Oddity: investors woke up, it will be huge

$ODD Q1 2025 ER update

Two days ago, Oddity Tech Ltd. ODD 0.00%↑ dropped its Q1 2025 earnings, and the numbers are a masterclass in execution. The beauty and wellness disruptor behind IL MAKIAGE and SpoiledChild isn’t just surviving the retail storm—it’s thriving. Let’s break it down.

If you haven't read my original deep dive on Oddity, I recommend doing so before reviewing this update. It's essential reading for a thorough understanding of the company.

Oddity reported Q1 revenue of $268 million, a 27% year-over-year leap, beating the guidance. Free cash flow clocked in at $87 million, up from $79 million of Q1 2024 and with adjusted EBITDA at $52 million. This isn’t just growth; it’s profitable growth, with gross margins ticking up to 74.9% (+1.2 points). Here the beauty of the Free Cash Flow per share which keeps rising.

And Oddity didn’t just beat expectations—it raised its full-year 2025 guidance. The company now expects revenue between $790–$798 million (up from $776–$785 million) and adjusted EPS of $1.99–$2.04 (from $1.94–$1.98). This confidence signals that Oddity’s AI-driven, direct-to-consumer model is firing on all cylinders.

With tariff talks rattling retail, CFO Lindsay Mann addressed the topic during the earnings call:

Relative to other consumer companies, we are very well-positioned. We have an attractive gross margin structure, limited exposure to China directly, a robust and flexible supply chain, and great relationships with our global suppliers

Oddity expects a modest 50–100 basis point hit to 2025 gross margins from tariffs, partly offset by efficiencies. Crucially, they’re still raising margin and EBITDA forecasts, with no threat to their long-term goal of 20% revenue growth at 20% EBITDA margins. Their flexible supply chain and minimal China reliance make tariffs a manageable annoyance, not a dealbreaker.

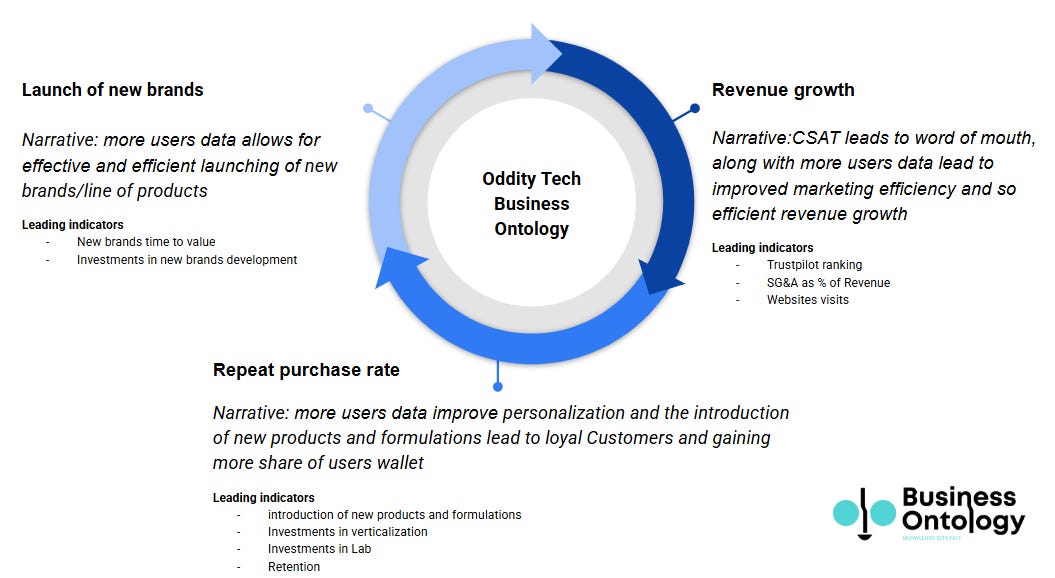

Oddity Tech Business Ontology

Oddity’s edge isn’t luck—it’s a deliberate framework I call the Business Ontology, a trifecta of revenue growth, repeat purchase rate, and new brand launches that powers its tech-driven, direct-to-consumer model. Here’s the blueprint:

This isn’t your typical beauty company; it’s a profit machine fueled by AI personalization and ruthless efficiency.

The next sections break down each pillar, updating how Oddity’s execution keeps it miles ahead of legacy retail.

