Mercado Libre = Amazon E-commerce + Paypal (Deep Dive Act II)

$MELI's unstoppable: Pioneering Latin America’s Digital Future Amid Macro Challenges and Stablecoins

Edited by Brian Birnbaum

If you missed Part 1 of this deep dive, I strongly recommend reading it before proceeding with this second and final part of the analysis.

Index

MELI+: A Strategic Loyalty Program Enhancing User Engagement and increasing Switching Cost

Mercado Pago vs. Nubank: A Deep Dive into Latin America's Fintech Race

Addressing the Bear thesis

Mercado Libre Business Ontology

Conclusion

1. MELI+: A Strategic Loyalty Program Enhancing User Engagement and increasing Switching Cost

MELI+, Mercado Libre’s paid loyalty program, launched in 2020, mirrors Amazon Prime in its design to boost user engagement and drive incremental growth within its ecosystem. A friend in Mexico shared:

I have MELI+. I stopped renewing my Prime subscription after 3 years because I don't order from Amazon as much anymore, I don't use Prime Music at all, and Prime Video doesn't have as much interesting content. However, I use Mercado Libre a lot. MELI+ gives me cashback on my purchases and includes a Disney+ subscription.

The program offers key Benefits for Members:

Free Shipping: MELI + members receive free shipping on millions of items above a lower threshold compared to the standard free shipping threshold

Content Bundle: The program offers access to premium video and audio content. This includes Disney+ and Deezer as part of the MELI+ Total plan, along with special discounts to subscribe to other streaming services like HBO Max, Paramount Plus, and Lionsgate Plus

MELI Delivery Day: a delivery option where members can choose a specific day of the week to receive all of their packages, which further lowers the free shipping threshold down. This feature aims to enable Mercado Libre to sell and deliver lower-value items cost-effectively.

Cashback on Mercado Libre purchases

Cashback on all purchases made with the Mercado Pago credit card, either on Mercado Libre platform or even outside.This cashback is paid in MELI Dollar, a stablecoin that users can buy, hold, and sell within the Mercado Pago app.

Extra financing (extra free installments) on purchases on Mercado Libre

Higher yield (extra remuneration) on funds held in the remunerated Mercado Pago accounts in Brazil, Mexico, Argentina, and Chile, compared to non MELI+ users.

MELI+ aims to enhance customer loyalty, increase purchase frequency, and reduce churn, as it drives more users to embrace the complete MELI ecosystem.

Mercado Pago churn is half of general user, underscoring improved retention through seamless services.

During the Q2 2024 earnings call, Executive Vice President of Commerce,

Ariel Szarfsztejn, highlighted,

Meli+ is successfully generating incremental engagement and incremental gross merchandise value (GMV)… users who enroll have higher frequency, higher GMV, lower churn,

Similarly, CFO, Martin de Los Santos, noted in Q3 2024,

We’ve seen more usage, better conversion, better engagement with our platform,

By integrating commerce and fintech synergies, MELI+ creates a loyalty program that competitors struggle to replicate, reinforcing Mercado Libre’s competitive edge and fostering sustained growth in Latin America’s digital market.

The recent introduction of fintech benefits within MELI+, originally focused on the E-commerce platform, aims to create a unique loyalty program that is difficult for competitors to replicate due to the synergy between the commerce and fintech ecosystems.

The content of this analysis is for entertainment and informational purposes only and should not be considered financial or investment advice. Please conduct your own thorough research and due diligence before making any investment decisions and consult with a professional if needed.

2. Mercado Pago vs. Nubank: A Deep Dive into Latin America's Fintech Race

Mercado Pago and Nubank stand out as two of the most influential fintech players in Latin America. While some revenue streams overlap, their mostly distinct business models and strategic positioning make them a fascinating case study—especially when evaluating the thesis that positions Mercado Libre as the long-term leader in both E-commerce and fintech in the region.

Both companies generate revenue through financial services, including lending (interest on loans and credit cards), payment processing (transaction fees), digital accounts (interest on balances), and ancillary offerings such as insurance and investments. However, the way these services are integrated into their respective ecosystems varies significantly.

Mercado Pago benefits from tight integration with Mercado Libre’s E-commerce platform. It leverages marketplace data for underwriting and payment facilitation, creating a powerful feedback loop that boosts both engagement and retention.

