Lemonade: A Hard Stop For Short Sellers

$LMND Q3 2025 ER Update

At this point, Lemonade has become very boring to follow, as everything the management guided for has materialized or is materializing very accurately. Of course, I am not complaining, and if Lemonade were not already my biggest position, I would certainly be buying even more at this price, as it looks like a steal.

The trust the management has gained at this point, together with Lemonade’s fundamentals, simply does not match the current valuation, even after the +34% the stock price gained right after earnings, last week.

Lemonade accelerated IFP growth for the eighth consecutive quarter, to 30% YoY, which is exactly the cruise growth pace the management said they want to maintain for the years to come, until 10x the company. Car growth played the role of the lion as expected, “which saw 40% growth with more than half of that coming from existing Lemonade customers essentially CAC-less acquisition” (Daniel Schreiber, Q3 ER Call).

My initial thesis, shared more than one year ago, that hyperbolically anticipated a scenario of growth with near-zero marginal cost, is slowly coming to life.

Looking ahead, we expect Car growth to continue to accelerate, fueled in part by TAM expansion from new state launches and increased brand / growth investment. We expect to launch Lemonade Car in Pennsylvania in the coming months, after which we’ll be live in 9 of the top 10 largest U.S. cities,

explained Daniel Schreiber during the Q3 earnings call.

