Nebius: Why I bought Before Earnings

$NBIS Q2 2025 ER Update

In my deep dive published only 2 months ago, on June 29, I stated that I was not going to open a position in $NBIS given my conviction was not at the right level yet, suggesting I might have taken advantage of the stock appreciation by using some options strategy eventually.

I changed my mind about one month later, and opened a position.

Here is why Nebius is now one of my 10 stocks portfolio, with about 8.7% of its allocation.

My main concern was about the short life of Nebius as a business and as a public company, which didn’t allow me to have enough data points to build a thesis solidly backed up by quantitative insights. But I then dug more in the numbers and figured out that the actual risk of owning the stock in the short term is quite low, mainly thanks to its valuation. While the upside is huge, potentially a 10x in a few years.

Indeed, even if only 80% of the growth projected by the management materializes over the next 12 months, the stock would still be reasonably priced, and, given the hotness of the AI industry, I have good reasons to believe that growth will happen, exactly as expected by Nebius.

What will happen across a period longer than one year, is much more uncertain. Nebius' verticalization strategy could prove weak, and so Nebius’ moat, with the consequence of slowing down growth and slashing margins as new players inevitably enter the juicy market.

But likely I have enough time to assess and confirm my thesis, or reject it and exit the position.

If you haven't read my original deep dive on Nebius, I recommend doing so before reviewing this update. It's essential reading for a thorough understanding of the company.

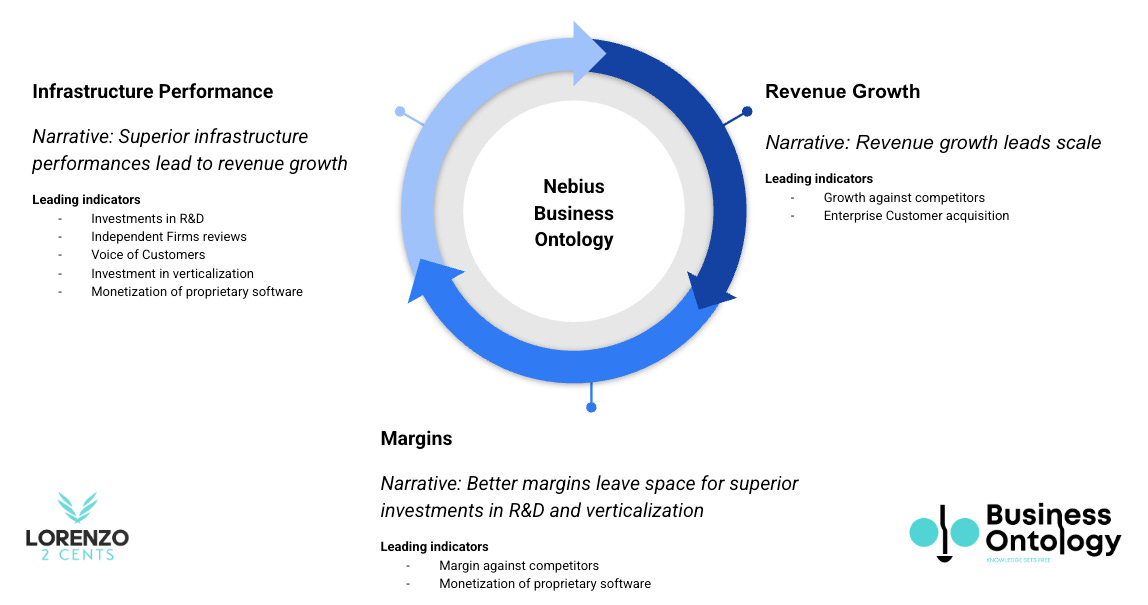

Business Ontology

In my analysis, I've framed Nebius's Business Ontology as a virtuous cycle where superior infrastructure performance drives revenue growth, which in turn enables better margins that fuel further investments in R&D and verticalization. To visualize this, here's a diagram I put together highlighting the key narratives and leading indicators:

It features three interconnected sections:

Infrastructure Performance - Narrative: Superior infrastructure performance lead to revenue growth; Leading indicators: Investments in R&D, Independent Firms reviews, Voice of Customers, Investment in verticalization, Monetization of proprietary software.

Revenue Growth - Narrative: Revenue growth leads scale; Leading indicators: Growth against competitors, Enterprise Customer acquisition.

Margins - Narrative: Better margins leave space for superior investments in R&D and verticalization; Leading indicators: Margin against competitors, Monetization of proprietary software.