Nubank, in contrast, operates as an independent digital bank, focusing heavily on a wide suite of financial products with a core emphasis on interest income from its lending operations.

Despite offering many of the same products, their revenue compositions reflect different strategic focuses. In 2024, interest income accounted for 83.6% of Nubank’s total revenue, driven largely by its expanding credit card and loan portfolio. For Mercado Pago, interest income represented only 42% of revenue in Q4 2024, with the rest coming from payment services and other services.

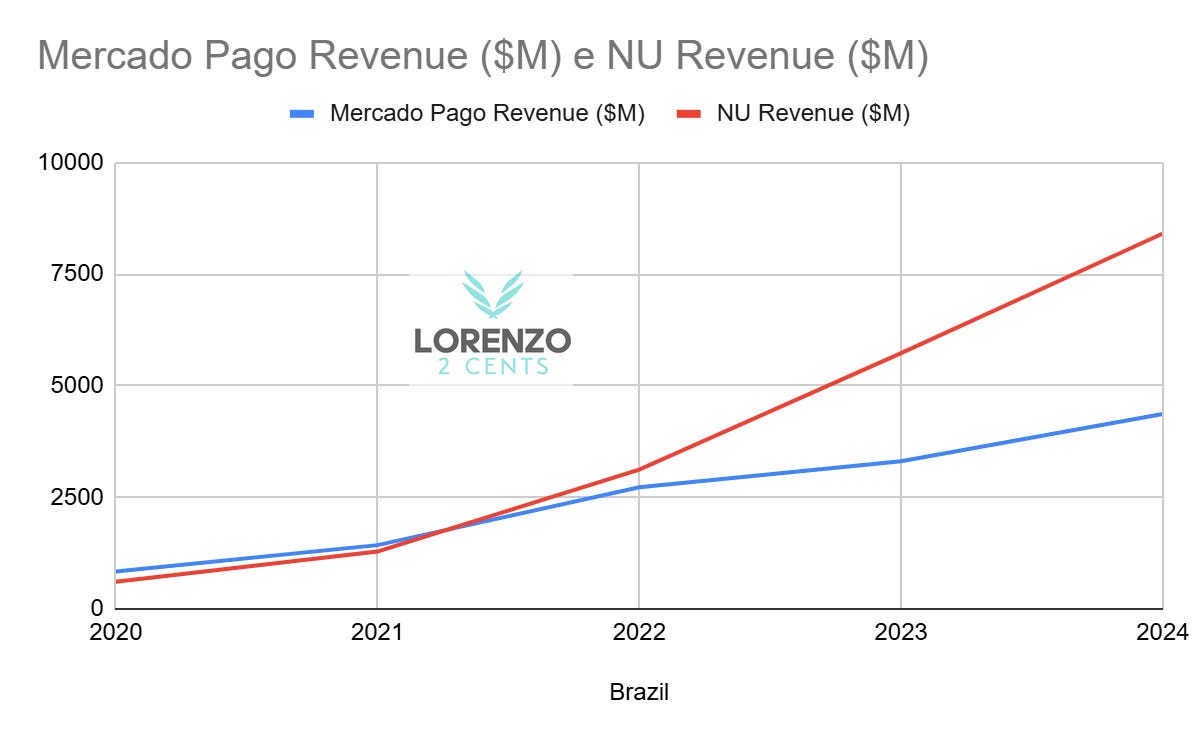

Both companies are riding the wave of increasing digital finance adoption across Latin America. Mercado Pago operates in eight countries—Argentina, Brazil, Mexico, Chile, Colombia, Peru, Uruguay, and Ecuador—while Nubank is active in only three (Brazil, Mexico, and Colombia). Yet despite this broader geographic reach, Nubank has a revenue lead, generating $3 billion in 2024 compared to Mercado Pago’s $2.53 billion. Nubank’s first-mover advantage in Brazil, where it launched its flagship Nu Credit Card in 2014, predates Mercado Pago’s formal fintech operations in the country by four years. Data from Mercado Libre investor relations page supports this; Mercado Pago is the leading fintech in terms of monthly active users in Argentina, Mexico, and Chile, while in Brazil, Nubank maintains the top spot.

