Competition Intensifies, But MELI Does Not Give a F**k

$MELI Q3 2025 ER Update

The content of this analysis is for entertainment and informational purposes only and should not be considered financial or investment advice. Please conduct your own thorough research and due diligence before making any investment decisions and consult with a professional if needed.

While investors in the second part of 2025 net sold Mercado Libre stock scared by an intensifying competition, Mercado Libre does not care and keeps gaining market share.

MELI internal data shows they have the highest NPS among fintechs in Brazil, and have maintained NPS leadership among fintechs in Mexico. MELI continues to be exceptionally well positioned to drive the offline to online retail shift in Latin America.

Table of Contents

Q3 2025 Update

Lorenzo2cents (L2C) take aways and performance

Business Ontology Framework by L2C

Business Ontology

4D Valuation Model

L2C portfolio strategy

Q3 2025 Update

MELI’s 4D chess play in Brazil

Mercado Libre, the e-commerce giant dominating Latin America, executed a series of masterful strategic maneuvers in Brazil amid escalating competition, particularly from rivals intensifying their marketplace presence. These moves, centered on aggressive investments in logistics, shipping incentives, and fintech enhancements, not only fortified its competitive edge but also propelled remarkable growth metrics, solidifying its market leadership.

A pivotal initiative was the strategic lowering of the free shipping threshold from R$79 to R$19 in June 2025—a 75% reduction that made free shipping eligible for a far broader range of lower-value purchases, igniting a surge in buyer accessibility and marketplace activity. This core change supercharged dynamics, with delivery speed nuances adding further appeal: non-MELI+ users receive free but slower shipping for orders between R$19 and R$79, while those above R$79 get faster options. Coupled with substantial investments in the supply and logistics ecosystem, the adjustment fueled robust supply-side momentum.

The number of merchants making sales in the R$19–79 range grew at a double-digit YoY pace in Q3’25, while new listings in that range grew 3x YoY,

company executives noted, highlighting how these trends broadened buyer choices and expanded seller opportunities.

The ripple effects were profound: website visits surged, conversion rates hit all-time highs, and retention reached record levels for both new and existing customers. In essence, as the the management described,

the lower free shipping threshold is attracting more buyers and enabling sellers to turn that traffic into higher sales. This, in turn, creates a powerful flywheel of supply and demand.

Bolstering this was Mercado Libre’s resilient logistics network, which seamlessly absorbed a 28% quarter-over-quarter spike in shipments without compromising service levels or delivery speeds. Improvements in the “slow layer” of the network—underpinning free shipping below R$79—made these options more appealing, even as shipping revenue dipped. Critically, unit shipping costs in Brazil plummeted 8% quarter-over-quarter in local currency, thanks to scaled slow volumes leveraging unused capacity.

Martin de Los Santos, a key executive, underscored the immediate impact:

The recent reduction in the free shipping threshold in Brazil has already delivered strong results with both GMV and items sold accelerating in the quarter.

Indeed, items sold in Brazil rocketed from 26% year-over-year growth in the prior quarter to an impressive 42% this period, while gross merchandise value (GMV) and buyer metrics—conversion, retention, and purchase frequency—all saw sharp upticks. Sellers reaped benefits too, with more flocking to the platform and listings in the R$19–79 bracket surging.

Complementing these e-commerce triumphs were savvy fintech plays, particularly in credit offerings. Investments in the Mercado Pago credit card matured, enhancing profitability and user engagement.

Mercado Pago had a stellar quarter. Monthly active users growth accelerated as our NPS hit record highs in Brazil,

de Los Santos affirmed, attributing this to UX refinements and high-value products like remunerated accounts.

In addition, to lock in loyalty, the company amplified its MELI+ subscription program. In October 2025, Brazilian subscribers gained eligibility for fast shipping on purchases from R$19 onward (contrasting with slow shipping for non-subscribers in that range), reinstating a key premium perk post the broader free shipping expansion. The launch of the MELI+ Mega “super bundle”—bundling Disney+, Netflix, HBO Max, Apple TV+, and ecosystem perks—positioned it as a powerhouse distribution channel. Partnerships with McDonald’s, Petrobras, and 99 further sweetened the deal, offering co-funded cashback in Meli Dólar for credit card payments. As executives emphasized,

We think we are uniquely positioned to offer the most compelling benefits package in LatAm, which will drive engagement with the Mercado Libre and Mercado Pago platforms.

