Rocket Lab: FOMO kicks in hard

$RKLB Q3 2025 ER Update

The content of this analysis is for entertainment and informational purposes only and should not be considered financial or investment advice.

In the past month, Rocket Lab’s stock has rocketed nearly 70%, propelled by blockbuster quarterly results, whispers of a SpaceX IPO on the horizon—likely in 2026—and mounting hype around orbital data centers, which literally lit the entire space on fire.

Just like I called it in my last article, the Neutron’s first launch got pushed back to Q1 2026. I figured that might trigger a big sell-off, but investors weren’t dumb enough to bail on what could be one of the best long-term plays out there right now.

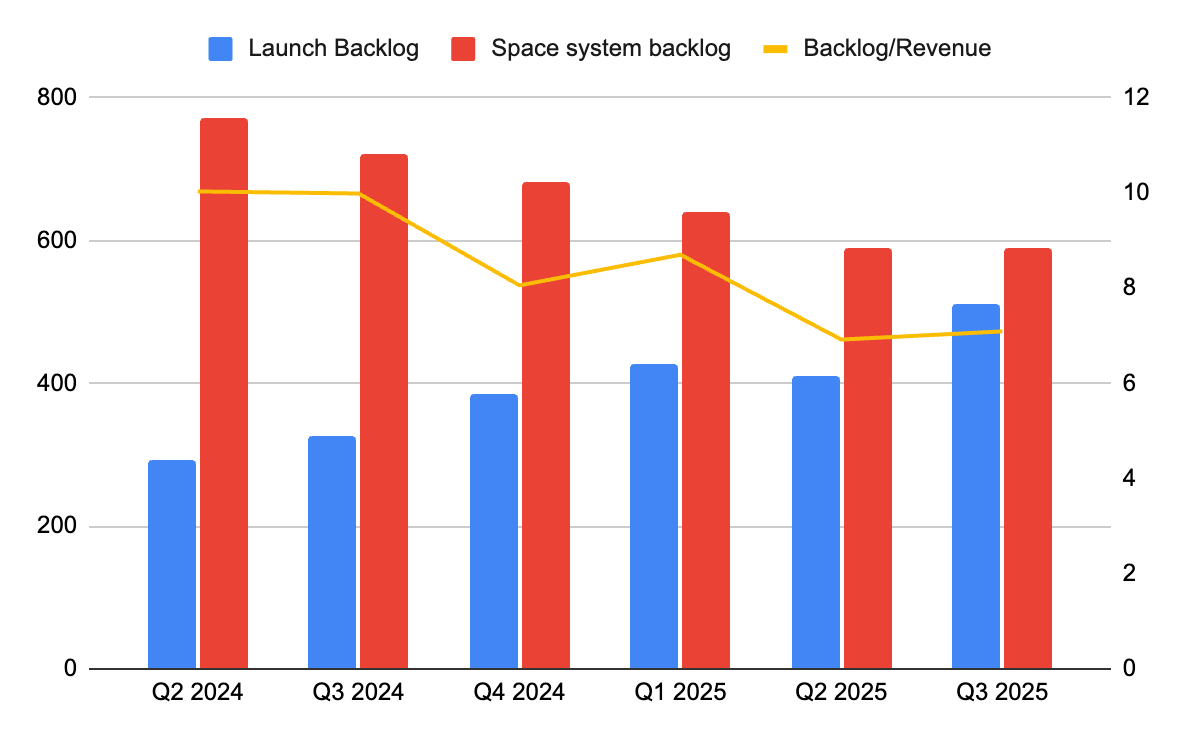

The other sell-off risk I flagged—slow revenue growth from that backlog-to-revenue drop that’s been dragging on for over a year—didn’t happen at all. In fact, that metric bounced back hard and started climbing again, showing demand’s got real momentum and no sign of cooling off.

Table of Contents

Q3 2025 Update

L2C take aways and performance

More Good News

Business Ontology Framework by L2C

Business Ontology

4D Valuation Model

L2C portfolio strategy

Q3 2025 Update

Electron Demand Through the Roof

Demand for Electron rockets is skyrocketing, as confirmed by CEO Peter Beck:

Electron demand is accelerating faster than ever before, and the momentum continues to build with our largest launch contract backlog yet—with 49 launches on contract.