However, the revenue story adds more depth.

By 2020, Mercado Pago had caught up with Nubank in Brazil. Both companies grew at comparable rates until 2022, when Nubank’s revenue growth accelerated sharply. This reflects its focus on lending, whereas Mercado Pago continues to prioritize integration with commerce services and platform utility.

Nubank’s edge in this field is confirmed by their underwriting approach, which is based on machine learning models and superior credit underwriting across different risk scores. Q4 2024 marked a 4.1% 15-90 NPL ratio, against the 7.4% Mercado Pago reported in the same period. The NPL ratio measures the percentage of loans overdue by 15-90 days relative to the total loan portfolio, an indicator of default risk.

Looking beyond Brazil, one might expect Mercado Pago’s broader presence and ecosystem synergies to drive stronger overall performance. While revenue still lags behind Nubank, Mercado Pago is rapidly closing the gap in user growth.

Comparing Monthly Active Users (noting that Nubank uses "Active Customers" while Mercado Pago reports "Users") shows that, from mid-2022 onwards, Mercado Pago may be outpacing Nubank in user growth year-over-year.

When comparing ARPAC (Average Revenue Per Active Customer), Nubank appears to be catching up to Mercado Pago, which has historically had a higher figure.

However, this is partly because Mercado Pago’s user base is growing faster than its revenue—suggesting that monetization may accelerate as more users begin using additional services in the ecosystem.

Despite operating in the same sector and offering similar products, Mercado Pago and Nubank are pursuing fundamentally different strategies:

Nubank is laser-focused on lending. Its core bet is that superior underwriting, powered by advanced machine learning models, will allow it to grow its loan portfolio efficiently and profitably. In a market where consumers show little loyalty when choosing lenders, the company that offers the most competitive rates—or provides products to underserved, unbanked populations—has the greatest opportunity to win. Nubank’s ability to underwrite loans across different risk tiers more accurately than the industry average is its key competitive advantage.

Mercado Pago, by contrast, is deeply intertwined with MELI’s overall commerce. Its goal isn’t just to offer financial services, but to enhance the value of the entire Mercado Libre ecosystem. Here’s how each component contributes:

Acquiring Business: Mercado Pago aims to be Latin America’s premier acquirer, enabling merchants to process digital payments both on and off the Mercado Libre platform. On-platform, this creates a seamless buyer-seller experience. Off-platform, it builds trust and brand recognition across the region.

Credit: Lending is integrated with marketplace activity. Products like credit cards, consumer loans, and buy-now-pay-later offerings not only generate revenue but drive more commerce on Mercado Libre. This tight integration fuels platform growth and engagement. Marketplace data enables more accurate credit scoring, especially among the unbanked. Merchant loans are repaid via platform sales, minimizing risk.

Digital Account: Mercado Pago’s digital accounts enhance user stickiness. Funds stored in these accounts facilitate quick purchases, increase gross merchandise volume (GMV), and promote daily usage. Integration with MELI+ loyalty benefits, such as cashback and rewards, further deepens engagement. These accounts also serve as gateways to credit, insurance, and investment products.

While Nubank currently leads in revenue and has demonstrated superior lending economics, Mercado Pago is steadily gaining ground in terms of users. Its user base is growing rapidly, and the platform synergies it leverages suggest that revenue per user could rise meaningfully in the near future.

Nubank is playing a traditional fintech game—disrupting banks through superior lending and product design. Mercado Pago, on the other hand, is playing an ecosystem game, where fintech is a tool to enhance commerce, build loyalty, and create a flywheel of growth.

Ultimately, as Mercado Libre’s ecosystem continues to scale, the ability to cross-sell high-value financial services—including credit—will only improve.

While Nubank may continue to outpace Mercado Pago in revenue growth in the short term, Mercado Pago’s broader integration and strategic flexibility could allow it to catch up and potentially lead in the long run.

Finally, Mercado Pago more closely resembles PayPal than Nubank thanks to its focus on payments, E-commerce integration, and a revenue model centered on transaction fees rather than lending. Although it shares some traits with Nubank, like lending and digital accounts, its strong E-commerce ties and transaction scale align it more closely with PayPal. In Latin America, Mercado Pago surpasses PayPal in E-commerce market share and rivals Nubank in fintech adoption, securing a unique hybrid position.

