Rocket Lab: Increasing the Asymmetry

$RKLB Q1 2025 ER update

RKLB 0.00%↑ blasted into Q1 2025 with $122.6 million in revenue, a 32.1% year-over-year surge, driven by an increase in launches (from 4 to 5) and Space Systems growth, particularly from the SDA satellite manufacturing contract and component businesses. However, revenue dipped 7.4% quarter-over-quarter due to lower ASP (Average Selling Price) for Electron launches and a shift in satellite manufacturing. CFO, Adam Spice, set a bullish tone:

Although variable quarter-to-quarter, we expect ASP for the calendar year 2025 to materially expand when compared to 2024. And with that, continued gross margin expansion,

Electron’s dominance is clear at this point, and it shines in a chart of American small launches since 2015, with 63 launches (59 successful), dwarfing competitors, as the second one, Northrop Grumman, follows with 9 succesfull launches.

The shareholder letter confirms,

Electron has completed 3x more successful launches than all other American small launch providers combined in the last decade.

And the CEO, Sir Peter Beck, added,

Electron continues to prove why it’s the global leader with 5 missions in the quarter all across only 6.5 weeks,

The HASTE program—a hypersonic test vehicle capability using the Electron rocket—also scored big, securing contracts under the U.S. Air Force’s $46 billion EWAAC program and seven DoD MACH-TB missions. Rocket Lab’s Q1 signals another breakout year for the launch segment.

In my original deep dive I compare Rocket Lab to AMD 0.00%↑ and to AWS with a beautiful and insightful IT analogy for the space economy.

If you haven't read it, I recommend doing so before reviewing this update. It's essential reading for a thorough understanding of the company.

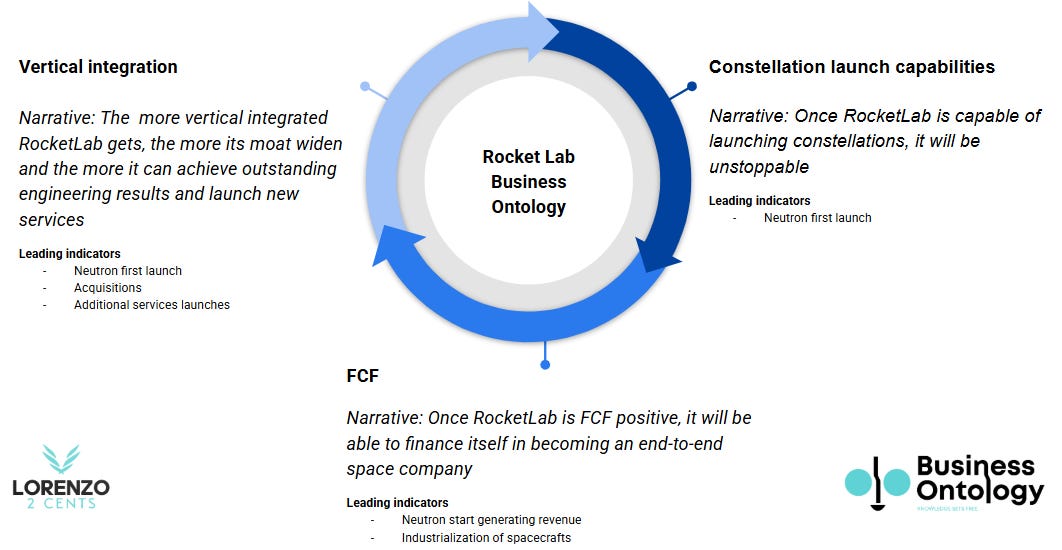

Rocket Lab Business Ontology

My Business Ontology framework evaluates the company’s long-term potential through three interconnected pillars: Vertical Integration, Constellation Launch Capabilities, and Free Cash Flow (FCF). Such lens reveals a company building an end-to-end space empire.

Vertical Integration strengthens Rocket Lab’s moat, with in-house engineering driving launches and space systems, making the supply chain resilient, and new services like Neutron and acquisitions expanding its reach.

Constellation Launch Capabilities highlight Rocket Lab’s path to dominating mega-constellation deployments and entering the space applications business, with Neutron’s first launch as a key milestone to becoming unstoppable.

Finally, FCF (Free Cash Flow) underscores Rocket Lab’s financial trajectory which once positive, it will fuel self-sustained growth, with Neutron’s revenue generation as a leading indicator. Rocket Lab’s strategy aligns perfectly, positioning it to lead the space industry.

If you’re new to my Business Ontology framework, check out this article for a detailed introduction.

Neutron update

Neutron, Rocket Lab’s reusable medium-lift rocket, is the linchpin of my thesis, as it unlocks the path to becoming and end-to-end space company, and Q1 2025 confirm it’s on the trajectory to shake up the launch industry. The market is betting on Neutron’s success, with a growing pipeline of customers.