Let’s crunch some numbers: 2025 will wrap up with 20+ launches, up from 16 in 2024—a solid YoY jump. But even bigger? Electron should hit profitability this year, based on what Beck’s hammered home more times than I can count: 20+ is the magic number. The current factory’s built for 52 rockets a year. And get this—just in the three months before the earnings call, they signed 17 new ones. You do the math, but we’re in a damn good spot on the Electron front. Those 52 slots could fill up way faster than expected, which means revenue could roughly quadruple from 2024 levels, especially with average selling prices on the rise.

If that’s not enough good news, Electron’s going global—diversifying the customer base, cutting reliance on U.S. government and commercial gigs, and racking up more market cred.

17 dedicated launches were signed in just 3 months, but—all but 2 of them were with international customers from Japan, Korea, and Europe. Those new missions, plus the ones already on the books for space agencies like ESA and JAXA, prove Electron isn’t just a leader in the U.S.—it’s becoming the go-to small launch vehicle worldwide.

Redundant (but worth repeating): Trust is the ultimate currency in space. As a customer—commercial or government—you need to know your payload hits orbit on time. Rocket Lab’s rep has never been stronger, with 100% mission success in 2025 and killer flexibility to tweak schedules around customer needs. Global players are catching on, letting the company nudge prices higher without pushback.

Revenue per launch has climbed from $7 million in Q3 2024 to over $10 million in Q3 2025.

Behind this international surge, I see a key dynamic at play—one that’s fueling a reinforcing cycle for Rocket Lab. Space is the next big frontier, and no one wants to get left behind, whether for commercial wins or geopolitical muscle. As the race heats up to deploy constellations this decade, FOMO kicks in hard. Space is tough—rocket science ain’t called that for nothing. Sure, we’ve heard bold talk (looking at you, EU) about building sovereign launch capabilities. But in reality, that timeline clashes with the urgency not to miss the boat. So instead of waiting years to build their own, more international players are eyeing off-the-shelf options like Rocket Lab. And with Neutron coming online as a SpaceX-competitive medium-lifter in 2026, they can do it without hitching their wagon entirely to Elon’s ride—which was never gonna fly anyway.

Peter Beck nailed it during the earnings call:

…for the first time, we see space agencies who typically use—or go to—the first stop is to go and use their own sovereign capabilities. But Electron is really the only vehicle of its kind operating in the world right now. So it was very, very promising to see space agencies now kind of standardizing on Electron as a platform.

Becoming a Top-Tier Supplier

Look, I’m not a fan of acquisitions. They can split management’s focus, make things more messy, and water down the great company culture that got them here.

But Peter Beck? He’s on another level. I think his real love and skill for rocket design and building is what pulls all these parts together and makes them fit. Whatever it is, we have to give him credit: Trust his team, and yes, acquisitions are the way. Let me say it loud—acquisitions are THE WAY.

Take the latest one: After buying Geost, the experts in satellite payloads for electro-optical/infrared (EO/IR) sensors, Beck said this:

…just now being a payload provider is—it brings you up to a whole another level because you’re having really detailed mission discussions rather than just talking about how you can provide a bus or a component or something. We’re really in mission formulation territory.

Big talks like that = less competition = better hold on the money coming in.

Yes—being a top supplier gives you more say in your future, clear view of what’s happening in the industry, and stronger power to talk prices with customers. And in this tough space game, you can count the top suppliers on one hand.

I’ve said it from the start: Pulling everything in-house—vertical integration—is the key to winning. Beck’s a pro at it, so we want him to keep pushing hard.

Rocket Lab’s growing good name helps too. Better money results mean more cash from investors, more buys, deeper in-house control, and even better money results.

You guys know by now—I love these loops that feed themselves! I see them all over. 😊

Peter Beck put it straight on the earnings call:

As for what’s next, we’ve built up our dry powder for future M&A with more than $1 billion in liquidity following the at-the-market offering program implemented in September. It was a very strategic move to lock in capital that will allow us to act quickly on some of the exciting opportunities in the pipeline. We’re not ready to reveal the details of these strategic plays just yet, but I can assure you that the pipeline is active… We’ve got a bit of a knack for identifying, acquiring, and then integrating businesses that enhance our end-to-end capabilities and make us a stronger competitor for large-scale programs. And that’s made us the consolidator of choice for many companies in the space sector. We’re often the ones being approached first by companies wanting to join Rocket Lab now because they see the value we create for growth and innovation.