3. Addressing the Bear thesis

The Bear Thesis for Mercado Libre hinges on fierce competition, economic volatility and currency depreciation. Competitors like Amazon and local players threaten MELI’s 34% E-commerce share with aggressive pricing and logistics. Economic instability in Latin American countries such as Argentina and Brazil, worsened by local currencies depreciation (28% Argentine Peso loss in 2024 only), erodes MELI’s dollar-based revenue and profits and raises import costs, pressuring GMV in dollar terms. Currency depreciation may also inflate Mercado Pago’s NPL ratio, straining its $6.6 billion credit portfolio (as of Q4 2024).

Because I have thoroughly addressed the competitive landscape in previous sections and I am confident that Mercado Libre’s moat is robust and resilient, in my analysis to validate or refute the Bear Thesis, I will examine the economic instability in Latin American countries and its potential impact on Mercado Libre’s business.

I will focus on Mercado Libre’s three primary markets: Brazil, accounting for 50% of sales; Mexico, contributing 22%; and Argentina, representing 18%. No other market currently generates more than 4% of the company’s revenue. For each of these countries, I will analyze three key indicators—currency stability against the USD, inflation, and GDP growth—to understand their implications.

Here is why.

Currency Stability Against USD: A stable local currency against the USD supports predictable pricing, import costs, and revenue conversion for Mercado Libre, as many of its transactions and costs (e.g., tech infrastructure) involve USD. Depreciation of local currencies (e.g., Argentine peso or Brazilian real) increases the cost of imported goods sold on its platform and reduces the USD value of its revenues, squeezing margins. For example, Argentina’s peso devaluation in 2023 raised costs for Mercado Libre’s operations. Conversely, stability or appreciation enhances profitability and investor confidence.

Inflation: High inflation, common in countries like Argentina (100% in 2023), erodes consumer purchasing power, reducing demand for non-essential goods on Mercado Libre’s platform. It also increases operational costs (e.g., logistics, wages), forcing price hikes that may deter customers. However, Mercado Libre’s fintech arm, MercadoPago, can benefit from inflation-driven demand for digital payments and credit solutions. Strong central bank policies to curb inflation (e.g., Brazil’s rate hikes) can stabilize prices, boosting consumer confidence, but also increase borrowing costs for consumers and businesses, reducing spending on Mercado Libre’s platform.

GDP Growth: Higher GDP growth, like Brazil’s 3.60% in Q4 2024, signals stronger consumer spending and economic activity, driving demand for Mercado Libre’s E-commerce and financial services. For instance, Brazil’s growth supports Mercado Libre’s largest market, where rising household consumption (60% of GDP) fuels platform sales. Low growth or stagnation limits consumer budgets, slowing Mercado Libre’s expansion and transaction volumes. Growth also attracts foreign investment, aiding Mercado Libre’s capital access.

Let’s start the analysis with Brazil.

The Brazilian Real has depreciated significantly against the USD over the past decade, losing 89% of its value. The majority of this decline occurred during the early stages of the COVID-19 pandemic, when the USD served as a safe-haven asset amid global macroeconomic uncertainty. Excluding the pandemic’s impact, the Real has been relatively stable over the past five years, with a modest 2% loss, indicating resilience when insulated from exogenous economic shocks.

Inflation in Brazil has fluctuated between 1.88% and 12.1% over the same period, peaking post-COVID, consistent with trends observed in major global economies. As of March 2025, inflation stands at 5.5%, which, while elevated, does not pose a significant threat to the country’s economic stability.

Brazil’s GDP grew by 3.4% in 2024, following a 3.2% increase in 2023, marking the fastest expansion since 2021. Historically, Brazil’s annual GDP growth has averaged 3.74% from 1963 to 2024, with a peak of 14% in 1973 and a low of -4.4% in 1990.

Overall, Brazil’s economy demonstrates notable resilience, which explains why it serves as the primary hub for E-commerce and fintech operations in Latin America.

