Mercado Libre: Cementing LatAm Supremacy

$MELI Q2 2025 ER Update

Mercado Libre delivered another solid quarter, with net revenues and financial income growing 34% year-over-year to $6.8 billion (53% FX-neutral) and gross merchandise volume up 21% to $15.3 billion (37% FX-neutral), reinforcing its position as Latin America's e-commerce powerhouse while fueling growth in fintech.

The company is aggressively investing in market penetration, even at the cost of short-term margins, to capture the region's vast untapped potential—where e-commerce still represents just a fraction of retail. This aligns perfectly with the thesis I've outlined in my deep dives: build an unbeatable commerce moat to drive users into a sticky fintech ecosystem.

If you haven't read my original deep dive on Mercado Libre, I recommend doing so before reviewing this update. It's essential reading for a thorough understanding of the company.

Thesis in Action: Slashing Commerce Margins to Unlock Ecosystem Growth

My core thesis on MELI 0.00%↑ has centered on their willingness to sacrifice short-term profitability in commerce to maximize long-term dominance, leveraging their superior logistics infrastructure to pull in users who then flow into higher-margin areas like fintech and advertising. This quarter, that playbook was on full display with the expansion of free shipping in Brazil.

As the shareholder letter explains:

Free shipping remains one of our most effective tools for bringing offline retail online and extending our position as Latin America's largest ecommerce platform. For nearly a decade, we have offered free shipping on a large portion of our business, so we know it is a crucial driver of conversion, retention and customer satisfaction.

They lowered the threshold to one fourth, from R$79 to R$19, for all buyers and reduced seller shipping charges. This smooths out pricing hurdles that limited low-value listings, encouraging sellers to add more assortment and drawing in new buyers.

CFO Martin de Los Santos highlighted the strategic intent:

In Brazil, we lowered our free shipping threshold for the third time in 5 years as part of our objective of bringing offline retail online by removing frictions. This strategic initiative is attracting new users to our e-commerce platform, increasing engagement among existing buyers and expanding our assortment.

This move compresses commerce margins through forgone revenue and higher marketing spend, but it's powered by MELI's logistics advantage—the fastest network in the region, built since 2013 with dozens of fulfillment centers handling most of shipments.

The payoff? Accelerated sales volumes as explained by the new appointed CEO Ariel Szarfsztejn,

We are very happy with the results that we are seeing in Brazil, particularly items sold in Brazil accelerated to 34% growth year-over-year in June. So that's a major acceleration. Of course, given the fact that we are accelerating in the segment where the ASP is the lowest, the impact in overall GMV growth is smaller, but both accelerated

More users mean more opportunities for fintech cross-sells—like payments, credit, and yielding accounts—and more advertising from sellers.