Lorenzo2cents (L2C) Takeaways and Performance

Demand’s booming for both rockets and space systems—you can see it clear as day in the $155M Q3 2025 revenue, up 48% from Q3 2024. Plus, that backlog-to-revenue ratio hit rock bottom in Q2 2025.

And now it’s set to climb strong again, thanks to the fresh $816 million prime contract from the U.S. Space Development Agency (SDA). That’s for designing, building, and launching 18 satellites under the Tranche 3 Tracking Layer program.

The Neutron delay to Q1? No biggie, and honestly, not a shock to me. At this stage, it’s smarter to push the first launch back 3 or even 6 months if it means nailing it perfectly—especially given what I’ve said about reputation being Rocket Lab’s golden ticket. Better to protect and build on that than rush and risk it.

As always, here is the “Deep Dive To Date” (DDTD), that is how the stock is performing since my initial deep dive. For RocketLab stock ($RKLB), the price on September 17th, 2024, when I published my analysis, was $7.19. As of this update, the price stands at $70.65, reflecting a

+9,8x DDTDMore Good News

Now, let’s talk more good stuff.

From here on, every quarterly update—for each company I cover on L2C—will pack in extra sections. These will share advanced, strategic info to give you a clearer map for your investment calls. This is the heart of my Business Ontology Framework, the tool I use to run the L2C portfolio. It’s what helped me hit the performance numbers so far. Of course, as always, nothing here is financial advice. It’s not made for you personally—just general info you can use (or skip) to shape your own choices.

These bonus sections? They’re behind a paywall. You need L2C Premium to unlock them. There’s tons of work in what I’ve built (and keep building), and this is the bare minimum to keep the lights on.

The cool part: This first article with the new extras doesn’t hide behind the wall. It’s here to show you a taste of what’s coming. Subscribe to Premium, and you’ll get way more—like step-by-step lessons on the tools I use plus access to them, full access to the L2C portfolio in real time and real time update of the portfolio. Give it a shot if you’re ready for that next level. Or, if not, stick with free L2C as is—no cuts to what you already get.

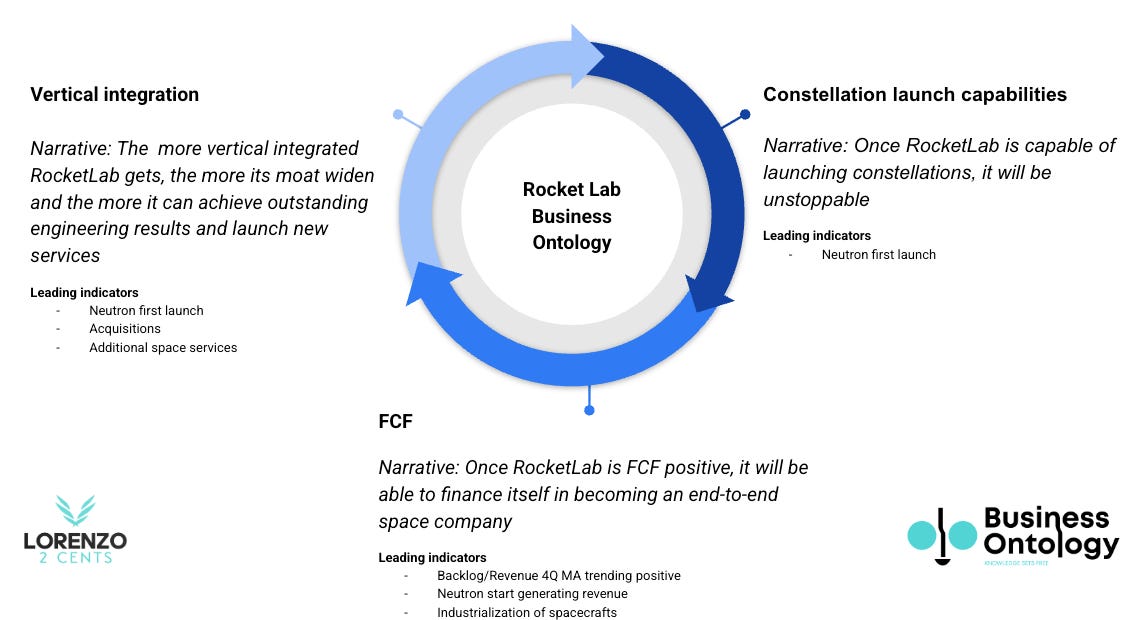

Business Ontology Framework by L2C

The Business Ontology is a framework I built after tearing apart several tech companies from the ground up—breaking them down to their basic parts and piecing together a real thesis on what drives them. Think of it as a map of a company’s soul. It’s a tight set of core indicators—tailored to each business—that show if it’s heading the right way, no matter what the stock price says. These aren’t your basic stats like P/E ratios or revenue bumps you grab from Yahoo Finance. They’re deeper, sharper, and linked straight to the thesis I’ve cooked up on how the company makes value and fights in its market.