Turning to Mexico, the Mexican Peso has depreciated by 29% against the USD over the past decade, reflecting a relatively stable currency. Inflation has ranged from 3% to 8.7% during this period, with post-COVID trends aligning with those observed in major global economies. As of March 2025, inflation stands at 3.5%.

Mexico’s GDP growth slowed to 1.5% in 2024, down from 3.3% in 2023. Historically, annual GDP growth has averaged 2.17% from 1994 to 2024, with a high of 6.8% in 1996 and a low of -8.4% in 2020.

Based on this high-level analysis, Mexico’s macroeconomic environment appears relatively favorable than Brazil’s, with a currency that has recently demonstrated greater resilience to external shocks.

Let’s now address the critical issue: Argentina. Over the past decade, the Argentine Peso has plummeted by 12,946% against the USD, and inflation has followed a similarly dire trajectory, never falling below 14% during this period, with a peak of 292% in April 2024.

GDP, measured in constant prices, has remained nearly stagnant over the same ten years, reflecting persistent economic stagnation.

Having established that Argentina represents the most challenging macroeconomic environment for Mercado Libre in the region, let’s examine how the company’s revenue in Argentina has performed over this period to gain insight into potential future outcomes.

From 2015 to 2024, Mercado Libre’s revenue in Argentina grew 15-fold, achieving a compound annual growth rate (CAGR) of 31.6%. This suggests that E-commerce penetration has, to a certain degree, overpowered the country’s macroeconomic conditions. However, as E-commerce penetration increases and the market matures, macroeconomic factors may become more significant.

Given that Argentina’s macroeconomic environment appears highly unattractive to outsiders, Mercado Libre’s ability to generate substantial profits in such conditions can be viewed as a strategic advantage. This challenging landscape deters competitors, providing Mercado Libre with the opportunity to solidify its dominance and establish a near-monopoly in less appealing markets.

Let’s finally consider a speculative yet significant upside to the thesis–a development that could reshape international currency dynamics and bolster macroeconomic stability in Latin America, creating a more attractive investment landscape.

David Sacks, the newly appointed White House AI and Crypto Czar, has stated,

Stablecoins have the potential to reinforce U.S. dollar dominance globally by increasing its digital use as the world’s reserve currency, potentially generating trillions in demand for U.S. Treasuries, which could lower long-term interest rates.

A stablecoin is a cryptocurrency designed to maintain a consistent value, typically pegged to a fiat currency like the USD or another stable asset, minimizing volatility.

The White House’s recent push to regulate and promote stablecoins could accelerate dollarization in allied nations. For Mercado Libre (MELI), which has already integrated stablecoins into its MercadoPago digital wallet and launched its own stablecoin, Meli Dólar (MUSD), widespread adoption could significantly mitigate the challenges of Latin America’s volatile macroeconomic environment, characterized by currency fluctuations, high inflation, and uneven GDP growth. Stablecoins, pegged to reliable assets like the USD, provide a stable store of value and medium of exchange, counteracting the effects of local currency devaluations, such as Argentina’s severe peso volatility, which erode consumer purchasing power and increase MELI’s operational costs.

By leveraging Meli Dólar (MUSD) and other stablecoins within MercadoPago, MELI facilitates faster, more cost-effective cross-border transactions and remittances, critical in markets like Brazil and Argentina, where stablecoin inflows reached $90.3 billion and $91.1 billion, respectively, in 2024. This enhances financial inclusion for the region’s 40% unbanked population, driving transaction volumes on MELI’s platform. Additionally, stablecoins’ low transaction fees and programmability could optimize MELI’s logistics and payment systems, improving margins in high-inflation environments where elevated interest rates, such as Brazil’s 10.75% Selic rate, pressure profitability. By expanding its stablecoin offerings, MELI could effectively hedge against macroeconomic risks, reinforcing its position as a resilient leader in Latin America’s digital economy.

4. Mercado Libre Business Ontology

Mercado Libre has established a powerful flywheel that drives its superior returns and market dominance in Latin America, as outlined in the present deep dive. This flywheel is fueled by a combination of strategic advantages and self-reinforcing dynamics:

First-Mover Advantage and Ecosystem Strength: MELI’s early entry into multiple Latin American markets has allowed it to build a robust ecosystem encompassing E-commerce, fintech (MercadoPago), and logistics. This ecosystem, paired with its scale, delivers unmatched value per user, attracting new users and maximizing ARPAC (Average Revenue Per Active Customer). The company’s superior GMV growth compared to competitors underscores its market leadership.

