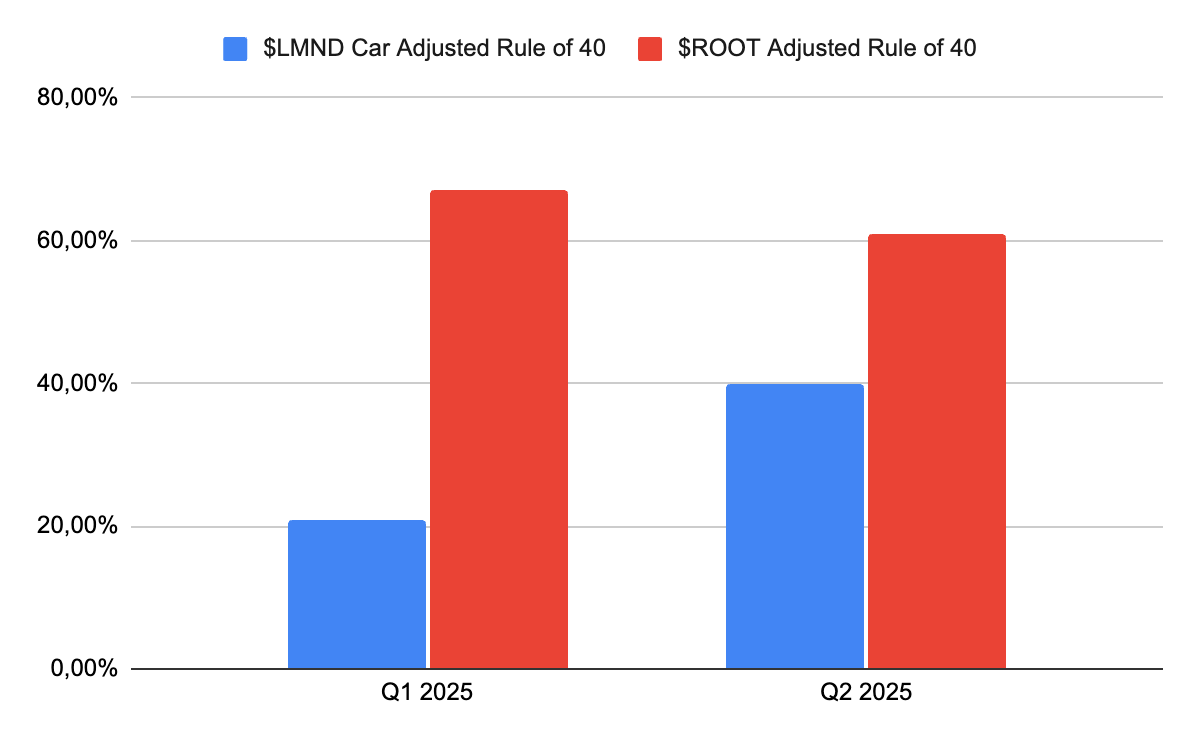

To measure it, I use my proprietary Rule of 40 adjusted for insurers. In this version, In Force Premium (IFP) growth is added to ‘1 minus the Gross Loss Ratio’. The higher, the better, and 40 looks to be still a good treashold to separate the good from the bad.