The framework boils down to two big pieces:

The Business Ontology—This checks if the company’s worth buying into or hanging onto.

The 4D Valuation Model—This gives you a 4D roadmap to guide your own calls on how much to put in (allocation).

Now, let’s dive into Rocket Lab and this quarter’s update.

Business Ontology

Here’s a quick visual on the Business Ontology for Rocket Lab.

The key indicators to watch right now are:

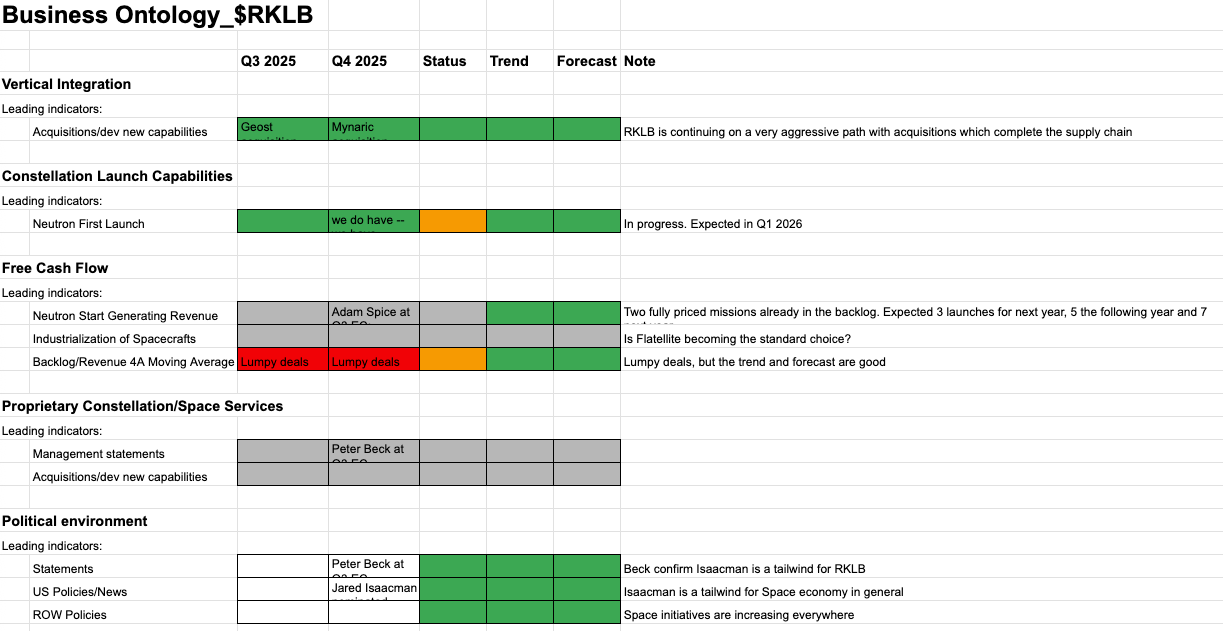

Vertical Integration: I want Rocket Lab to keep stacking on new skills in payloads and space services (down the line), mostly through buys. The recent Geost grab and the ongoing Mynaric deal are solid wins—I need them to stay on this path to turn into the ultimate end-to-end top-tier space player. Check the chart below: “Status,” “Trend,” and “Forecast” for this one are all green and looking good.

Neutron First Launch: Delayed, sure. But it’ll likely hit in the first half of 2026. This is the big cornerstone of Rocket Lab’s plan—it unlocks the next revenue jump and shifts the team’s focus to space services (the hot new wave). “Status” is orange (not great), but “Trend” and “Forecast” are positive, with Neutron locked in for Q1 2026

Backlog-to-Revenue Ratio (4-quarter moving average): The trend has to keep going positive. It turned negative not long ago, which worried me a bit, but now it’s flipped strong to the upside—thanks to that $816 million win

Overall, my final assessment on the business:

You can access the Business Ontology Spreadsheet, with the complete and detailed information, including all the inputs, updated by me in real time, by clicking here.