Unrivaled User Data and Behavioral Insights: MELI’s extensive user base provides a wealth of data, enabling the creation of a “digital twin” of its customers. This deep understanding of user behavior drives the industry’s best credit risk calculations and allows MELI to offer tailored services at competitive prices. As more users join the platform, this data advantage grows, creating a significant barrier for competitors.

Resilience in Macroeconomic Challenges: Despite economic volatility in key markets like Brazil, Mexico, and Argentina, MELI has demonstrated resilience, particularly in Argentina, where it achieved a 15x revenue increase (31.6% CAGR) from 2015 to 2024. The integration of stablecoins, including its own Meli Dólar (MUSD), into MercadoPago mitigates currency volatility and enhances financial inclusion for the 40% unbanked population, driving transaction volumes and operational efficiency.

Virtuous Cycle of Market Development: MELI’s investments in logistics, payments, and digital infrastructure contribute to the development of Latin America’s E-commerce and fintech markets, creating a virtuous cycle that further entrenches its dominance. Vertical integration strengthens this cycle by optimizing costs and improving service quality.

Potential for Expansion into New Verticals: MELI’s ultimate strategy could involve entering social networking, entertainment, and healthcare, capturing a majority of the population’s attention and data. This “winner-takes-all” scenario would solidify MELI’s grip on Latin American consumers’ share of wallet, leveraging its unparalleled knowledge to dominate additional sectors.

If you’re new to my Business Ontology framework, check out this article for a detailed introduction.

In summary, MELI’s flywheel—driven by its first-mover edge, data-driven personalization, macroeconomic resilience, market development contributions, and potential for vertical expansion—creates a self-reinforcing cycle that delivers superior returns and positions MELI as the leading force in Latin America’s digital economy.

Building on the comprehensive analysis of the MELI flywheel and its strategic advantages, I have developed a Business Ontology to distill the key performance indicators (KPIs) that enable us to monitor the company’s performance, assess its alignment with the investment thesis, and detect any potential erosion of its competitive edge or weakening of its moat.

This Mercado Libre Business Ontology, as illustrated, focuses on three core drivers: Total Users Growth, GMV Growth, and Value per User (ARPAC).

Total Users Growth: MELI’s first-mover advantage in multiple countries, combined with its robust ecosystem and user data, drives superior user growth. Leading indicators include user growth versus Nubank, user growth versus GMV Growth and deployment of new verticals such as entertainment and social platforms.

GMV Growth: Superior GMV growth compared to competitors serves as the primary indicator of MELI’s market leadership. Leading indicators to monitor include net PPE (Net Property Plant and Equipment) growth trends and versus Sea Limited.

Value per User (ARPAC): MELI’s ecosystem and scale enable it to deliver greater value per user, attracting new users and maximizing ARPAC. Key indicators include ARPAC/Gross Margin, CFO/PPE trends and versus Seal Limited, new product introductions, and vertical integration efforts.

This ontology provides a structured framework to evaluate MELI’s ongoing success and resilience in Latin America’s dynamic market landscape.

5. Conclusion

Mercado Libre (MELI) boasts a formidable moat, reinforced by its expansive logistics network, first-mover advantage, robust ecosystem, and unparalleled user data insights, as demonstrated throughout this deep dive.

If MELI continues its exceptional execution and strategic investments to capture a greater share of Latin American users’ portfolios, it is poised to become a dominant force in the region’s digital economy. This growth trajectory is strongly supported by its free cash flow per share, which has been rising at a non-linear rate, reflecting operational efficiency and scalability.

With the stock currently priced at a multiple Price to Free Cash Flow of 20, there is significant upside potential, indicating that the stock has substantial room to run. Consequently, MELI 0.00%↑ undoubtedly deserves a place in my portfolio, and I will consider if and how to build a position in the near future.

Check all the Ontologies I have built: ODD 0.00%↑ , RKLB 0.00%↑ , DUOL 0.00%↑ , LMND 0.00%↑ , CRWD 0.00%↑ , HIMS 0.00%↑ .