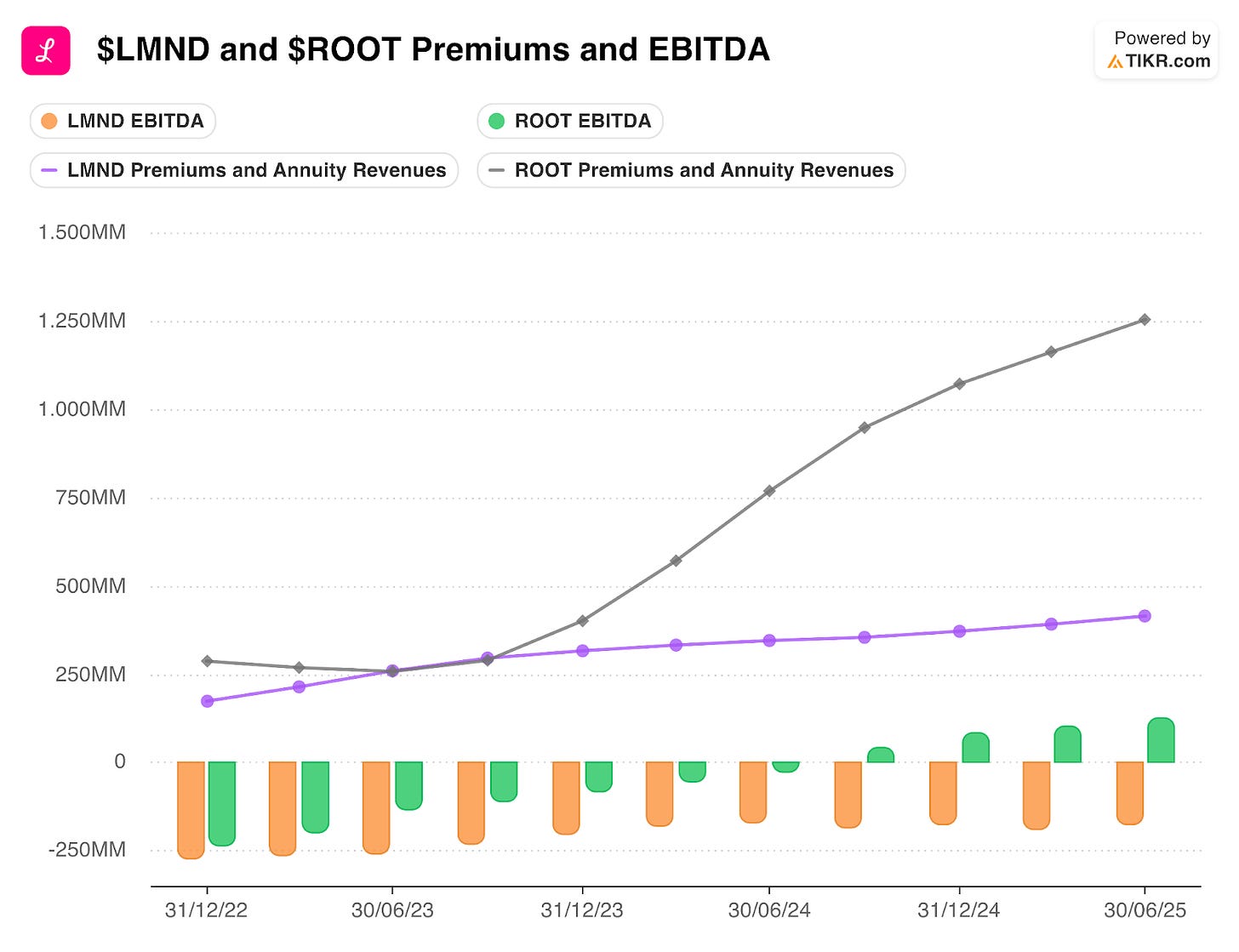

Right now, this metric isn’t carrying much weight, as Root holds a clear lead thanks to their first-mover advantage and established scale, but I fully expect Lemonade to close the gap and pull ahead in the coming quarters, given their ability to leverage a much smaller starting point in car IFP—$150 million in Q2 2025, compared to Root’s towering $1.5 billion—which makes achieving 30% year-over-year growth feel almost effortless for them, while Root’s momentum is already tapering off to 19% in Q2 after 23% in Q1.

It’ll be fascinating to track how this plays out over time, especially as the true showdown emerges when Lemonade approaches that $1.5 billion mark in car IFP, setting the stage for a head-to-head comparison on truly even footing.

Root Leads with Distribution Excellence

At the essence of Root’s success is their ability to train machine learning models with data from telematics and other sources, and as new customers join the platform, they relentlessly improve their pricing algorithms using that fresh influx until they’ve achieved what stands as the best in the industry.