If you don’t have access yet, request it and I’ll approve it within 24 hours. But heads up—don’t request if you’re not a L2C Premium member (I’ll have to turn it down).

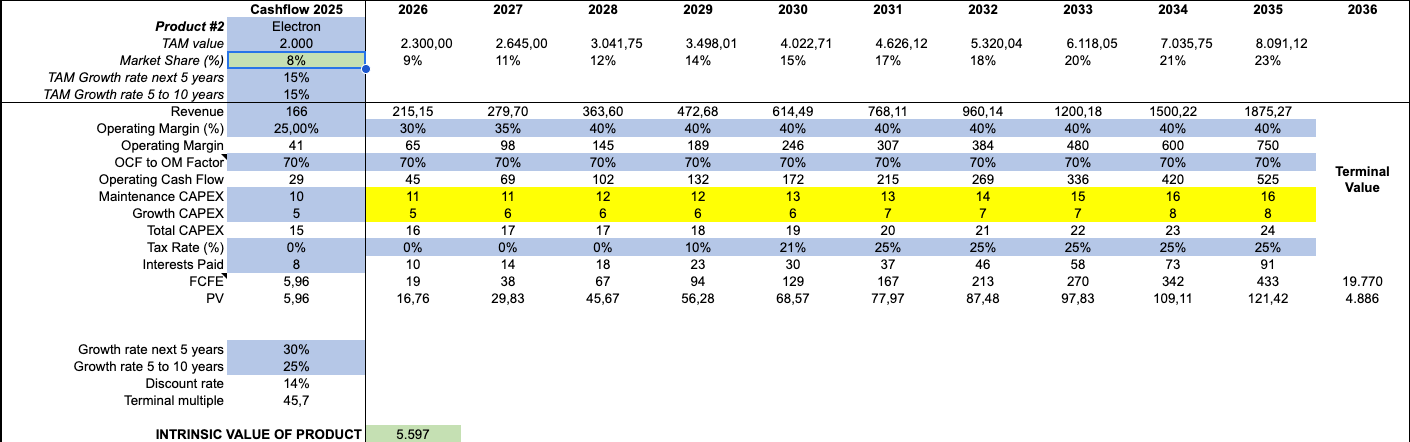

4D Valuation Model

Fair value is useless. I explain why in the firt video-lesson:

What I do is model three scenarios—normal, worst, and best—by crunching the numbers and weaving in the story for each (that’s where the 4D Valuation Model name comes from).

Here’s a quick snapshot of the normal case for Electron.

The full Rocket Lab model gets pretty detailed, with separate assumptions for Electron, Neutron, and Space Systems.

Click this link for full access to the 4D Valuation Model Spreadsheet:

If you don’t have access yet, request it and I’ll approve it within 24 hours. But heads up—don’t request if you’re not a L2C Premium member (I’ll have to turn it down).

And here’s what the model spits out:

Normal Case Scenario (50% probability): Price Target $52 (0.73x return)

Best Case Scenario (25% probability): Price Target $173 (2.45x return)

Worst Case Scenario (25% probability): Price Target $27 (0.38x return)

L2C portfolio strategy

Look, the model’s numbers aren’t super exciting—I know. This isn’t a huge-risk, huge-reward bet. Best case, you double your money plus a bit; worst case, you lose half. Most times? You stay about even.

BUT:

I really think space is the next huge boom, and it’s hard to guess the future when it’s so new. Short version: I’m playing it safe with my guesses, so they’re probably too low.

Even if the stock sits at a fair price now, the growth I see goes way beyond 10 years (my model’s limit). So if they keep growing ~30% a year without big problems, the stock could rise 30% a year too—and that’s pretty good.

Taxes lock it in: I’d say “HOLD” like the experts do. 90% of my position is profit, so selling or cutting back means a nasty tax bill. And the big wins are still out there.

Bottom line, I feel good keeping my full Rocket Lab spot—it’s around 14% of the L2C portfolio. If it hit over 25%, I’d think about selling some. But right now? I’m all in.

See you in the next update!

The content of this analysis is for entertainment and informational purposes only and should not be considered financial or investment advice. Please conduct your own thorough research and due diligence before making any investment decisions and consult with a professional if needed.