Through these integrated strategies, Mercado Libre not only outmaneuvered competitors but transformed competitive pressures into a virtuous cycle of expansion, efficiency, and user devotion, cementing Brazil as a cornerstone of its regional dominance.

Argentina is an opportunity, not a risk. Venezuela Next?

Despite persistent macroeconomic headwinds in Argentina—such as election-related instability, rising interest rates, and consumption pressures—Mercado Libre has turned what many investors viewed as a risk in its thesis into a clear competitive advantage: deep expertise in navigating volatility while sustaining robust growth and profitability (check my original deep dive for more details).

The company added nearly 1 million new buyers per quarter in 2025, a record pace that underscores its unmatched value proposition against physical retail, which still claims about 85% of the market. Martin de Los Santos highlighted this resilience:

Growth in Argentina remained resilient in Q3’25 despite a challenging macro backdrop, with sold items up 34% YoY and FX-neutral GMV up 44%.

Even as trends softened mid-quarter due to midterm elections, revenues climbed 39% year-over-year in U.S. dollars (97% in local currency), and the credit portfolio doubled to 100% YoY growth with healthy metrics on non-performing loans. This stability stems from Mercado Libre’s playbook: relentless focus on user experience over macro noise, as Osvaldo Giménez emphasized,

More than macro, the important thing about our business is what we do with our users and our platform.

Key moves included opening a second fulfillment center in Buenos Aires, boosting same- and next-day deliveries by nearly 7 percentage points year-over-year and hitting a record in fulfillment penetration.

The launch of a fee-free credit card—unlike nearly all competitors—tapped into Mercado Pago’s engaged user base, offering ecosystem perks that Giménez called a “huge plus.”

Adding drop-shipping from China for affordable categories like fashion and toys further diversified assortments.

De Los Santos affirmed,

Despite the headwind Argentina continues to be a very profitable market with strong long-term growth perspective,

proving the company’s leadership position equips it to thrive where others falter, transforming Argentina from a worry into a profit engine.

Could Meli apply the same playbook to Venezuela, next? Food for thoughts.

Lorenzo2cents (L2C) take aways and performance

Mercado Libre had another great quarter. Net revenues and financial income jumped 39% year-over-year to $7.4 billion (49% without currency changes). Gross merchandise volume rose 28% to $16.5 billion (35% FX-neutral). This strengthens its lead in Latin America’s online shopping and boosts fintech growth.

