Rocket Lab: Neutron is my thesis’ single point of failure

$RKLB Q4 2024 ER update

The content of this analysis is for entertainment and informational purposes only and should not be considered financial or investment advice. Please conduct your own thorough research and due diligence before making any investment decisions and consult with a professional if needed.

Rocket Lab closed out 2024 with a phenomenal Q4, delivering financial and operational results that cement its leadership in the rapidly evolving space industry.

The company achieved a record-breaking annual revenue of $436 million, a robust 78% increase over 2023, with Q4 contributing $132 million—representing a staggering 121% year-over-year growth and a 26% sequential jump from Q3.

This performance underscores the success of Rocket Lab’s end-to-end space services model, blending reliable launch capabilities with a thriving spacecraft business.

The launch segment shone brightly, completing a record 16 missions across Electron and HASTE platforms, all with 100% mission success. This cadence not only reinforced Rocket Lab’s position as the world’s leading small launch provider but also highlighted its growing role as the second most frequently launched U.S. rocket annually. New contracts worth over $450 million further bolstered the backlog to $1.07 billion, half of which are expected to be converted in 2025, signaling strong demand and anticipating the rapid growth is not over.

On the spacecraft side, the Space Systems division delivered $90 million in Q4 revenue, driven by standout achievements like the completion of twin spacecraft for NASA’s ESCAPADE mission to Mars and three successful Pioneer spacecraft missions for Varda, including a flawless reentry in South Australia. These wins reflect Rocket Lab’s ability to execute complex projects on tight timelines and budgets, a point Peter Beck proudly emphasizes:

we do what we say we’re going to do

With a 382% revenue surge since its 2021 NASDAQ debut, Rocket Lab’s Q4 results paint a picture of a company firing on all cylinders.

On the operational efficiency side, full year 2024 non-GAAP gross margin increases from 28,1% to 32%, driven primarily by increased launch cadence, partially offset by unfavorable mix shift in our Space Systems business. It is worth remembering that Rocket Lab's target gross margin for launches is 50%, and they expect to achieve this once they reach 24 launches per year. This goal is attainable in 2025 if the current growth trend continues.

In my original deep dive I compare Rocket Lab to AMD 0.00%↑ and to AWS with a beautiful and insightful IT analogy for the space economy.

If you haven't read it, I recommend doing so before reviewing this update. It's essential reading for a thorough understanding of the company.

Business Ontology Framework

Sir Peter Beck emphasized the urgent demand driving Rocket Lab’s ambitions:

There's more than 10,000 satellites that need launch in the next 5 years from commercial constellations alone. And then there's the growing demand from national security and defense missions as well as interplanetary exploration for the science community, and it goes on. The need is clear, so I won't labor on it other than to say that the industry is crying out for more launch options in this class, and Neutron is coming to market in record time to deliver it.

Currently, launch options are scarce, creating a significant bottleneck. Neutron aims to break through this constraint, and Rocket Lab is pursuing an aggressive timeline to make it happen. With its debut flight scheduled for the second half of 2025, Neutron isn’t just a solution for the industry—it’s also pivotal to Rocket Lab’s own plans, enabling the launch and operation of its future satellite constellation.

For every stock I evaluate, I develop a customized blueprint to monitor its performance, grounded in my Business Ontology Framework. As I unpacked my investment thesis for Rocket Lab and identified its core pillars and key performance indicators, one truth became evident: Neutron sits at the heart of it all.

Sir Peter Beck has articulated a bold vision to transform Rocket Lab into a fully integrated, end-to-end space company. With Electron and the spacecraft business, Rocket Lab has already demonstrated an exceptional execution engine, proving its ability to turn vision into reality. Quarter by quarter, the company widens its competitive moat through deeper vertical integration—a critical advantage that delivers unmatched capabilities, speed, and excellence in the space industry while fostering rapid innovation. There’s every reason to believe Neutron will succeed, unlocking the path to fully realizing Beck’s vision. Once achieved, Rocket Lab will evolve into an end-to-end space powerhouse, generating the bulk of its revenue from space applications—a business with a potential market value in the hundreds of billions.

Below is a visual representation of Rocket Lab’s Business Ontology, presented in a clear and structured format.