If you’re new to my Business Ontology framework, check out this article for a detailed introduction.

Revenue growth: International Engine Ignites

Oddity’s Q1 revenue increase was driven by a bold international push. CEO Oran Holtzman said,

We decided back in 2024 to accelerate our international expansion in 2025. We are very pleased with the results from Q1 and plan to continue our international scaling,

Unlike competitors with 70%+ revenue outside the U.S., Oddity’s U.S.-heavy mix (80%) signals massive global potential. Holtzman added,

Q1 is our biggest quarter for new user acquisition

cementing a strong Q2 foundation.

Addressing my prior concerns (check out the previous update here) about declining website traffic for IL MAKIAGE and SpoiledChild, the negative trends have flipped—both brands now boast all-time high traffic, fueling Q1’s growth and reflecting robust digital demand.

However, international expansion sparked a Trustpilot dip: IL MAKIAGE’s score fell to 4.1 (from 4.2) across 81,711 reviews, still above my 4.0 alarm threshold, while SpoiledChild dropped to 3.8 (from 4.0) with 1,857 reviews. New international users’ differing expectations likely drove these shifts—not a red flag yet, but worth watching.

Repeat Purchase Rate: Loyalty Meets Game-Changing Innovation

Repeat revenue is Oddity’s backbone, with Mann noting,

Repeat revenue is the largest part of our business, exceeding 60% of total revenue in 2024 and increasing as a percent of our business again so far in 2025,

Q1’s acquisition push, paired with a 4% rise in average order value (driven by premium SKIN products), sets up a robust repeat order backlog for the year.

But Oddity’s not just banking on loyalty—it’s investing heavily in ODDITY LABS to redefine beauty. Holtzman explained,

Our mission at LABS is to drive massive innovation by bringing real science at high scale to our industry… developing proprietary molecules for both Brands 3 and 4 in the short-term, while also working on longer-term developments with huge market potential,

This R&D bet, spanning skin, hair, and body, aims to outpace competitors’ efficacy, positioning Oddity for “almost unlimited” scale. Loyalty keeps the engine humming; LABS could make it soar.

Launch of new Brands: Rewriting the Playbook with Brand 3

Oddity’s innovation engine is charging toward Brand 3 and 4, with Holtzman declaring,

Brand 3 is on schedule to soft launch in Q3 with formal launch in Q4… based on the level of complexity, both technology and product offering, I am more excited than ever before,

Brand 3, a skincare disruptor, uses AI and computer vision for personalized prescription and OTC treatments, boasting acne grading algorithms (94% dermatologist agreement), lesion classification models (93% recall, meaning the model correctly identifies 93% of true acne lesions), and hyper-pigmentation detection (84% accuracy). Gen AI-powered visuals further enhance user trust. Holtzman added,

We believe that we have the ability to change this category with our new offering.

Complementing organic growth, Mann noted,

We expect the current volatile market backdrop will create new opportunities for us to put our strong balance sheet to work… This could take the shape of brand and business acquisitions that plug into our platform, or acquisitions of technology and teams that advance our capabilities.

With disciplined M&A and Brand 3’s telehealth infrastructure setting the stage for future medical domains, Oddity’s startup DNA and category-killing ambition make it a force to watch.

Conclusion

Oddity’s Q1 is a thunderclap, waking investors to a tech juggernaut that’s rewriting retail’s playbook. The stock’s 30% surge the day after earnings torched shorts who underestimated this beauty disruptor, proving the market’s finally seeing what’s been clear all along: Oddity’s vision is unstoppable.

From global expansion to ironclad repeat revenue, the company’s execution is flawless.

But it’s Brand 3—blending AI-driven skincare with telehealth—that’s the real game-changer, stretching far beyond beauty into healthcare’s infinite TAM. If Oddity keeps executing like this, the sky’s not the limit—it’s just the start.

As always, here is the “Deep Dive To Date” (DDTD), that is how the stock is performing since my initial deep dive on the July 16th 2024, when the price was $44.24.

+40% DDTDSee you in the next update!

Check all the Ontologies I have built: DUOL 0.00%↑ , RKLB 0.00%↑ , HIMS 0.00%↑ , LMND 0.00%↑ , CRWD 0.00%↑.

The content of this analysis is for entertainment and informational purposes only and should not be considered financial or investment advice. Please conduct your own thorough research and due diligence before making any investment decisions and consult with a professional if needed.