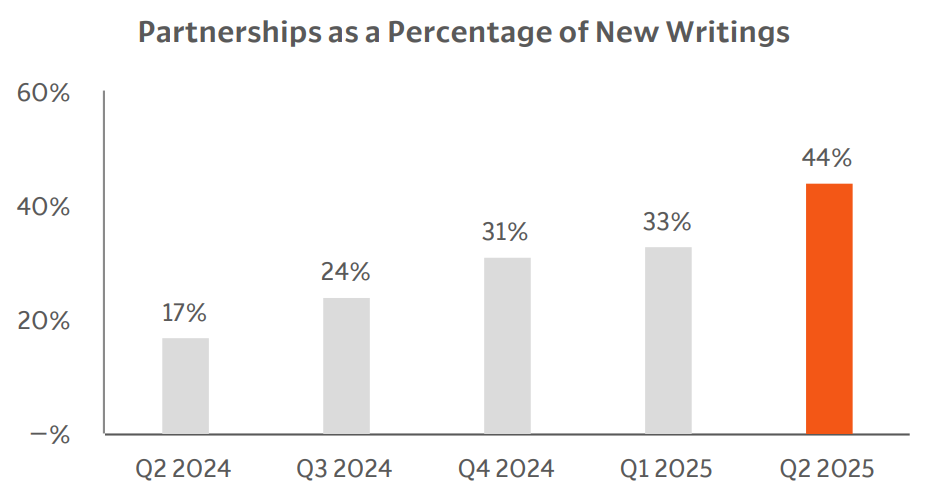

And once you have the best pricing algorithm in the industry, the second smartest thing to do is maximize its distribution, and that’s exactly what Root is doing. In addition to their DTC channel, which effectively powered the hypergrowth they reached in 2024, Root is relentlessly investing in partnerships and agents to build a distribution network as extensive as—or even more than—their competitors’. Here’s how partnerships as a percentage of new writings have increased over the last quarters, steadily claiming a larger share and turning distribution into a true competitive weapon.

Root embeds insurance right into partners’ platforms—for example, offering 3-click quotes at Carvana checkout, integrating with Hyundai Capital for financing, tying into Experian for credit-based shopping, or distributing through Goosehead agencies—which boosts low-cost acquisition far beyond what the direct channel can deliver, since DTC relies on continuous marketing investments with returns that feel uncertain and heavily dependent on the cutthroat competitive environment.

Lemonade, on the other side, stays DTC-focused: it relies primarily on app-based onboarding with 90-second quotes via AI bots like Maya, viral marketing, and behavioral nudges for direct sales, a streamlined approach that works well but doesn’t match Root’s hybrid scale.

The results of these two different strategies are clear—Root scales faster and bears lower acquisition costs, which is clearly reflected in the financials, from quicker IFP ramps to leaner expense ratios.

Like the graphs and my analysis? Check out my “Tools I Trust” page to see what I use—and grab ‘em via my links to support my work!

Another fundamental distinction between Root and Lemonade lies in the nature of their core products, which has given Root a structural advantage in customer acquisition and cost efficiency right from the start.

Let’s take renters insurance, a product that is often optional and unfamiliar to many potential customers. In its early years, approximately 87% of Lemonade’s policyholders were purchasing this type of insurance for the first time, so the company had to invest significantly in customer education—through targeted marketing campaigns, explanatory content, and enhanced support services—just to build awareness and overcome barriers to adoption. This educational effort substantially increased Lemonade’s customer acquisition expenses, making every new policy a harder-fought win.

In contrast, Root operates primarily in the auto insurance market, which is large, consolidated, and dominated by established competitors, but auto insurance is a well-understood necessity for vehicle owners, with widespread familiarity gained through everyday life experiences such as obtaining a driver’s license or purchasing a car. Customers enter this market already informed and actively seeking coverage, which reduces the need for extensive education and keeps Root’s customer acquisition costs way lower than Lemonade’s, allowing the company to achieve growth with far greater efficiency.