This framework guides how I track whether Nebius's claimed edges in verticalization and software are materializing into competitive advantages.

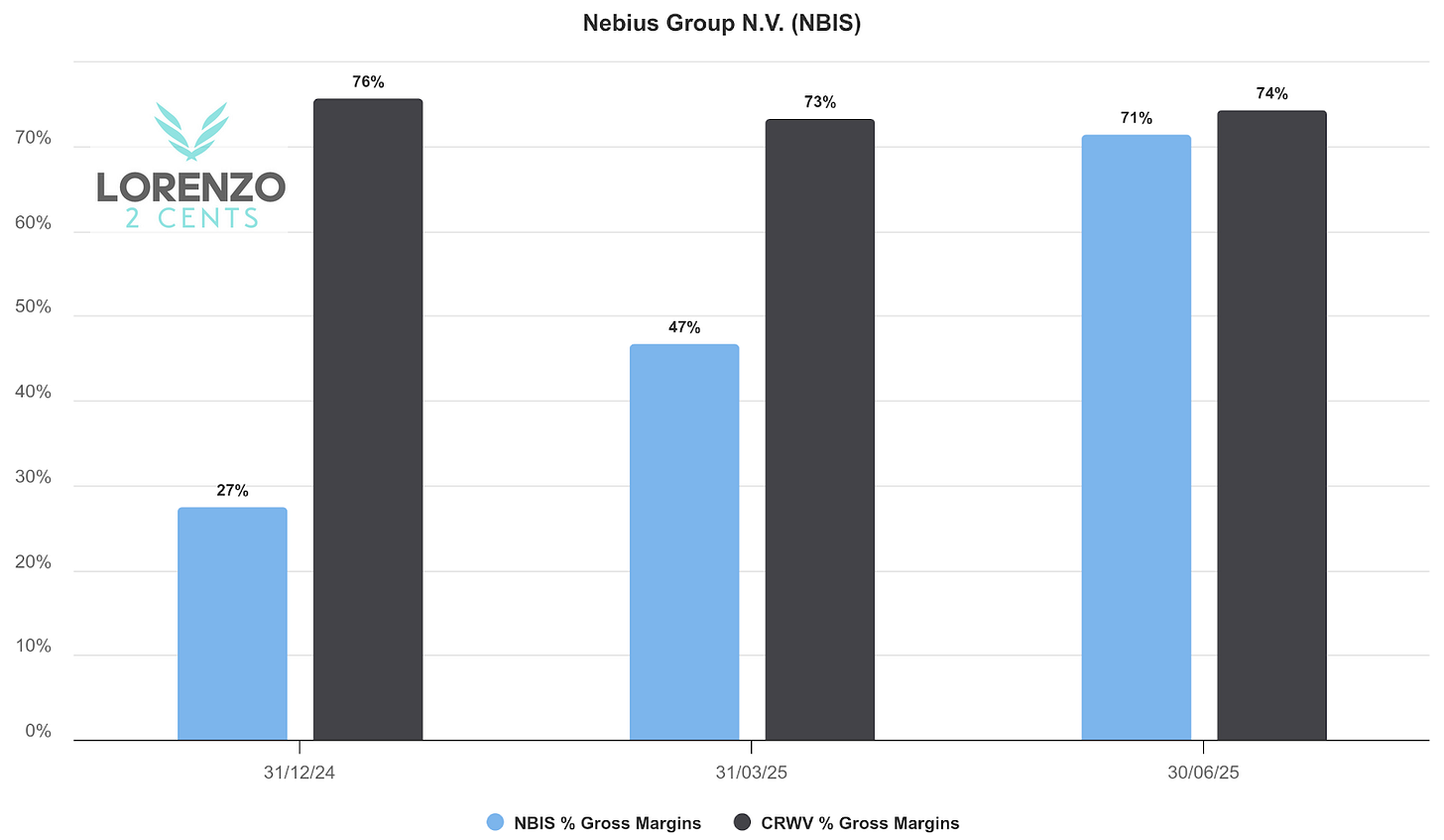

On the basis of the above, let’s see some metrics against Coreweave, as it is the closest competitor comparable:

Gross margin - the KPI where Nebius gains against Coreweave should materialize quicker, as it is not weighted by the heavy GPUs and hardware depreciation and amortization, and by the expenses for R&D, which still impact for around 40% of the revenue given the relatively small size of Nebius business as of now.