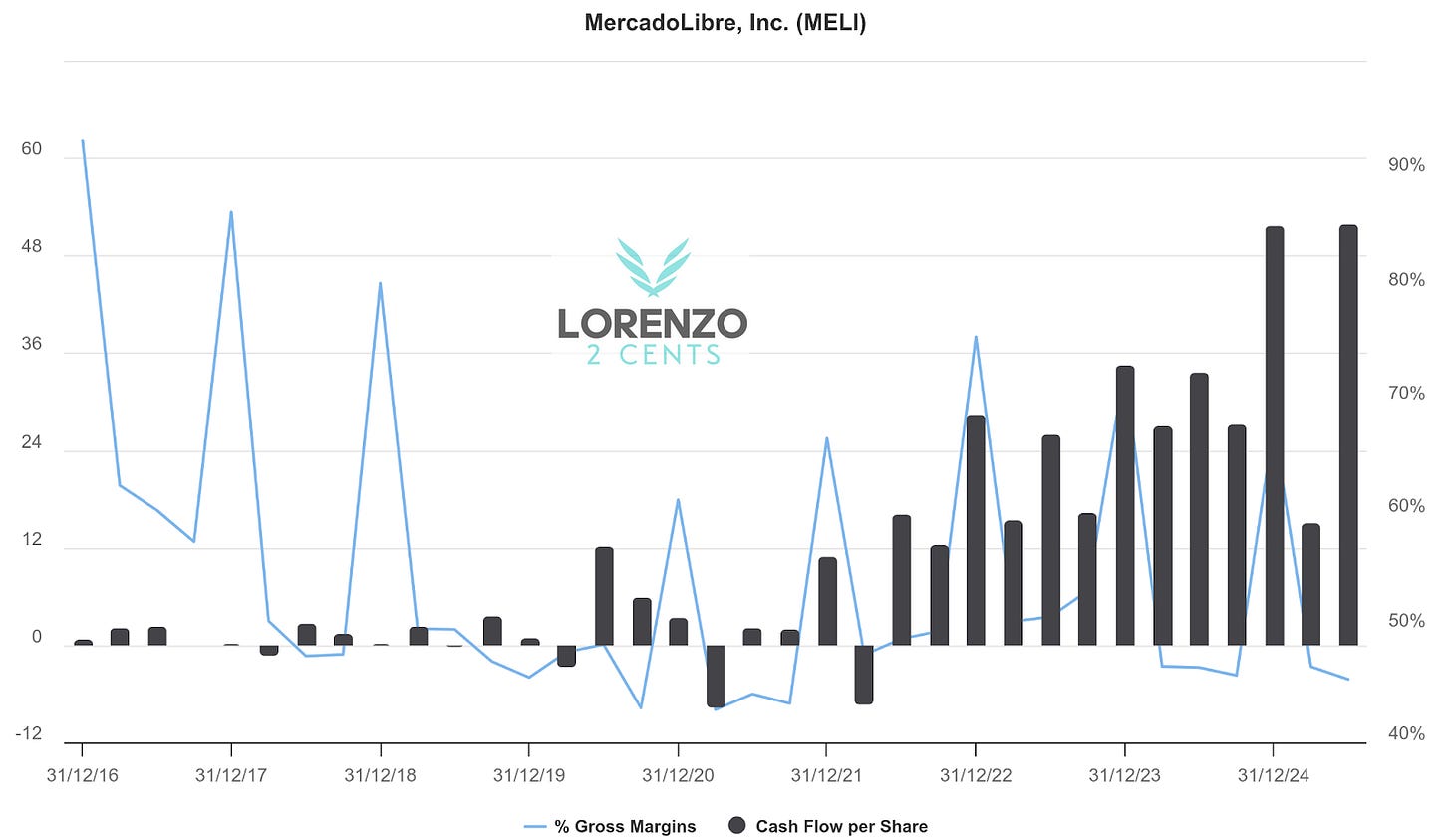

Declining gross margins paired with improving cash flow per share illustrate this beautifully: MELI is expanding its footprint while monetizing better overall.

This relentless investment in infrastructure to support growth is further evidenced by the steady and accelerating rise in “net property, plant, and equipment” over the years, as shown in the graph below. From near zero in 2016 to over $3,5 billion by 2025, this trend reflects MELI's ongoing commitment to expanding their logistics network, with continued expansions like new facilities in Mexico mentioned this quarter, indicating the upward trajectory persists into 2025.

Advertising and Fintech: The High-Margin Beneficiaries

This commerce push directly amplifies advertising and fintech—key to my thesis. Advertising is evolving into a full-funnel powerhouse, with the Google Ad Manager integration enabling targeted campaigns using MELI's first-party data. Display and video formats are scaling quickly, while AI tools help sellers optimize, creating a virtuous cycle: more engagement boosts ad ROI, deepening the moat. As Ariel Szarfsztejn, noted:

We are using AI today in order to help our sellers better understand our ad stack to have onboarded into our ad technology to optimize their bidding and so on.

Advertising Growth is accelerating, with revenue up 38% year-over-year (59% FX-neutral), building on Q1's 26% year-over-year (50% FX-neutral).

Fintech is the real star, where commerce users convert into a sticky base. Engagement is deepening, with users adopting more products over time, as stated in the shareholder letter:

The average number of products per user in Brazil, Mexico and Argentina has risen by approximately 50% over the same two and a half year period, and the proportion of high frequency users continues to rise consistently across-the-board.

Marketing emphasized yielding accounts—de Los Santos called it “the Fintech equivalent of free shipping”—drawing funds and digitalizing payments in cash-heavy markets. Credit quality remains solid, with improving delinquencies enabling faster expansion while keeping risk in check.

Momentum is building here too: the credit portfolio grew 91% year-over-year to surpass $9.3 billion (up from 75% in Q1), assets under management more than doubled year-over-year once again, and monthly active users hit 68 million (up 31% year-over-year, following another 31% in Q1).

This ecosystem synergy ties back to the continent-wide network effects I've emphasized: investments in one area compound across others and borders. As de Los Santos said:

We are pleased with our performance in Q2 as the benefits of years of disciplined investments continue to compound. Engagement is rising across all areas of our ecosystem, reinforcing the strength of our platform and the long-term potential ahead.

Outpacing Newbank

A clear sign my thesis is materializing? MELI's fintech is outperforming Nu Holdings ($NU), even as both navigate similar markets. While NU delivered solid results—adding millions of customers and growing revenue respectably—Mercado Pago revenue surged faster, driven by rapid user growth, doubling assets under management, and outsized credit expansion. This edge stems from MELI's commerce moat: users attracted by e-commerce deals seamlessly transition to fintech services, creating higher engagement and cross-sell rates than standalone players.

As illustrated in the graph below, Mercado Pago's average revenue per active customer (ARPAC) has been climbing steadily, reaching around $14 per month in Q2 2025 from about $12 in Q3 2024, while NU's ARPAC remains relatively flat at roughly $10.

Meanwhile, MELI's monthly active user (MAU) year-over-year growth, though decelerating slightly, stays robust at approximately 30% in Q2 2025—well above NU's, which has dipped to around 15%.

This trend underscores MELI's superior monetization per user, fueled by the ecosystem's cross-sell opportunities in payments, credit, and yields, compared to NU's more focused banking approach. It's visual proof that MELI's commerce investments are translating into outsized fintech gains.

Wrapping Up: Positioned for the Long Term

MELI's Q2 shows the thesis unfolding: bold commerce investments, powered by infrastructure superiority, are accelerating growth in fintech and ads, outpacing competitors.

The CEO transition to Ariel Szarfsztejn, set for January 1, 2026, ensures continuity—Szarfsztejn has been with Mercado Libre since 2017, holding several leadership positions including his current role as President of Commerce, bringing nearly a decade of deep company knowledge and expertise in scaling the e-commerce operations.

While macro risks persist, MELI's execution makes it a standout for patient investors in LatAm's digital shift.

As always, here is the “Deep Dive To Date” (DDTD), that is how the stock is performing since my initial deep dive on the May 18th 2025, when the stock price was $2585. As proved by my post on X, where I share real time updates, I opened a position a few days later.

- 7% DDTDSee you in the next update!

The content of this analysis is for entertainment and informational purposes only and should not be considered financial or investment advice. Please conduct your own thorough research and due diligence before making any investment decisions and consult with a professional if needed.

Thank you for the article, great take! I can add that the pillars are also synergetic, the fintech and deposits finance the scale of the marketplace. It creates a self-reinforcement cycle. I argued similar PoV in some debate on SA, that Meli is superior to NU because it's a twin engine business combining consumption and finance of the consumer in the single superapp. Another similar business is KSPI, with even more advance fintech side, as it started as a bank.