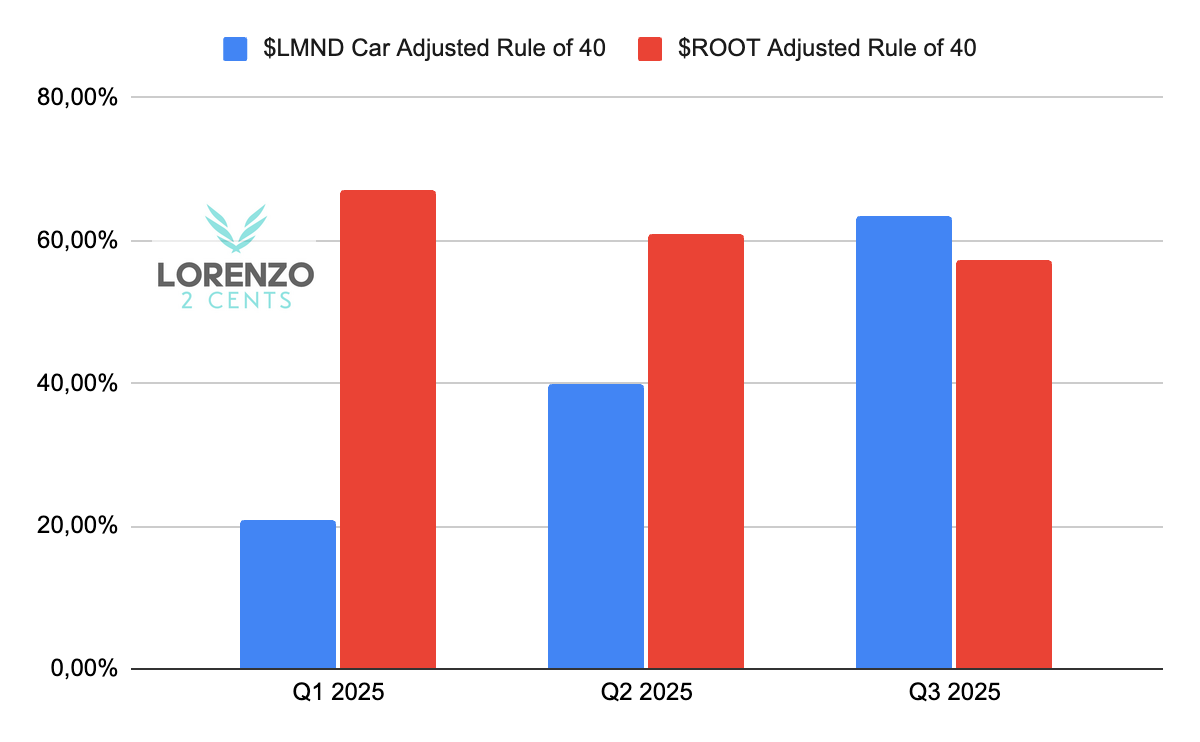

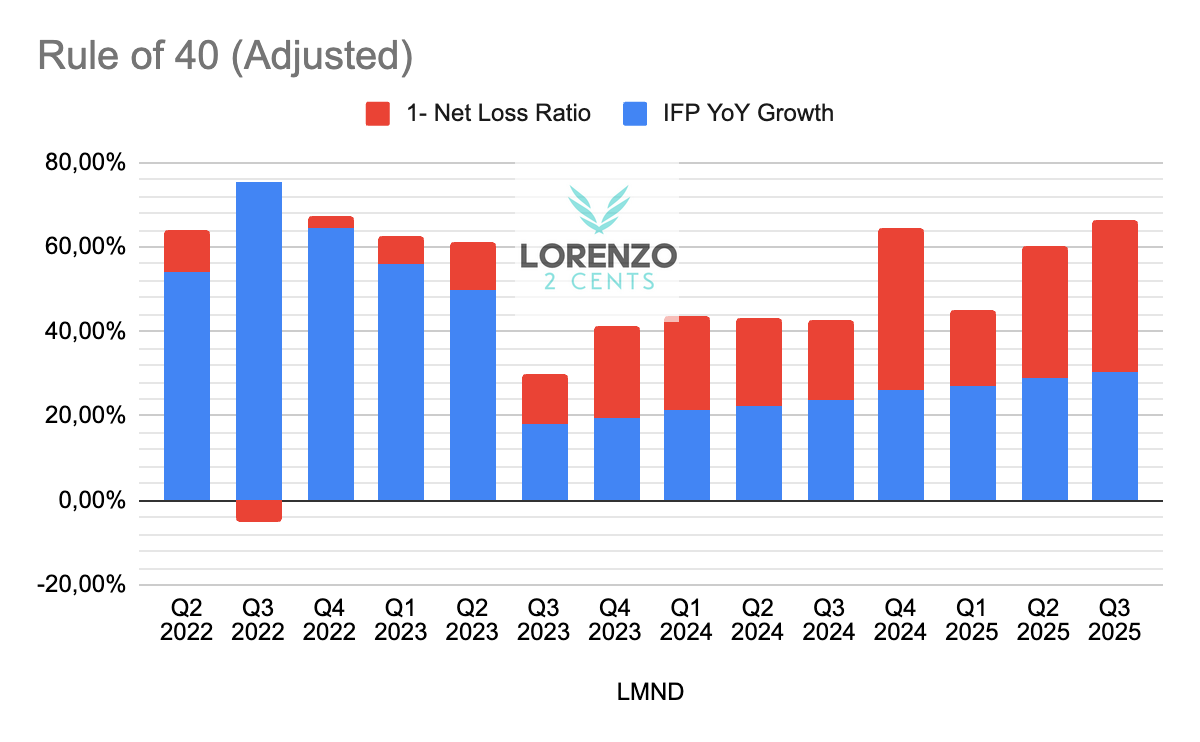

What we are seeing with Car is exactly what the management said would happen: it becoming the engine of growth for the entire Lemonade business while the loss ratio slowly comes down to a level that allows it to maximise the gross profit, as with the rest of the products. Unexpectedly, this quarter, Car’s gross loss ratio printed at 76%, down from 82% in the previous quarter—a big improvement that allows Lemonade to take the lead on the adjusted Rule of 40 metric I use to compare it to Root, which I consider the benchmark for Lemonade Car.

In Q3 2025, Lemonade scored 63, while Root scored 57.

Of course, this comparison is not completely fair, as Lemonade Car has a tiny IFP compared to Root—and even in absolute terms as well—and one could argue it takes less to grow from there. Indeed, we should keep this metric monitored for longer to get a really relevant signal.

One of the points always highlighted by skeptics is that Lemonade has no edge from its AI in assessing risks, and that incumbents and competitors have plenty of data scientists crunching numbers as good as or even better than Lemonade. But Lemonade doesn’t care about skeptics, and the company-wide gross loss ratio in Q3 printed at 62%, with the trailing 12-month loss ratio at 67%, both their lowest ever.

If nothing unexpected happens in the coming weeks, I anticipate that we will set a new record once more this quarter, Q4,

said Daniel Schreiber.

The loss ratio is going exactly where the management said it would go.

It is worth reiterating what I have already explained several times in my previous articles, which this time was perfectly articulated by Daniel Schreiber during the earnings call.

