Lorenzo2cents 2025 Portfolio Performance

Mission Accomplished

The content of this analysis is for entertainment and informational purposes only and should not be considered financial or investment advice. Please conduct your own thorough research and due diligence before making any investment decisions and consult with a professional if needed.

As you all know by now, the goal of the Lorenzo2cents portfolio (L2C Portfolio) is to grow $50,000 to $1 million. This must be achieved in the shortest time possible, while avoiding excessive risk. To define “excessive,” I can tolerate a severe drawdown of up to 60% in the event of a black swan event, but I cannot accept permanent capital loss (i.e., wiping out the initial $50,000) or a drawdown that persists for longer than five years.

In terms of timeline, I believe the $1 million target is achievable by 2032, assuming no major black swan events or asset bubbles burst. In such scenarios, it would naturally take longer.

Target and KPIs

Every meaningful goal requires a clear path and process, which is why the portfolio’s success is evaluated on a rolling five-year average basis using two key performance indicators (KPIs):

Compounding at a minimum of 30% year-over-year (YoY)

Outperforming the NASDAQ Composite benchmark by at least 10%

A consistent 30% YoY compounding rate won’t quite deliver $1 million by 2032, but it represents a realistic yet ambitious target—one that would likely surpass the performance of most institutional and retail investors alike.

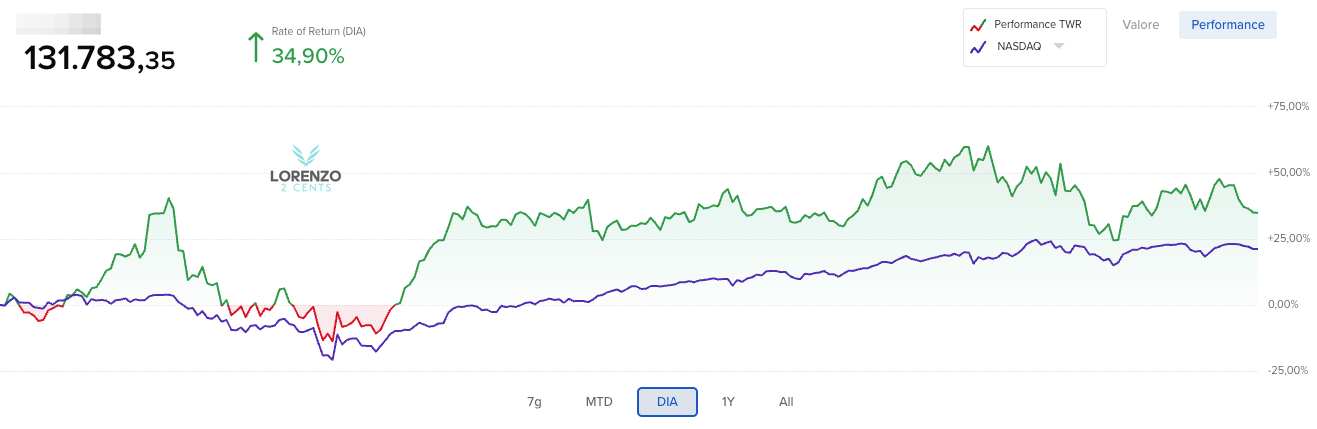

L2C Portfolio Performance

Now, turning to the 2025 performance.

Following a stellar 2024, here’s how 2025 stacked up:

Lorenzo2cents Portfolio: 34.90%

NASDAQ Composite: 20.5%

S&P 500: 16.39%

Beyond these excellent results, I’m particularly pleased that, just like last year, the portfolio held up well even during periods of negative broader-market returns. For instance, in the spring, markets faced historic volatility as Trump rolled out his so-called “Liberation Day” tariffs. Even then, the portfolio’s YTD performance remained above the NASDAQ Composite and only slightly below the S&P 500.

This resilience signals that, despite being composed of high-beta tech stocks, these are actually high-quality names that don’t get dumped as severely by the market, even in critical conditions.