A game-changing milestone came with its selection for the U.S. Space Force’s National Security Space Launch (NSSL) Phase 3 Lane 1 program—a $5.6 billion contract through June 2029. Sir Peter Beck highlighted,

This is the most competitive launch program in the industry to fly the DoD’s highest priority and most critical missions. Our selection to it is a huge vote of confidence by the Pentagon,

Rocket Lab joins an elite group as one of only five onboarded launchers, and Beck proudly noted,

We’re also the only publicly traded company to ever onboard NSSL,

This selection included a $5 million task order to showcase mission assurance—essentially proving Neutron can handle the DoD’s toughest requirements. Rocket Lab has already held a kickoff meeting with key players like the U.S. Space Force, NRO (National Reconnaissance Office), and other government stakeholders, setting the stage for future task orders post-launch.

Progress is on track: Stage 2 qualification is complete (the lower section passed key tests), Stage 1 (upper section) qualification is underway for the booster, rocket assembly is in progress, the launch site is on schedule, and the Archimedes engine is being tested at double capacity to ensure reliability. Beck added,

We’re targeting the first launch by the second half of this year.

Neutron is set to redefine Rocket Lab’s future.

Free Cash Flow

Rocket Lab is on the cusp of a financial milestone: Free Cash Flow (FCF) positivity excluding Neutron costs. CEO, Sir Peter Beck, noted in a past earnings call that their target gross margin for launches is 50% (currently ~33%), achievable at 24 launches per year—a goal attainable by 2025 if growth trends continue. This margin improvement, driven by higher cadence, better ASP, and efficiencies like reusing components, supports FCF positivity. Beck added,

We booked 8 new Electron and HASTE missions for Q1… and there is demand for more than 20 launches this year,

with 5 already done in Q1. CFO, Adam Spice, confirmed margins will expand, especially on the launch side, with ASP peaking in Q4.

This means if further financing is needed for Neutron or acquisitions, investors will see minimal risks and be willing to provide it. With $517 million in cash and cash equivalents—bolstered by a recent $92.8 million equity offering—Rocket Lab is set to fund growth like the Mynaric acquisition.

Vertical integration

Rocket Lab’s vertical integration strategy is vital for a resilient supply chain, ensuring reliability in the fragmented space industry.

The pending Mynaric acquisition, a leader in laser-based satellite communications, strengthens this chain by securing high-speed, secure links for constellations—key for contracts like the SDA’s $0.5 billion program.

Mynaric terminals are already being supplied for the Space Development Agency, along with many other companies, making this even more of a logical integration,

Peter Beck also noted,

This deal also sees us sit down our first European footprint in Munich,

boosting production scale.

About in-house new product development, Adam Spice, explained,

Our suite of Space Systems components and mission software is constantly under development, allowing us to consistently produce and release new products that really move the needle for the industry and for us.

Example of new products are STARRAY solar arrays, frontier radios, and MAX software, powering missions like NASA’s CAPSTONE, which enables further exploration of lunar orbit characteristics, advancement of navigation technologies through interaction with other NASA spacecraft and communication networks, and demonstration of innovative networking and spacecraft positioning technologies.

Beck explained the goal:

We're really trying to solve 2 problems here. One is provide -- be that merchant supplier at scale for the industry. And then as you point out, when it comes time for us to build our own stuff, then we already have that capability at scale. And we're just methodically going through every element of the satellite that we're going to need now and in the future and when opportunities present themselves, we take advantage of that

With a half-dozen M&A deals in the pipeline, Rocket Lab is building a self-sufficient space powerhouse.

Ready for more deep dives? Unlock all my in-depth analyses and updates—including coverage of LMND 0.00%↑ , HIMS 0.00%↑ , MELI 0.00%↑ , ODD 0.00%↑ , CRWD 0.00%↑ and DUOL 0.00%↑ —by visiting Lorenzo2cents. Want the latest articles delivered straight to your inbox? Subscribe here and stay ahead of the curve.

Conclusion

Rocket Lab’s Q1 2025 reaffirms my thesis is on track.

The investment’s asymmetry is increasing: Neutron’s progress toward reality drives the upside, while Electron’s near-FCF positivity, alongside Space Systems, limits the downside. Even if Neutron fails, Rocket Lab could be profitable within a year on Electron and Space Systems alone. RKLB is poised to dominate the space industry.

As always, here is the “Deep Dive To Date” (DDTD), that is how the stock is performing since my initial deep dive. For RocketLab stock ($RKLB), the price on September 17th, 2024, when I published my analysis, was $7.19. As of this update, the price stands at $25.42, reflecting a

+3,5x DDTDStay tuned for the next update!

The content of this analysis is for entertainment and informational purposes only and should not be considered financial or investment advice. Please conduct your own thorough research and due diligence before making any investment decisions and consult with a professional if needed.