This product-driven disparity—combined with the fact that auto policies generate roughly four times the annual premium revenue of renters policies—has enabled Root to scale more cost-effectively.

Why I Am Invested in Lemonade and Not in Root

Root seems to beat Lemonade on most metrics tied to car insurance, and even when you stack up their full businesses side by side, Root comes out looking stronger across pretty much every key measure—from growth to costs and beyond.

So why am I invested in Lemonade, with no plans to switch over or add a Root position to my portfolio?

It’s a fair question, especially after digging this deep. The short answer is straightforward: Lemonade is an autonomous organization built to upend the sleepy, multi-trillion-dollar insurance industry, while Root is “simply” an excellent car insurer that’s likely to thrive for the next decade. And honestly, I rarely bet on the runner-up when the upside feels this asymmetric.

What does “autonomous organization” even mean in practice?

Lemonade operates like a well-oiled machine, where AI and machine learning handle the core functions with minimal human intervention. Their chatbot Maya processes most of policy sales instantly, while automated claims and underwriting draw on proprietary data from millions of customer interactions and 10 million driving trips to make real-time decisions. This setup bypasses traditional drags like agent commissions—which for instance touch 95% of U.S. homeowners policies—and paves the way for frictionless scaling in the long run.

Take claims processing, for instance. This approach slashes overhead, accelerates payouts, and boosts customer satisfaction all at once. A clear sign of its power? The loss adjustment expense (LAE) ratio, which tracks the costs of investigating, managing, and settling claims. Leading insurers with tens of billions in premiums average around 10%, but Lemonade clocked in at just 7% in Q2 2025—impressive for a company still ramping up. Technology is driving that efficiency now, even before the full benefits of scale kick in. Root holds a similar ratio, sure, but their larger footprint and auto-only focus make those gains a bit easier to come by.

The true magic of an autonomous model boils down to this: revenue can scale massively while headcount barely budges.

How that looks in the numbers?