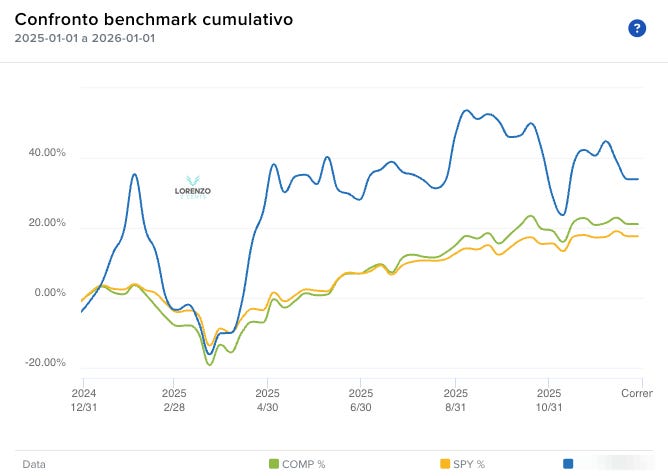

Let’s now review the success KPIs since inception (January 1, 2024) through December 31, 2025:

L2C Portfolio CAGR: 62% — exceeding the minimum goal of 30%

L2C vs. NASDAQ Composite (IXIC) CAGR: 62% vs. 25% — surpassing the minimum goal of outperforming the market by 10% (overperformed by 37%)

L2C Portfolio Composition (as of December 31, 2025)

The following positions constitute the portfolio as of the end of 2025:

$HIMS - 15.3% Allocation – Redefining healthcare by making it accessible and affordable.

$ODD – 8.2% Allocation - Revolutionizing the beauty industry.

$TSLA– 9.0% Allocation - The ultimate leader in transportation autonomy, sustainable energy, and humanoid robotics.

$RKLB– 14.2% Allocation - The leading public space company.

$DUOL – 3.1% Allocation - Transforming education by making learning both fun and effective.

$LMND– 26.0% Allocation - Reinventing the insurance sector.

$META – 4.3% Allocation - Unlocking AI’s future with an unparalleled dataset, paving the way for groundbreaking AI applications.

$MELI – 5.2% Allocation - The backbone of Latin America’s digital economy, poised to benefit from continent-level network effect.

$NBIS - 10.1% Allocation - The Application Software’s Universal Substrate for Agentic Computation

Liquidity - 4.6%

Key Portfolio Moves

Sold $CRWD - While I still believe it’s the premier business in the cybersecurity space, its current valuation doesn’t offer sufficient upside relative to the other holdings in my portfolio.

Sold $PLTR - Despite my conviction that Palantir is evolving into the backbone of the U.S. economy, the current valuation limits its potential outperformance compared to my other positions.

Sold $SEA- I cannot see a sufficiently robust moat to justify its place in the portfolio

Doubled down on $LMND - My highest-conviction holding

Tripled down on $HIMS - Likely the most explosive upside opportunity on Wall Street

Opened a $NBIS position - Incredibly undervalued with an exceptional management team; the moat remains to be fully validated, but it’s compelling enough for an initial stake at current levels.

Opened a $MELI position - Astonishingly cheap, backed by outstanding management and a formidable moat.

Top Performers and Top Losers (+-20% movements)

$RKLB +143%

$LMND +60%

$NBIS +59%

$DUOL -46%

Notes

The performance of the L2C portfolio has been severely penalized—by approximately 15%—due to the devaluation of the USD against the EUR. This stems from the fact that my portfolio is denominated in EUR, as I am a resident of Italy and have set EUR as the primary currency in my brokerage account. In other words, if the portfolio were measured in USD, the performance would have been 34.9% + 15% = +49.9%.

Additionally, I generated approximately €2,220 by selling call and put options throughout 2025.

I’m quite pleased with 2025’s performance and anticipate an even more exhilarating 2026. The Lorenzo2Cents project is growing steadily and is poised to deliver even greater value to those willing to engage with it. Stay tuned!

Lorenzo

Lorenzo2cents

Hi Lorenzo, could you share more details about selling call and put options in 2025? Specifically, how does this strategy work to generate cash?

Thank you.