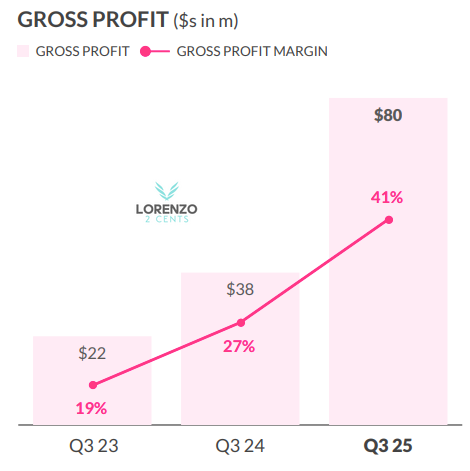

Declining loss ratios and expanding gross margins are a thrill, they are not per se what we are solving for…the metric we are looking to maximize is gross profit dollars. Loss ratios always affect gross profit but not always as a simple counter movement, whereby lower loss ratios yield higher gross profit. In reality, the relationship is non-onotomic, meaning that often a higher loss ratio will yield higher gross profit. The underlying mechanics are obvious when you think about it. Given the incredible price sensitivity in insurance, each percentage reduction in price can often yield outsized returns in terms of conversion and retention.Lower prices worsen gross margins and loss ratio, yes, but the attendant boost in revenue often more than makes up for that. This means that for some parts of our business, certain products, certain channels, certain segments, a higher loss ratio and slimmer gross margins will actually translate into higher gross profit. Given the choice, we will always privilege dollars over percentages,...And indeed, as noteworthy as our loss ratio progression has been in these past 2 years, during that time, our gross profit has surged by 261%.

This is why I believe my proprietary adjusted Rule of 40 metric is really indicative of how the business is performing, at a rough level at least. Gross profit and its growth lie at the heart of an effort to optimize IFP growth and the loss ratio. And we can see from the trend that Lemonade has been able to navigate this trade-off beautifully so far.

Daniel Schreiber then reinforced the message by explaining what is happening to the variable costs, which still align perfectly with my initial thesis.