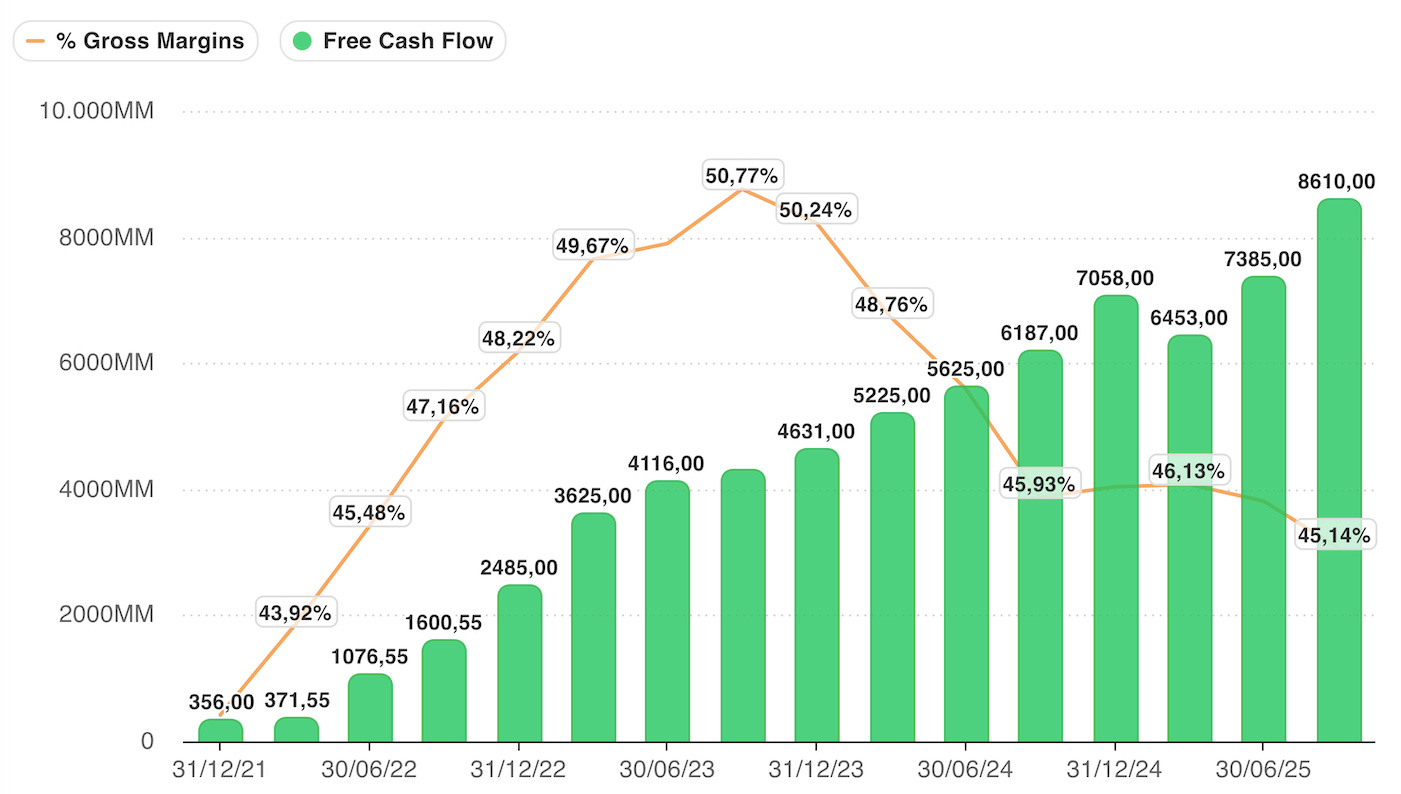

The company is spending big to reach more customers in areas where online sales are still small compared to stores. It accepts lower short-term profits for bigger long-term wins. This shows in shrinking gross margins but strong free cash flow gains.

This aligns perfectly with the thesis I’ve outlined in my deep dives: build an unbeatable commerce moat to drive users into a sticky fintech ecosystem.

With a Free Cash Flow of $8,6 Billion and Revenue growing 39% YoY, 30x can be considered a conservative multiple, which if applied, projects MELI to $258B market cap. Today’s MELI market cap is around $100B. I leave it to you to do the math.

As always, here is the “Deep Dive To Date” (DDTD), that is how the stock is performing since my initial deep dive on the May 18th 2025, when the stock price was $2585. As proved by my post on X, where I share real time updates, I opened a position a few days later.

- 24% DDTDFrom here on, the content is restricted to L2C Premium Members, folks who’ve chosen to unlock this toolkit and support my independent research:

Business Ontology Framework by L2C

Business Ontology: My core blueprint for modeling and tracking company performance at every level.

4D Valuation Model: the valuation tool I use to value all my investments (Fair price is useless)

L2C Portfolio Strategy: My portfolio allocation and strategy in details

L2C Portfolio access & trades alerts: Real-time views into my holdings, plus instant notifications on buys, sells, and shifts.

Business Ontology Framework by L2C

The Business Ontology is a framework I built after tearing apart several tech companies from the ground up—breaking them down to their basic parts and piecing together a real thesis on what drives them. Think of it as a map of a company’s soul. It’s a tight set of core indicators—tailored to each business—that show if it’s heading the right way, no matter what the stock price says. These aren’t your basic stats like P/E ratios or revenue bumps you grab from Yahoo Finance. They’re deeper, sharper, and linked straight to the thesis I’ve cooked up on how the company makes value and fights in its market.

The framework boils down to two big pieces:

The Business Ontology—This checks if the company’s worth buying into or hanging onto.

The 4D Valuation Model—This gives you a 4D roadmap to guide your own calls on how much to put in (allocation).

Now, let’s dive into MELI and this quarter’s update.