As visible from the graph above, numbers already show a material improvement for Nebius metric which seems on the way to catch up with Coreweave. I believe it is too soon to celebrate as the last data could be an outlier, but definitely it is encouraging. Still, with the AI infrastructure space heating up, it's worth watching if this edge holds as more competitors pile in, potentially eroding any early advantages.

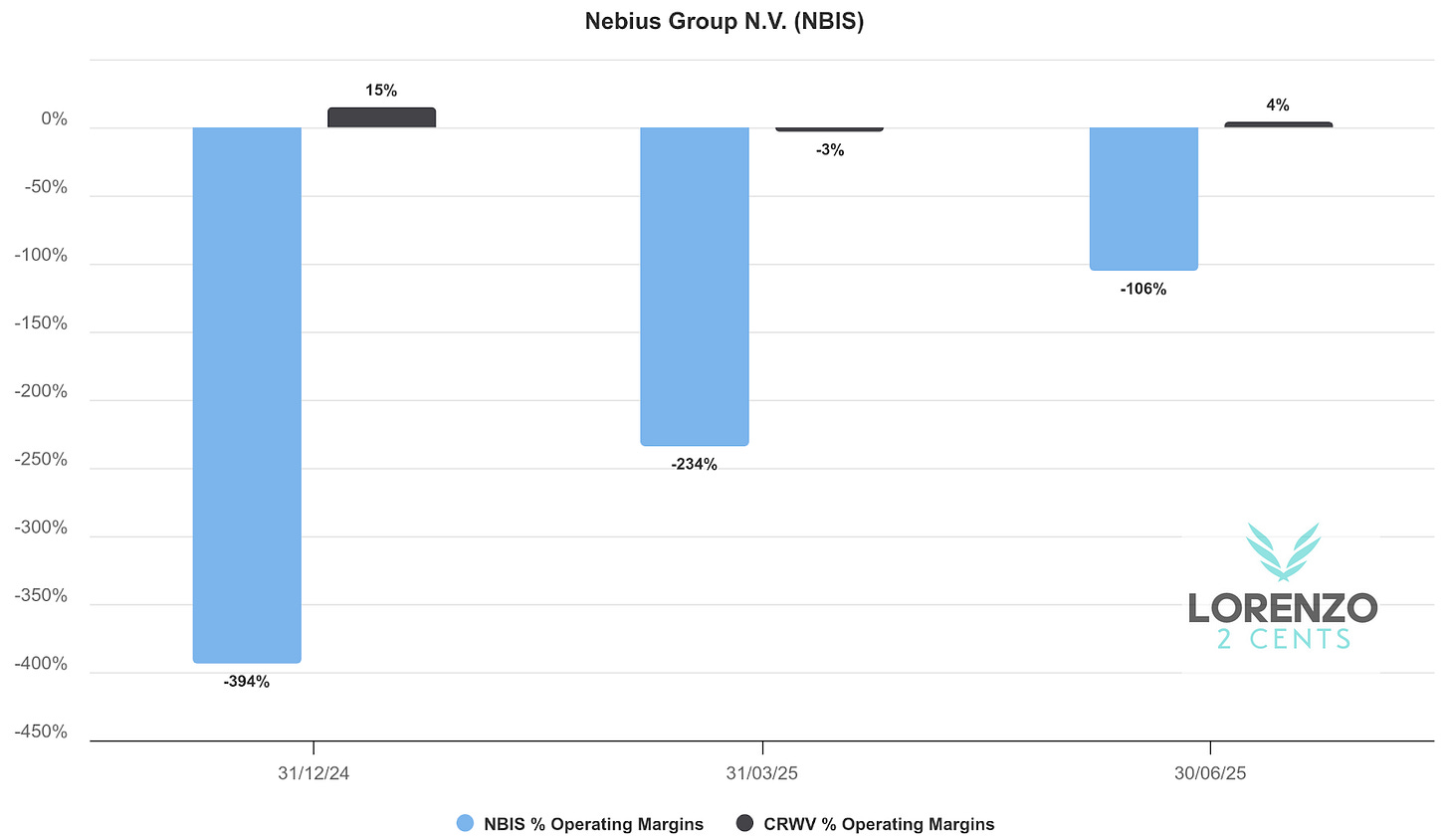

Operating Profit - I consider this a confirmation metric as it will follow the former, with some lag as it includes depreciation & amorization and R&D, which dilute as revenue scale.