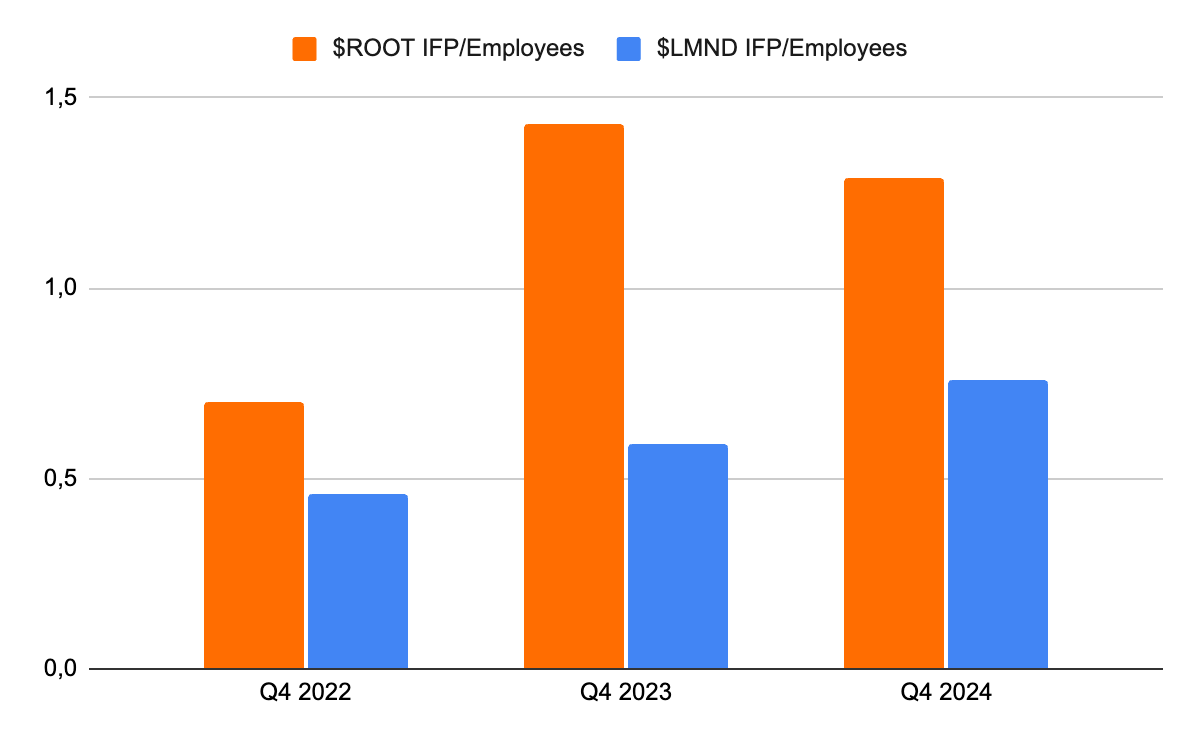

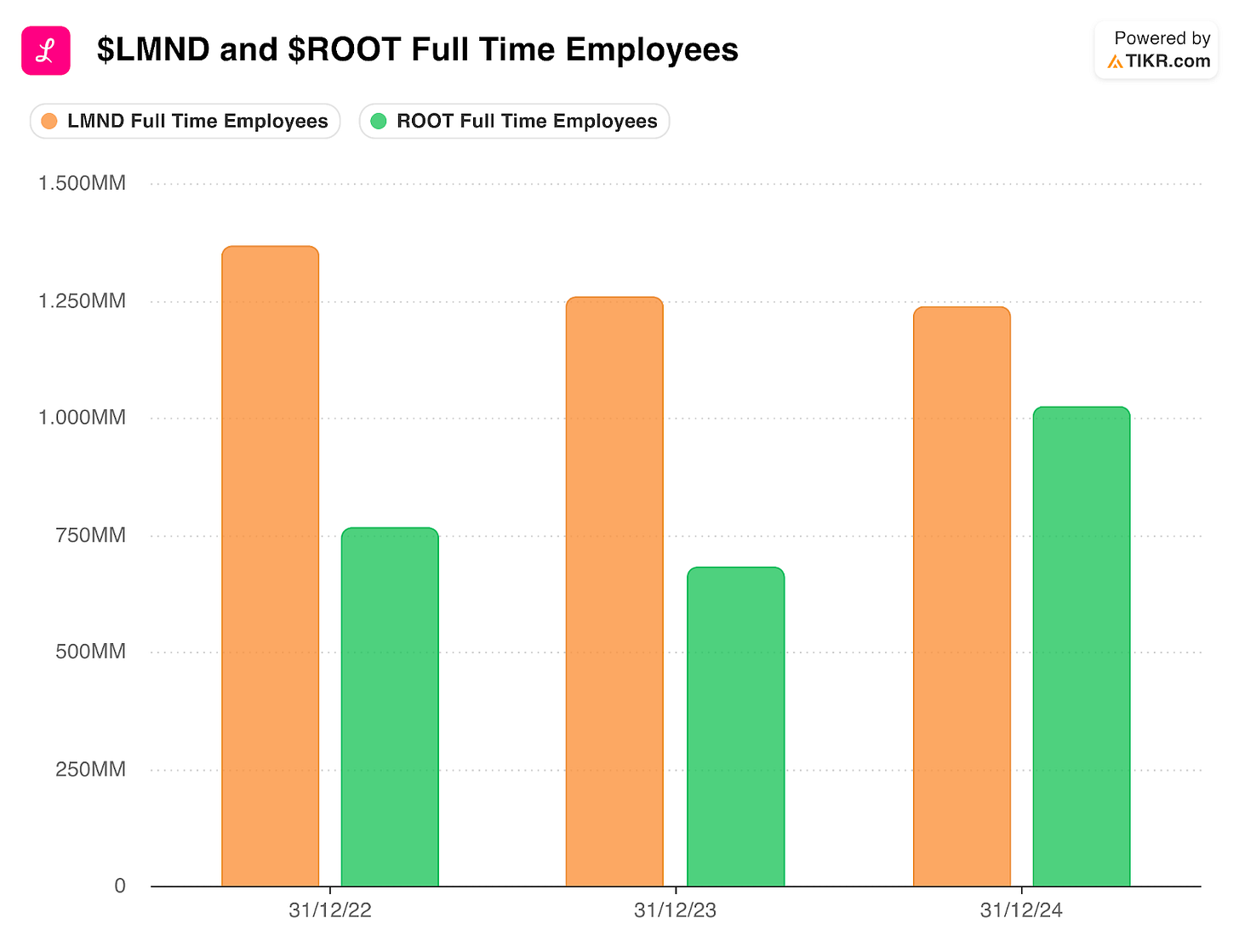

Consider IFP per employee as a quick proxy.

Root still leads on the absolute figures, riding high on their scale and the inherent efficiencies of car insurance. But the trends paint a different picture—one that tilts toward Lemonade.

Their revenue keeps climbing even as employee numbers hold steady or dip slightly, whereas Root’s headcount feels lumpier, prone to occasional spikes despite no major overall growth.

I’ll be honest here, when I kicked off this deep dive, I was biased in thinking that Lemonade would emerge as the undisputed winner without much debate. To my surprise, though, Root proved to be an outstanding company, one that’s clearly positioned for solid success ahead. If I pared this analysis down to pure quantitative metrics, Root would probably claim the crown.

Yet here’s why I stick with Lemonade—and why I still see it as the premier investment in the insurance space, maybe even one of the best risk-reward setups in the public markets today.

They’re playing a different game altogether: a bigger one, a longer-term one.

Lemonade’s all-in on the DTC model because it gives them total control over customer data and the levers of the business, even if that means leaving some profits on the table in the near term and growing at a more measured pace.

A telling signal that Root isn’t on the same autonomous trajectory? Their push to expand the agent channel—which is the last thing you’d do if data ownership was your north star. Ever thought about how handing off leads to agents could dilute that precious customer insight?