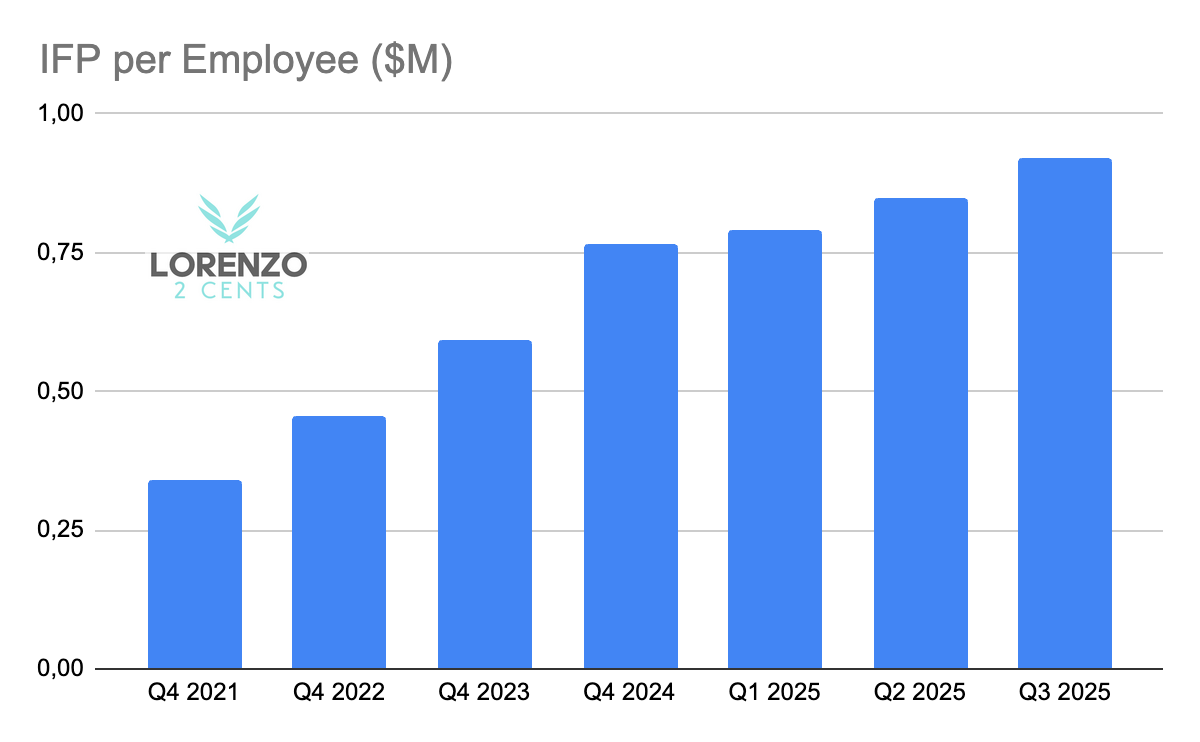

The full significance of this comes into sharp relief when paired with the fact that during the same time, our underlying expenses increased by single digits. This means that we’ve essentially transformed our variable expense into fixed costs. That’s extraordinary. It’s the hallmark of an AI-first company, and it is the reason why our gross profit trend line charts our path to profit and beyond.

At this point, nobody should have any doubt that Lemonade is successfully leveraging AI to disrupt the insurance industry. This quarter, headcount decreased sequentially from 1,274 in Q2 to 1,259 in Q3, and it was up about 3.5% versus the prior year and essentially flat versus 24 months ago. As a consequence, IFP per employee does not stop growing.

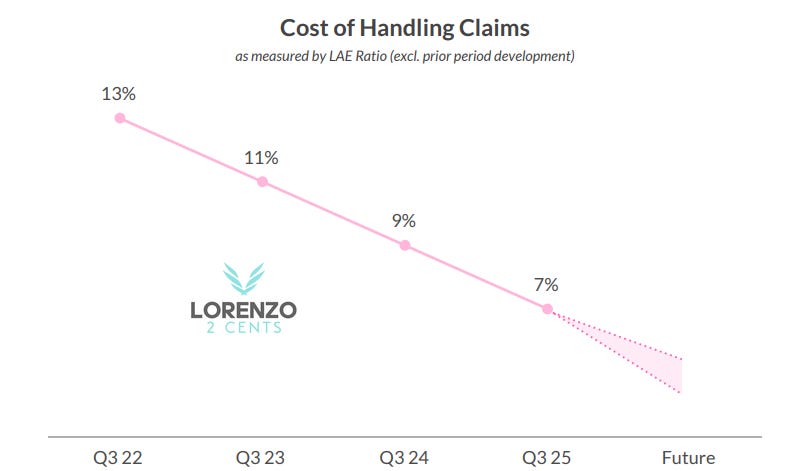

Another key indicator of the performance of Lemonade’s AI is the LAE ratio.

In the past 3 years alone, we’ve cut our LAE ratio in half and the number of Lemonade claims adjusters actually declined, all this despite our claim volume growing 2.5-fold… But having the best-in-class LAE is not where we stop. We wanted to take this further and expect to cut the LAE ratio in half yet again in parallel with our next doubling of the business.

I repeat: expect to cut the LAE ratio in half yet again!

For context, large carriers typically report around 9% LAE. In other words, they spend about 9% of their premium dollars to handle claims on top of the claim payment itself. Root, which is focused on car, is a bit less directly comparable to Lemonade, which has a broader mix; but for the record, in Q3, it reported 7.5%, still a good number.

Like the graphs and my analysis? Check out my “Tools I Trust” page to see what I use—and grab ‘em via my links to support my work!

Conclusion

I believe at this point even shorts should have understood that they are playing with fire, and will probably cover their position as soon as possible. If that does not happen, there will be a hard stop for them, which is Q4 2026.

That is the quarter when Lemonade guided to be EBITDA positive, and on the basis of what was shared during the last earnings call, there is no plan to postpone that milestone. The closer we get to that date, the hotter a short position becomes.

Take your popcorn; we’ll have fun.

As always, here is the “Deep Dive To Date” (DDTD), that is how the stock is performing since my initial deep dive on the September 24th 2024, when the stock price was $17.23.

4x DDTDSee you in the next update!

The content of this analysis is for entertainment and informational purposes only and should not be considered financial or investment advice. Please conduct your own thorough research and due diligence before making any investment decisions and consult with a professional if needed.