Some insight from shareholder letter:

Depreciation and amortization expenses (“D&A”) for the group were $75.2 million compared to $11.4 million in the prior year period, or 72% of revenue for the period, down from 79% in Q2’24. The key driver of the dollar increase in D&A expenses was the significant ramp-up in investments in GPU-related capital expenditures and related data center hardware for the core AI infrastructure business. We depreciate our hardware over a four-year period which we believe is conservative when compared to some other cloud providers.

These figures underscore the heavy upfront costs Nebius is shouldering to scale, which could pressure operating profits in the near term. While the core business hit positive adjusted EBITDA ahead of schedule—a solid win—longer-term profitability will hinge on whether their vertical integration truly delivers efficiency gains over peers like Coreweave.

On this front, new CFO Dado Alonso provided some color on how they approach hardware ROI:

When we price our GPUs, we aim for healthy margins on a per hour compute basis. For the hopper generation, we expect to break even in roughly 2 to 3 years on a gross profit level.

Free Cash Flow - As always, the most important metric as it cannot be tricked by accountant plays, which in this case I expect to be a lagging but fundamental indicator. Every quarter these raging growing clouds company use most of their capital to buy new hardware and build new datacenter to keep up with demand, and indeed, operating margin will lead Free cash flow as in the latter the capital expenditure cost for the new hardware will be immediately accounted for 100% of the value, while in the former it will be spread over years.

With capex hitting $510.6 million in Q2 alone, Nebius is burning cash to fuel growth, and while that's par for the course in AI infra, it introduces uncertainty if demand softens or if their moat doesn't solidify against entrants.