Root’s model might deliver steeper auto growth and quicker profits in the short haul, while Lemonade’s DTC purity fits a vision of a durable ecosystem, albeit with higher upfront costs to match. I believe this likely sets Lemonade up to underperform Root near-term, but over a longer horizon, they’ll pull away decisively.

Lemonade’s now pushing hard into car insurance, and there’s every reason to expect they’ll deliver the same top-tier performance they’ve already unlocked in renters, home, life, and pet lines—which will supercharge their growth to rival or surpass Root’s. On top of that, a multi-product strategy opens the door to cross-selling across their customer base, which naturally trims acquisition costs while driving retention through the roof.

As always, here is the “Deep Dive To Date” (DDTD), that is how the stock is performing since my initial deep dive on the September 24th 2024, when the stock price was $17.23.

3x DDTDSee you in the next update!

The content of this analysis is for entertainment and informational purposes only and should not be considered financial or investment advice. Please conduct your own thorough research and due diligence before making any investment decisions and consult with a professional if needed.

Fascinating comparison between ROOT and LMND. The loss ratio gap you highlighted is massive (61% vs 82%) and really shows ROOT's current edge in auto insurance. What really caught my atention was your point about ROOT's distribution strategy with partnerships like Carvana and Goosehead. That embedded insurance approach at point of sale is brillant for keeping CAC low. I get your thesis on LMND's autonomous model and long term potential but ROOT's near term fundamentals are just so much stronger that it feels like the safer bet for the next few years. The 32 billion miles of telematics data is a real moat. Grat writeup breaking down both sides!

Thank you! ROOT is solid, I agree!