Neutron - my thesis’ single point of failure

Central to my investment thesis is the Neutron rocket, a medium-lift vehicle poised to revolutionize Rocket Lab’s trajectory if it launches successfully in 2025. Progress in Q4 was nothing short of remarkable, keeping Neutron firmly on course for its second-half 2025 debut. At Launch Complex 3 in Wallops Island, Virginia, all major infrastructure is in place—civil works are nearly complete, and key hardware like the 165-ton FLIR Stack launch mount and giant LNG tanks (the heaviest objects ever to cross the Wallops Island Bridge) have been installed. The innovative “Hungry Hippo” fairing, a reusable nosecone design, is now fully integrated with avionics and actuators, undergoing full-speed open-and-close tests. Beck, who witnessed the initial tests firsthand, called it

a wonderful sound to hear the Hungry Hippo in action

a testament to its readiness.

The Archimedes engine, powering Neutron, is advancing through an intensive qualification campaign, with hot fires occurring every few days at the Mississippi test site. Recent iterations have shed over 200 kilograms from the engine, enhancing performance and manufacturability.

Production is ramping up, with Stage 1 tanks stacked and ready to ship, and a second Archimedes test cell nearing completion to support the accelerated pace. The ocean landing platform, dubbed “Return on Investment” in a nod to CFO Adam Spice, is being outfitted with autonomous systems and heat shielding to enable reusable missions starting in 2026, though the first flight will opt for a soft splashdown.

Beck expressed optimism, stating, “I’m very happy with the progress and of the development program,” and emphasized that tasks are running concurrently to meet the aggressive timeline.

Flatellite - a step closer to making Rocket Lab the AWS of space

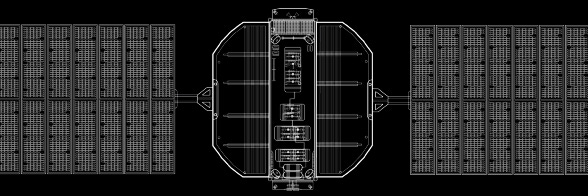

The unveiling of Flatellite, a low-cost, mass-producible satellite platform, marks a bold step toward Rocket Lab’s vision of becoming an end-to-end space company, with space applications as the final frontier.

Designed for large constellations, Flatellite leverages Rocket Lab’s deep vertical integration—spanning solar panels, reaction wheels, star trackers, and more—to deliver a scalable, high-power spacecraft capable of supporting secure low-latency connectivity and remote sensing for defense, national security, and commercial markets.

With a production target of up to one satellite per day, Flatellite’s stackable, low-profile design maximizes launch efficiency, particularly with Neutron, which can deploy dozens in a single mission.

This industrialization and standardization of satellite manufacturing is poised to transform the economics of space, enabling Rocket Lab to not only build and launch constellations but also operate them to deliver data and services. As Beck noted, Flatellite is

a bold strategic move towards completing the final step of Rocket Lab’s ultimate vision

positioning the company as a gatekeeper of space access.

Paired with Neutron’s promise of frequent, affordable launches, Flatellite could slash the cost and time to orbit, democratizing space like never before.

For any company seeking access to space, it will make sense to leverage Rocket Lab’s space infrastructure, just as it’s logical to build your application on AWS to minimize total cost of ownership and focus on your business.

Ready to dive deeper? Unlock all my in-depth analyses and updates—including coverage of LMND 0.00%↑ , HIMS 0.00%↑, RKLB 0.00%↑, ODD 0.00%↑, CRWD 0.00%↑ and DUOL 0.00%↑ —by visiting Lorenzo2cents. Want the latest articles delivered straight to your inbox? Subscribe here and stay ahead of the curve.

Conclusion

Rocket Lab’s execution remains impeccable, and my investment thesis is progressing exactly as anticipated.

Once the first Neutron launch is successfully completed, any lingering doubts among investors about the company’s growth trajectory will dissipate, and they will begin factoring Neutron’s potential into the share price. However, should the initial launch face delays or fail, the stock price could experience a setback. That said, as long as Rocket Lab maintains sufficient cash reserves to persist in its efforts, I believe nothing can fundamentally derail this thesis. Until Neutron achieves a successful launch—ideally in the second half of 2025, as Sir Peter Beck has pledged—the primary metric to monitor is the company’s financial runway. On this front, CFO Adam Spice provided reassuring insight:

The ending balance of cash, cash equivalents, restricted cash, and marketable securities was $484 million as of the end of the fourth quarter of 2024. We exited Q4 in a strong position to execute on our organic expansion initiatives as well as inorganic options to further vertically integrate our supply chain with critical capabilities and expand our addressable market, consistent with what we have done successfully in the past.

As always, here is the “Deep Dive To Date” (DDTD), that is how the stock is performing since my initial deep dive. For RocketLab stock ($RKLB), the price on September 17th, 2024, when I published my analysis, was $7.19. As of this update, the price stands at $17.89, reflecting a

+2,5x DDTDStay tuned for the next update!