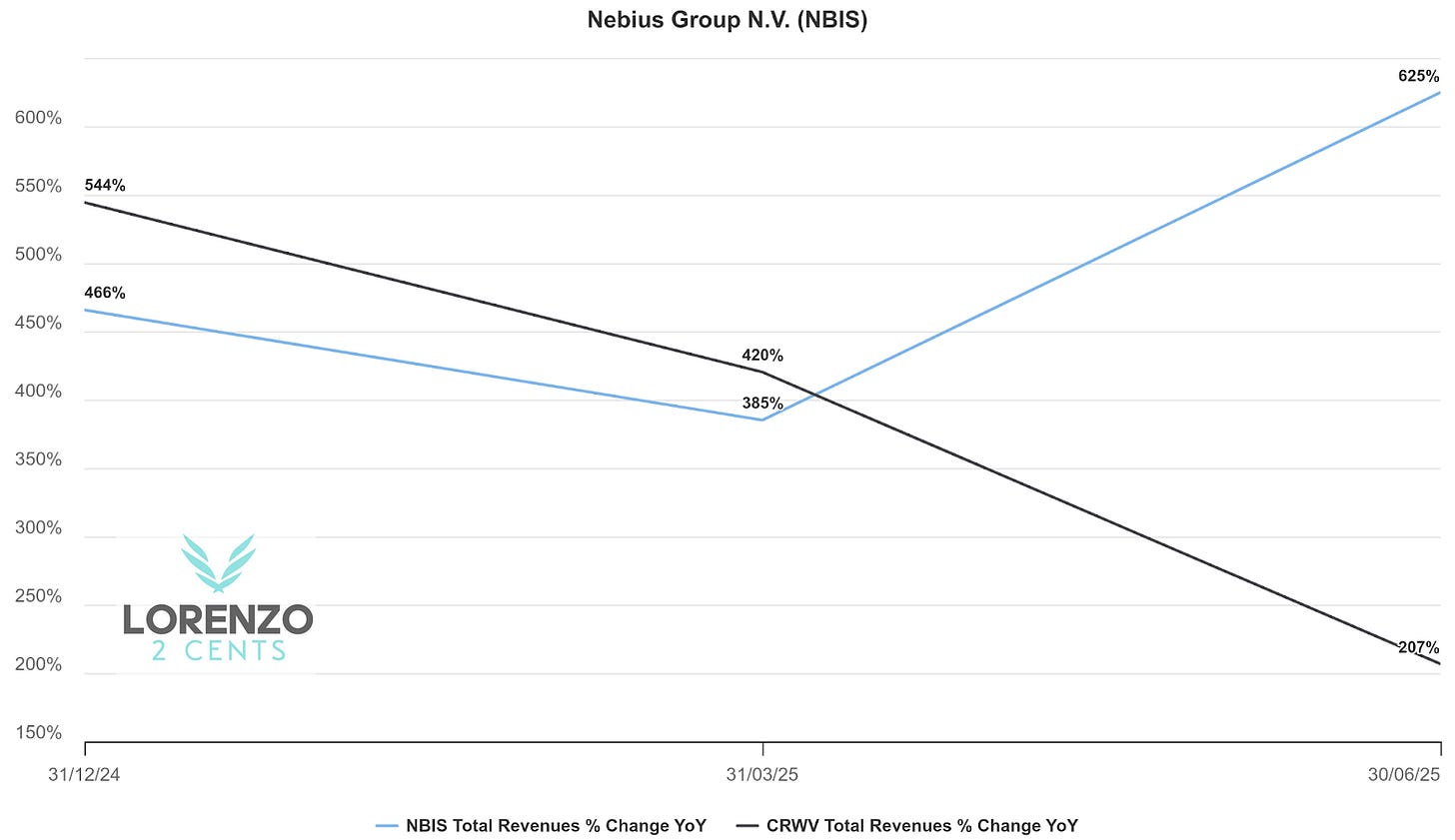

Revenue growth - while Nebius revenue growth is astonishing, I think, here again, I want to see it constantly outpacing Coreweave growth by a consistent number. This is because Nebius revenues are around one tenth of Coreweave revenues, and so it must grow much faster from here to prove the company has a clear edge. But even when Nebius will catch up, if their moat is real, I want to see the growth keep outpacing the one of Coreweave.

In Q2 Nebius revenues grew 3 times faster than Coreweave revenue, with group revenue hitting $105.1 million—up 625% year-over-year and 106% quarter-over-quarter. The core AI infrastructure business ended the quarter with annualized run-rate revenue of $430 million, up from $249 million at the end of March, driven by strong demand, expanding client base, and near-peak utilization despite significant GPU additions.

Management is super-bullish

Management's confidence came through loud and clear in the earnings call, with Founder and CEO Arkady Volozh highlighting the influx of next-gen GPUs and rapid infrastructure buildup as key drivers for growth. As he put it,

The new Blackwells are coming to the market in masses, and in parallel, we are dramatically increasing our data center capacity. That's why we expect to significantly increase our sales... and that's why we are increasing our ARR guidance for the year-end from the previous $700 million to $1 billion to a new guidance, which is now $900 million to $1.1 billion.

Volozh also emphasized Nebius's aggressive expansion plans:

We are aggressively ramping up. By the end of this year, we expect to have secured 220 megawatts of connected power that is either active or ready for GPU deployment, and this expansion includes our data centers in New Jersey and Finland. In addition, we have nearly closed on 2 substantial new greenfield sites in the United States. And overall, we are in the process of securing more than 1 gigawatt of power by the end of 2026 to capture industry growth next year.

He went on to note progress with customer acquisition:

We continue to significantly expand our customer base. We started to gain real traction on the enterprise side, adding large global technology customers such as Cloudflare, Prosus and Shopify. And we still remain a leading new cloud provider for so-called native AI tech startups. We have added customers like HeyGen, Lightning.AI, Photoroom and many, many others.

Volozh wrapped up with a big-picture view:

In short, this is an exciting time for Nebius. We are in the midst of a once-in-a-generation opportunity. That's what we believe in. The demand for AI compute is strong and will just get stronger. We are rapidly increasing our capacity to pave the way for accelerated growth in 2026 and beyond.

This bullish tone from management underscores their focus on capacity expansion—targeting 220 MW by year-end 2025 and over 1 GW by 2026—which positions Nebius to ride the AI demand wave.

Conclusion

Nebius's Q2 results and guidance reinforce the appeal of the stock.

The company's push into enterprise customers and massive capacity ramp-up—aiming for over 1 GW by 2026—aligns well with the AI boom, and early margin improvements versus Coreweave suggest the verticalization strategy is gaining traction.

That said, the longer-term picture remains hazy: heavy capex and the absence of full cash flow details highlight ongoing cash burn, while the moat's durability against new entrants, other Neoclouds, and hyperscalers, is unproven, especially if software monetization doesn't scale as hoped.

I'll keep a close eye on upcoming quarters to see if these trends solidify the thesis—or prompt an exit if the competitive landscape shifts unfavorably. Follow me on X for real-time thoughts as things unfold.

As always, here is the “Deep Dive To Date” (DDTD), that is how the stock is performing since my initial deep dive AND when I started a position, on the July 28 2025, when the stock price was $51.63.

+33% DDTDSee you in the next update!

The content of this analysis is for entertainment and informational purposes only and should not be considered financial or investment advice. Please conduct your own thorough research and due diligence before making any investment decisions and consult with a professional if needed.